Islamic Fund Management

140

4.5

South Africa

Africa has untapped potential in Islamic finance, ranging from Islamic banking,

takaful

, sukuk

for infrastructure development and Shariah funds. Home to more than 250 million Muslims

and with the presence of Islamic finance in more than 21 African countries, the African

continent is well poised to become a strong contender in the development of Islamic finance.

The region’s positive trends that include a rapidly expanding population, rising consumer

spending, economic needs and a modest rebound in GDP growth support this ambition.

South Africa had been the first Sub-Saharan African country to establish itself as a potential

hub for Islamic finance. Despite its relatively small Muslim population (1.5% of total

population), South Africa is ranked among the top 10 countries in terms of contribution to the

global Islamic fund management industry.

This case study on South Africa aims to examine the present environment and development of

its Islamic finance industry, with a specific focus on the Islamic fund management segment.

The issues and challenges faced by the country will be analysed and recommendations

proposed. South Africa has been chosen as a case study for the following reasons:

Its unique value proposition is envisaged to encourage other non-Muslim countries to

consider the benefits of encouraging the development of their own Islamic finance

markets.

Given the level of development of its conventional financial system, South Africa has a

competitive edge over most African countries in actively capturing and promoting the

Islamic finance industry.

4.5.1

Overview of South Africa’s Islamic Finance and Islamic Fund Management

Industries

A Snapshot of South Africa’s Islamic Financial Market Landscape

South Africa has one full-fledged Islamic bank, four Islamic banking windows offered by

conventional banks, one

takaful

company and seven Islamic AMCs.

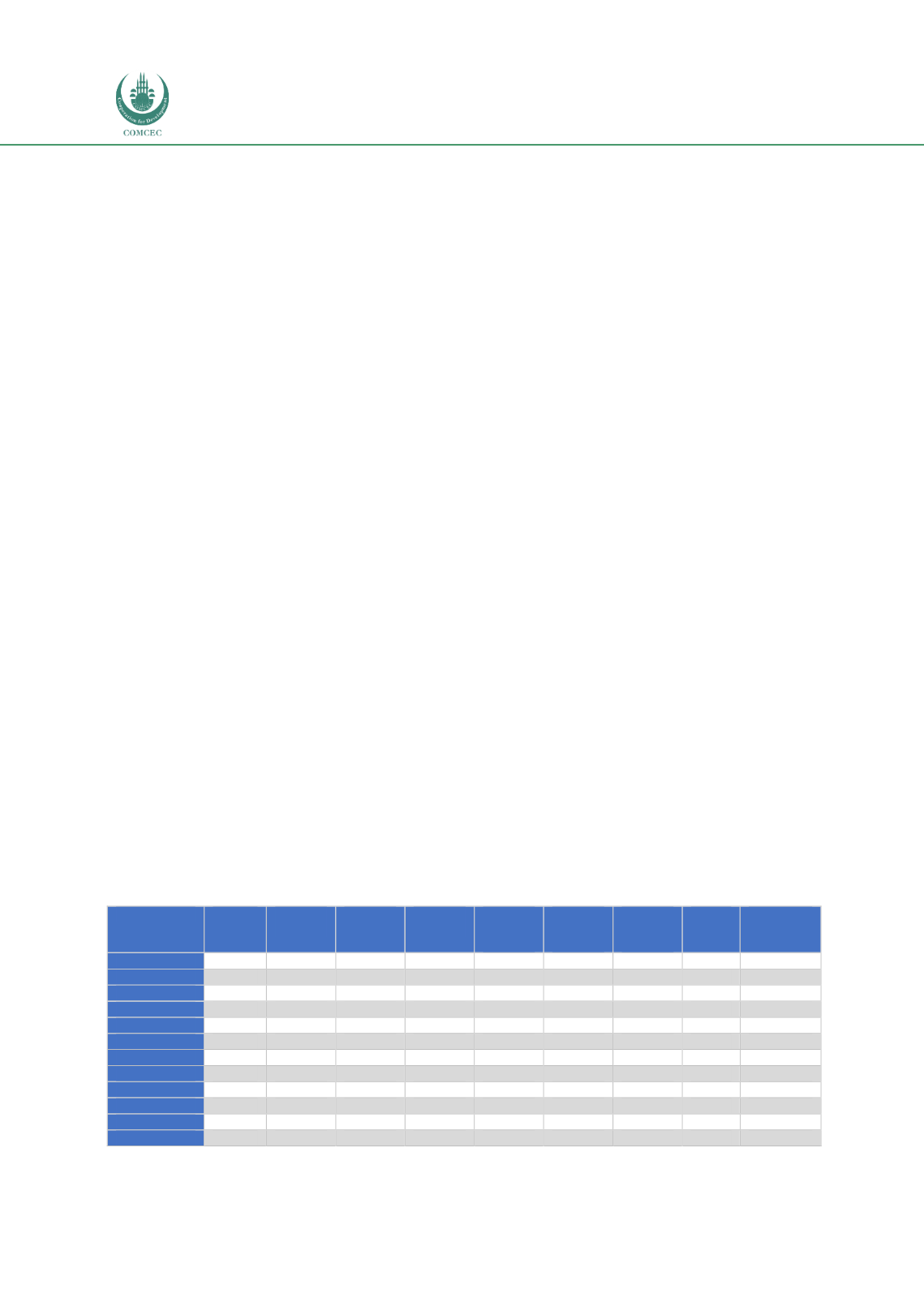

Table 4.20 compares the

Islamic finance products offered by Sub-Saharan African countries:

Table 4.20: Islamic Finance Activity in Sub-Saharan Africa

Country

Issued

sukuk

Planning

sukuk

Islamic

banks

Islamic

windows

Foreign

Islamic

banks

Islamic

micro-

finance

Other

Islamic

products

Islamic

funds

Islamic

regulation

Nigeria

√

√

√

√

√

√

√

South Africa

√

√

√

√

√

√

Sudan

√

√

√

√

√

√

Senegal

√

√

√

Gambia

√

√

√

√

Kenya

√

√

√

√

√

√

Tanzania

√

√

Mauritius

√

√

√

Zambia

√

√

√

Uganda

√

√

Niger

√

√

Ethiopia

√

√