189

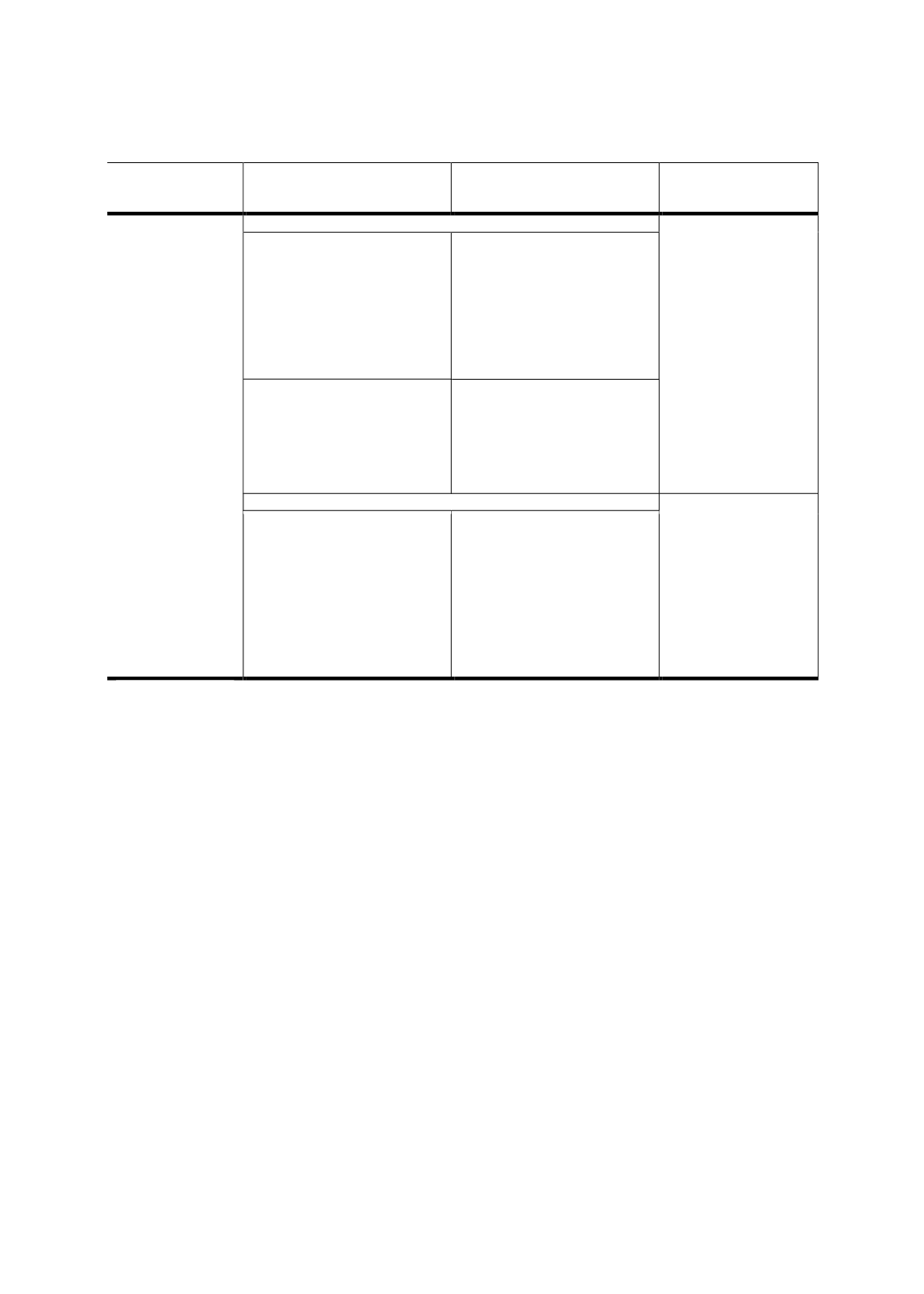

Stage of sukuk

market

development

Issues and challenges

Key recommendations

Rationale

Market and infrastructure development

To create more

efficient capital-

market

intermediation

and encourage the

issuance of more

sukuk as a credible

source of funding.

Lack of awareness on the

importance and benefits

of sukuk as an effective

financing tool to fund

infrastructure projects.

Government, regulatory

authorities and market

players need to make

concerted efforts to

promote sukuk as an

effective financing tool to

fund the infrastructure

gaps in underdeveloped

economies.

Lack of awareness on ICM

instruments among non-

Muslim religious groups.

Promote understanding

among the non-Muslim

population on sukuk and

other ICM instruments, by

having more engagements

with influential religious

bodies.

Diversified market players on the supply and demand sides

To diversify the

investor base.

Issues of financial

inclusion and a relatively

small ratio in terms of the

working population

relative to the total

population of the country.

To provide incentives to

low-income groups and

the mass market to

encourage them to take

up

takaful

or insurance

services, thereby spurring

the establishment of more

takaful

/insurance

companies that subscribe

for long-term sukuk.

Sources: RAM, ISRA