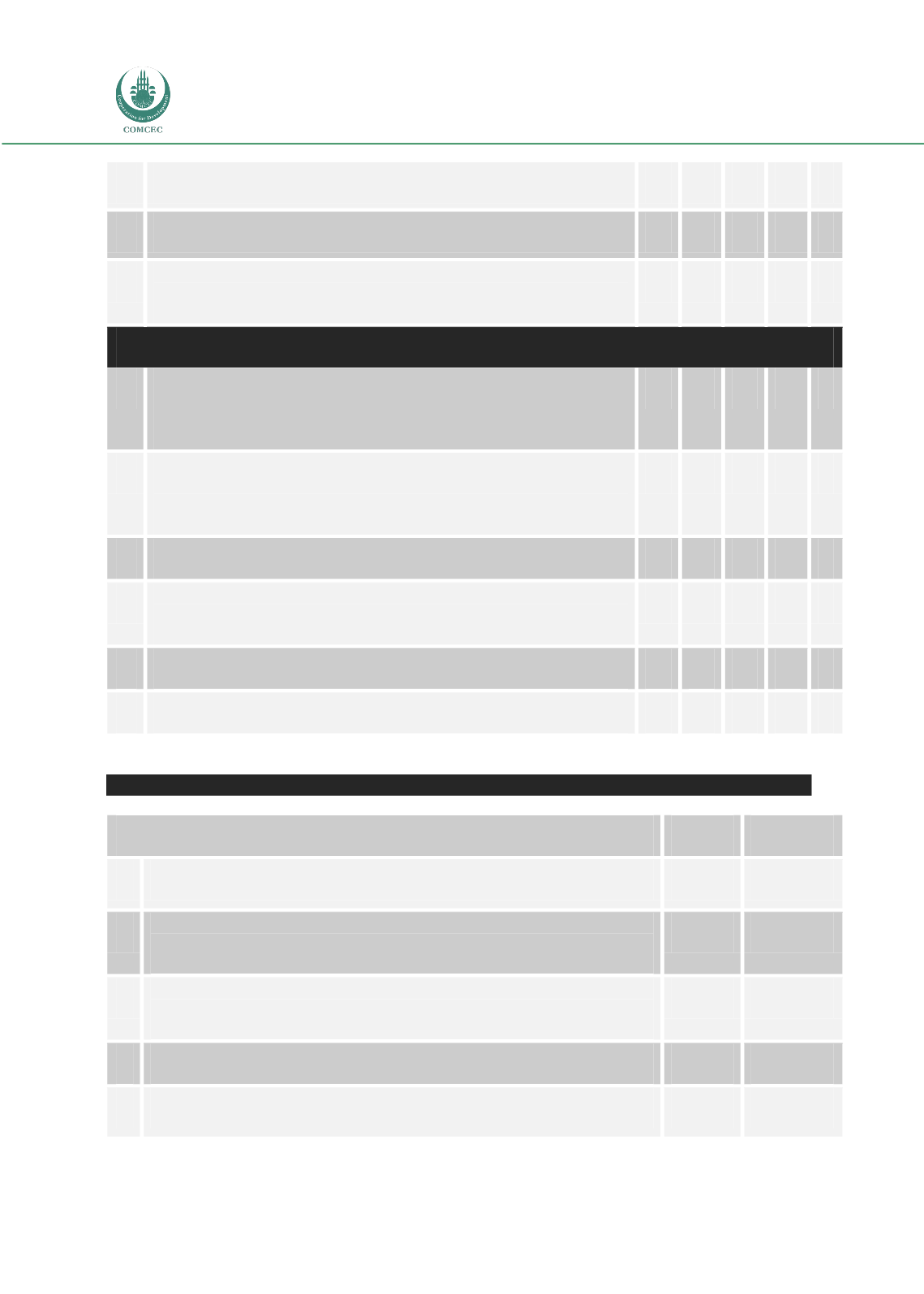

Risk Management in

Islamic Financial Instruments

1

Short-term Islamic financial assets that can be

sold in secondary markets

5

4

3

2

1

2

Islamic money markets to borrow funds in case

of need

5

4

3

2

1

3

Inability to use derivatives for hedging

5

4

3

2

1

4

Inability to re-price fixed return assets (like Murābahah) when the benchmark rate

changes.

5

4

3

2

1

5

Lack of legal system to deal with defaulters.

5

4

3

2

1

6

Lack of regulatory framework for Islamic banks.

5

4

3

2

1

Part II: Risk Management Environment

Establishing an Appropriate Risk Management Environment, Policies and Procedures

Yes

No

1

Do you have a formal system of Risk Management in place in your organization?

2

Is there a section/committee responsible for identifying, monitoring, and controlling

various risks?

3

Does the bank have internal guidelines/rules and concrete procedures with respect to the

risk management system?

4

Is there a clear policy promoting asset quality?

5

Has the bank adopted and utilized guidelines for a loan approval system?

2

The rate of return on deposits has to be similar to that offered by other banks.

5

4

3

2

1

3

Withdrawal Risk: A low rate of return on deposits will lead to withdrawal of funds

5

4

3

2

1

4

Fiduciary Risk: Depositors would hold the bank responsible for a lower rate of return

on deposits

5

4

3

2

1

Risk Perception: Lack of Instruments/Institutions related to Risk Management