Islamic Fund Management

141

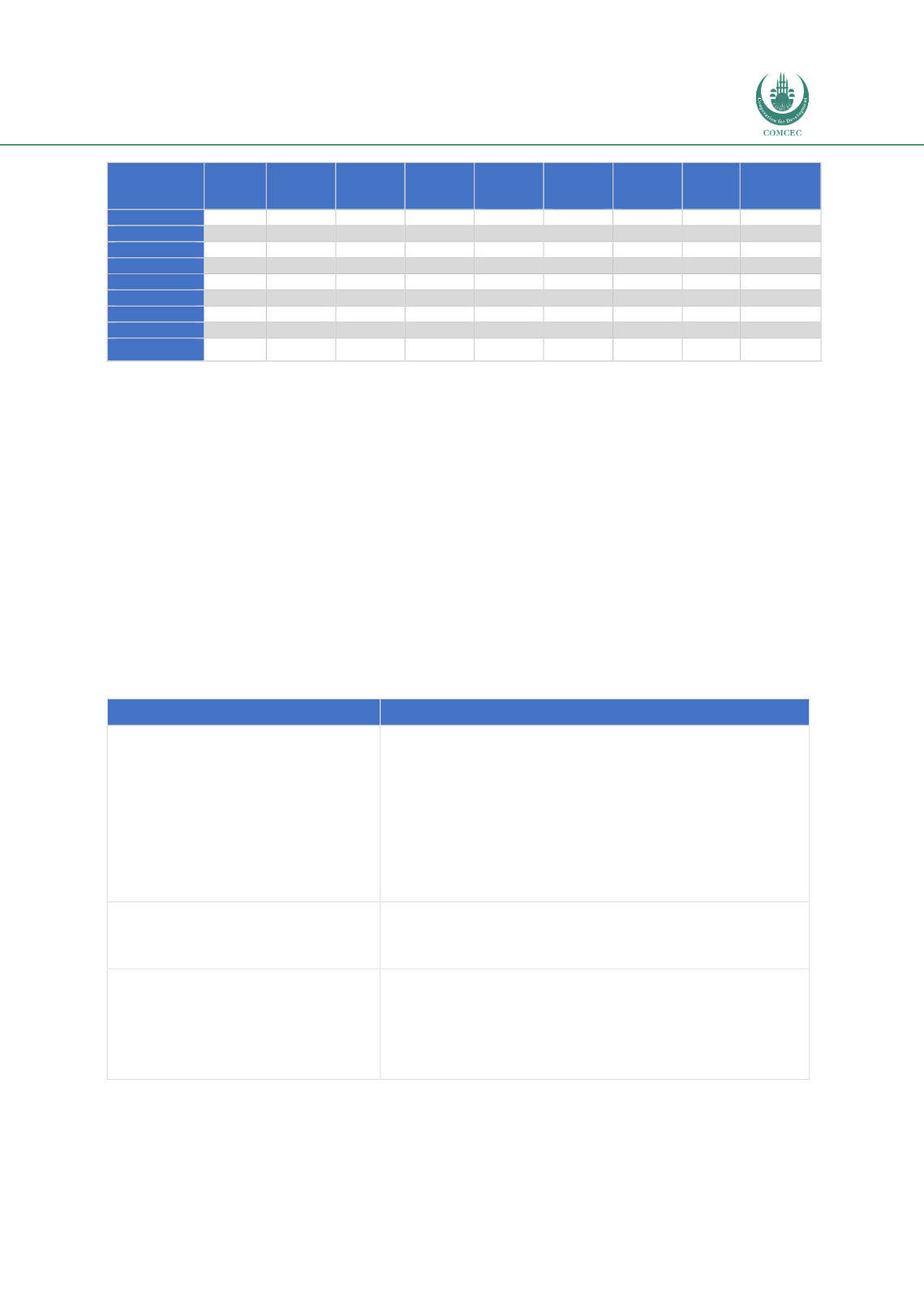

Country

Issued

sukuk

Planning

sukuk

Islamic

banks

Islamic

windows

Foreign

Islamic

banks

Islamic

micro-

finance

Other

Islamic

products

Islamic

funds

Islamic

regulation

Botswana

√

Ghana

√

√

Guinea

√

Cameroon

√

Chad

√

Djibouti

√

√

Mozambique

√

Mauritania

√

√

Cote d’Ivoire

√

Source: The Economist (2015)

On 1 April 2018, a new regulatory model known as Twin Peaks was implemented in South

Africa. The entire South African financial market is supervised by the Financial Sector

Regulation (FSR) Act, which was signed in August 2017 and came into effect on 1 April 2018.

The legislation will bring about a major transformation of the South African financial services

regulatory and risk management frameworks, including the move to a Twin Peaks approach to

regulation.

The Twin Peaks model regulates prudential and risks under two separate bodies, the

Prudential Authority (PA)―contained within the South African Reserve Bank (SARB)―and the

Financial Sector Conduct Authority (FSCA) (formerly known as Financial Services Board

(FSB)). Both the PA of SARB and the FSCA become the resolution authorities responsible for

the protection, maintenance and enhancement of financial stability.

Table 4.21lists the

regulators’ roles and responsibilities within South Africa’s financial markets.

Table 4.21: Regulators of South Africa’s Financial Market

Regulator

Roles

National Treasury

Increase investment in infrastructure and industrial

capital.

Improve education and skill development to raise

productivity.

Improve the regulation of markets and public entities.

Fight poverty and inequality through efficient public

service delivery, higher employment levels, income

support and empowerment.

FSCA (formerly known as the FSB)

Regulate and supervise the conduct of financial

institutions.

Ensure consumer protection and market conduct.

SARB

Responsible for the prudential aspect of Twin Peaks.

Therefore, this responsibility includes both micro and

macro prudential aspects.

The SARB has been mandated to protect and enhance

financial stability.

Source: National Treasury’s website, Financial Sector Regulation Act: Implementing Twin Peaks and the Impact

on the Industry, The Banking Association of South Africa: Regulations for a Safer Financial Sector