190

6.

CONCLUSION

This final section summarises the key findings and recommendations of the study, which can

be categorised into 3 main dimensions:

Sukuk structures

Sukuk issuances (supply – sell side)

Sukuk investments (demand – buy side)

These 3 dimensions have been used to measure the development of sukuk markets in the case

studies and assess the main challenges faced by the particular country. Central to the

development of a sukuk market is having a comprehensive framework that emphasizes 3 key

components, as exemplified in Table 6.1.

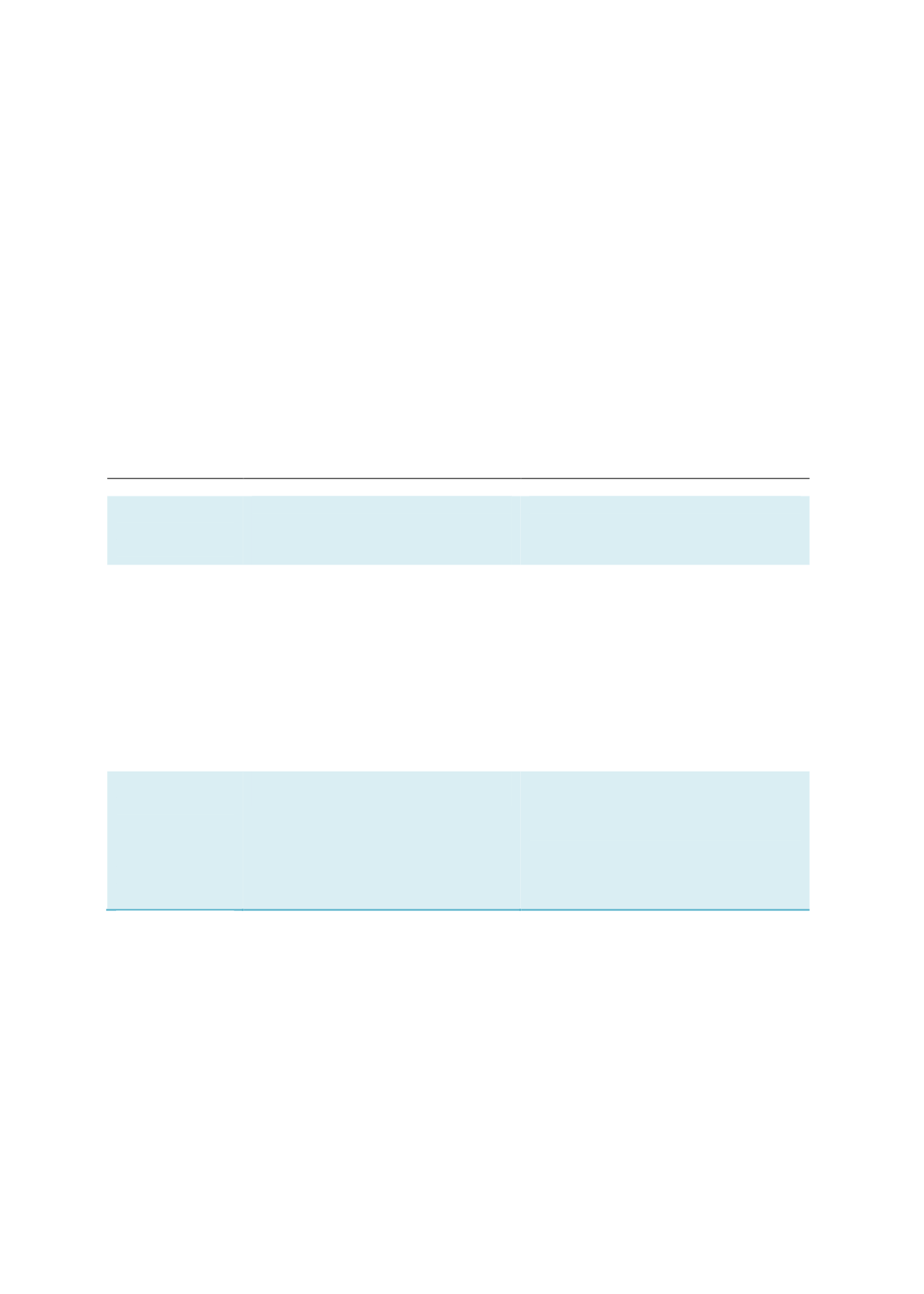

Table 6.1: Key Components of a Comprehensive Framework to Develop a Sukuk Market

Component

Role

Responsible Stakeholder

Legal and

regulatory

framework

To improve the existing legal, regulatory,

Shariah governance and tax frameworks

to level the playing field between sukuk

and conventional bonds.

Ministry of Finance (or its equivalent)

Capital-market authority

Tax authority

National Shariah authority

Market and

infrastructure

development

To develop an active Islamic money

market to support secondary trading, an

electronic trading platform for

transparency and to monitor issuances

and for price guidance.

Central bank

Securities and commodities

exchanges

To promote the issuance of LCY and FCY

sukuk that have different commercial

features (i.e. tax neutrality and

incentives, competitive costs, innovative

structures catering to various needs, and

benchmark yield curves) to attract

market players to tap the sukuk market.

Ministry of Finance (or its equivalent)

Tax authority

Central bank

Government-related entities

(GREs)or their equivalent (i.e.

SOEs/GLCs)

Corporate Issuers

Diversified

market players

on the supply

and demand

sides

To foster supply (sell side) of and

demand (buy side) for sukuk issuance.

Government

Service providers (investment banks,

securities companies, advisory

houses, brokers, traders, rating

agencies)

Banking institutions and their

holding companies

NBFIs

Sources: RAM, ISRA

The study shows that countries with an active LCY bond market spearheaded by corporates

make it easier to promote sukuk as an alternative form of financing. The following sub-sections

summarise the current status of the different sukuk markets based on the abovementioned

aspects.

6.1

SUKUK STRUCTURES

AAOIFI Shariah Standard No. 17 on Investment Sukuk has paved the way for the issuance of

various sukuk structures, particularly in Arab countries. While

ijarah

contracts constitute a

large portion of sukuk issuance in that region, recent trends indicate that

wakalah/wakalah bil