Risk Management in

Islamic Financial Instruments

181

ruling, conciliation and arbitration may involve such a third party whose decision may be

binding on the parties. But any settlement agreement that emanates from the compromise of

action proceedings, which is duly signed by the parties, should be enforceable by the courts.

While the East Cameron case involved a junk

sukuk

issuance, which ended up in the U.S. courts,

the Nakheel debacle was properly managed through appropriate steps toward debt

restructuring with the creditors. After reaching a compromise with the trade creditors, it

completed the $10.9 billion debt restructuring in the first half of 2011. Recently, as part of its

restructuring plan, it issued $32.94 million

sukuk

on 7 January 2013, which represents the

third tranche in the restructuring process.

In 2009, the Investment Dar also defaulted on a $100 million sukuk, and it was restructured in

2011. Part of the arrangement was to convert part of the claims of the creditors into equity in

the company. In a similar vein, the near-default Dana Gas sukuk issue is being resolved

through compromise of action. Dana has proposed a $920 million debt restructuring deal

where it offered bondholders $70 million in cash, while the remaining $850 million debt will

be refinanced. At present, the shareholders are still considering this offer, but there are

indications that some of them will agree with the proposed plan.

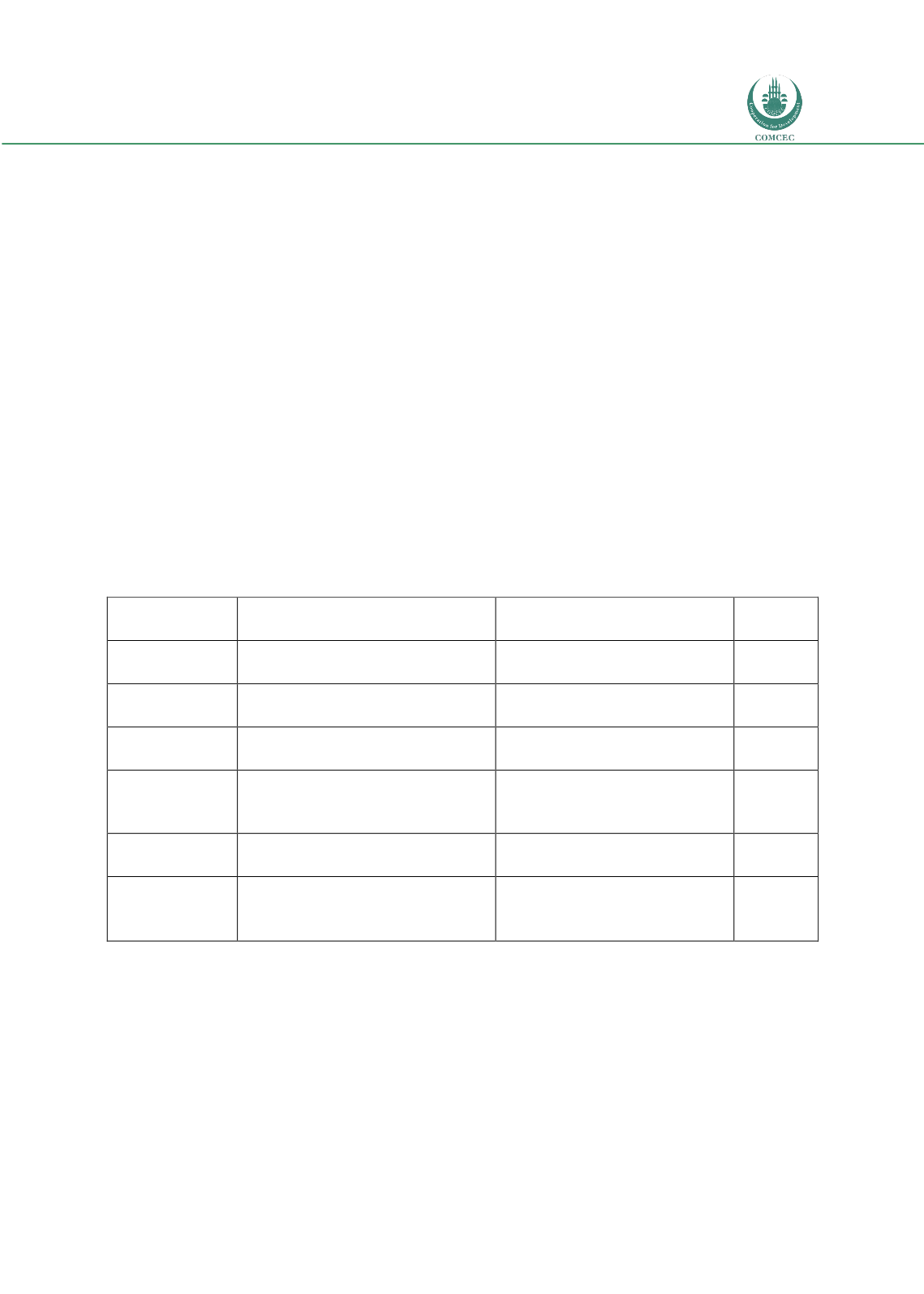

Table A.2: Remedial Measures for Sukuk Defaults and Near Defaults

Name of Sukuk

Immediate Cause of Default or

Near-default

Exit

Strategy

/

Remedial

Measure

Year

of

Default

The Investment

Dar

Default on a $100 million debt

repayment

Debt restructuring to revive the

sukuk

sales

2009

Golden Belt 1

(Saad Group)

Default in repayment of $650 million

to Citicorp Trustee Co. Ltd.

Dissolution of the Trust

2009

East

Cameron

Partners

Filing of one of the parties (East

Cameron Partners) for bankruptcy

Bankruptcy proceedings

2008

Nakheel

Delay in repayments of $4 billion

sukuk

Default narrowly averted with the

rescue of Abu Dhabi

2009

IIG

Funding

Limited

Inability to make periodic distribution

to sukuk holders

Looming debt restructuring plan

2012

Dana Gas

Inability to repay outstanding $920

million of the sukuk, issued in 2007,

on time and in full

Presently seeking consensual deal

on sukuk by weighing options of

repayment

2012

Source: (Oseni, 2012)

What can be gleaned from Table A.5 above is the preference of stakeholders for remedial

measures as exit strategies for the sukuk debacle. Apart from the extreme situation where a

party has to commence bankruptcy proceedings, it appears parties prefer debt restructuring,

which agrees with the Qur’anic principles of forbearance and forgiveness in issues relating to

debt. Be that as it may, a clear legal framework is necessary for debt restructuring in cases of

sukuk defaults. The proposed Islamic bankruptcy law should be comprehensive enough to

accommodate pre-default issues that may require debt restructuring. A looming default should

ordinarily trigger the process of debt restructuring. Managing the dispute at its early stage will

help prevent an escalated dispute that may end up in bankruptcy proceedings.