Islamic Fund Management

147

4.5.2

Evolution of South Africa’s Islamic Finance and Islamic Fund Management

Industries

South Africa’s regulators have taken several measures to develop and promote its Islamic

finance industry, including amending tax laws to create an equitable and level playing field

for Islamic finance. Proposed tax amendments were announced in May 2010, which provided

tax parity treatment between Islamic finance products and conventional banking products in

terms of diminishing

musharakah

,

mudarabah

,

murabahah

and sukuk.

Other than that,

Regulation 28, which was promulgated in 1962, aims to protect the pension

fund member by setting out prudent investment limits on certain asset classes in investment

funds and this regulation is enforced on both conventional and Islamic pension funds.

Regulation 28 was later amended in 1998 and 2011. The recent amendments were made in

February 2018 where the allowed maximum exposures to certain asset classes have been

revised to 75% for equities; 25% for property; 30% for foreign (offshore) and 10% African

assets

. Table 4.22shows the important milestones of Islamic finance in South Africa, followed

b

y Table 4.23 ,which exhibits the regulatory timeline.

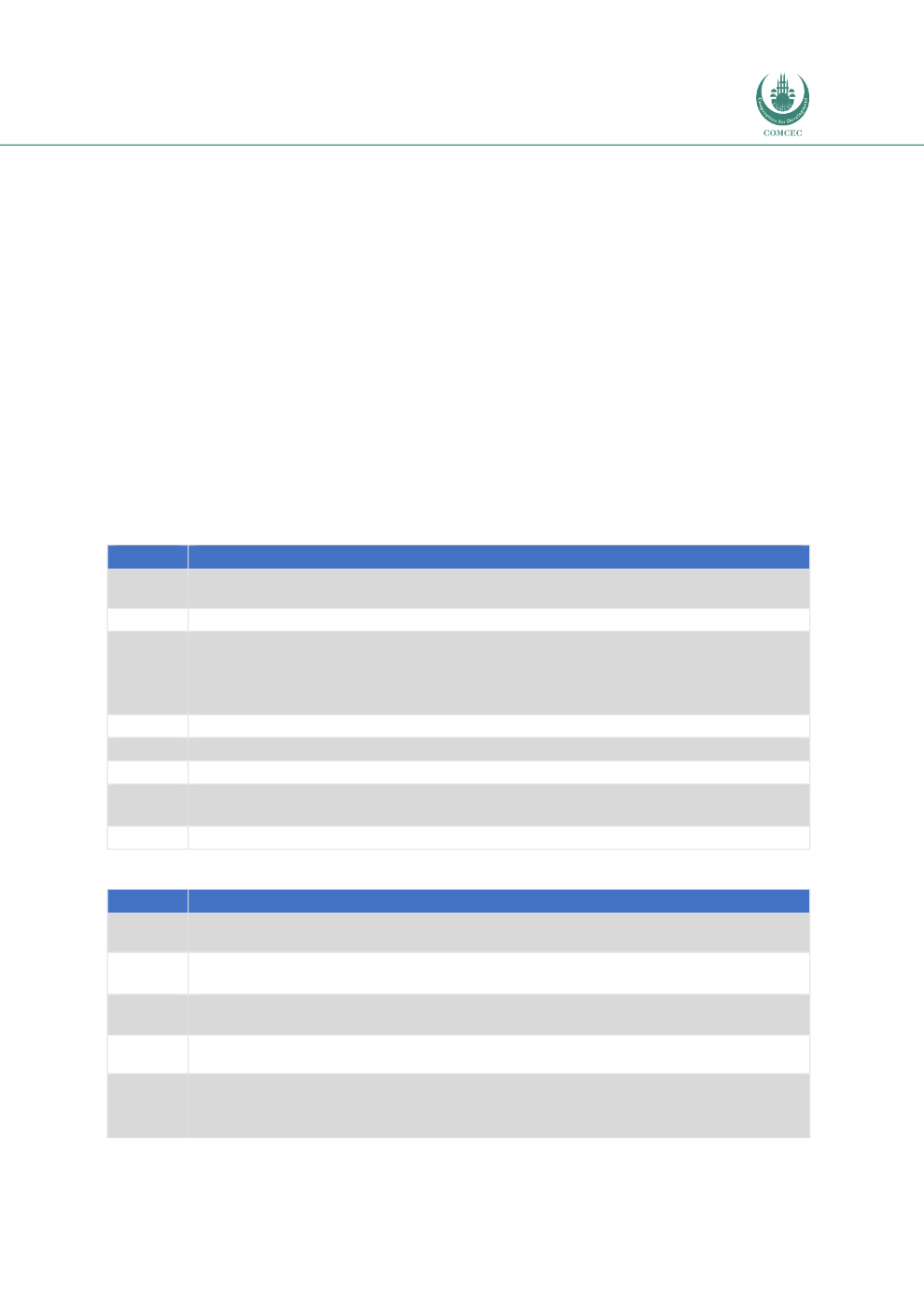

Table 4.22: Milestones of Islamic Finance in South Africa

Year

Islamic Finance Milestone

1989

Al Baraka Bank was the first full-fledged Islamic bank granted a licence by the

SARB.

2003

Takaful

was launched by Takaful South Africa.

2004

WesBank launched an Islamic window, i.e.the WesBank Motor Vehicle and Asset

Finance.

First National Bank (FNB) launched an Islamic window offering Shariah-compliant

financing.

2006

Absa Islamic Bank was established.

2007

FTSE/JSE Shariah All Share Index was launched.

2008

FTSE/JSE Shariah Top 40 Index was launched.

2011

FTSE/JSE Capped Shariah Top 40 Index was launched.

Takaful South Africa was acquired by Absa Group.

2014

Issued debut USD500.0 million sovereign sukuk.

Table 4.23: Regulatory Timeline of South Africa

Year

Description

1962

Regulation 28 of Pension Fund Act was announced. It was amended in 1998, 2011

and February 2018.

2002

Collective Investment Schemes Control Act (CISCA)

Financial Advisory and Intermediary Services Act (FAIS)

2010

Taxation Laws Amendment Act of 2010 (the Act), recognising arrangements such

as diminishing

musharakah

,

murabahah

and

mudarabah

.

2011

Amendment of Taxation Laws Amendment Act of 2010 (the Act),

introducin

g sukuk as another form of Islamic finance limited to the government.

2016

National Treasury proposed further amendments to tax laws to extend the current

legislation in respect of

murabahah

and sukuk to cover all listed companies.

Twin Peaks model of financial regulation.

Source: RAM