187

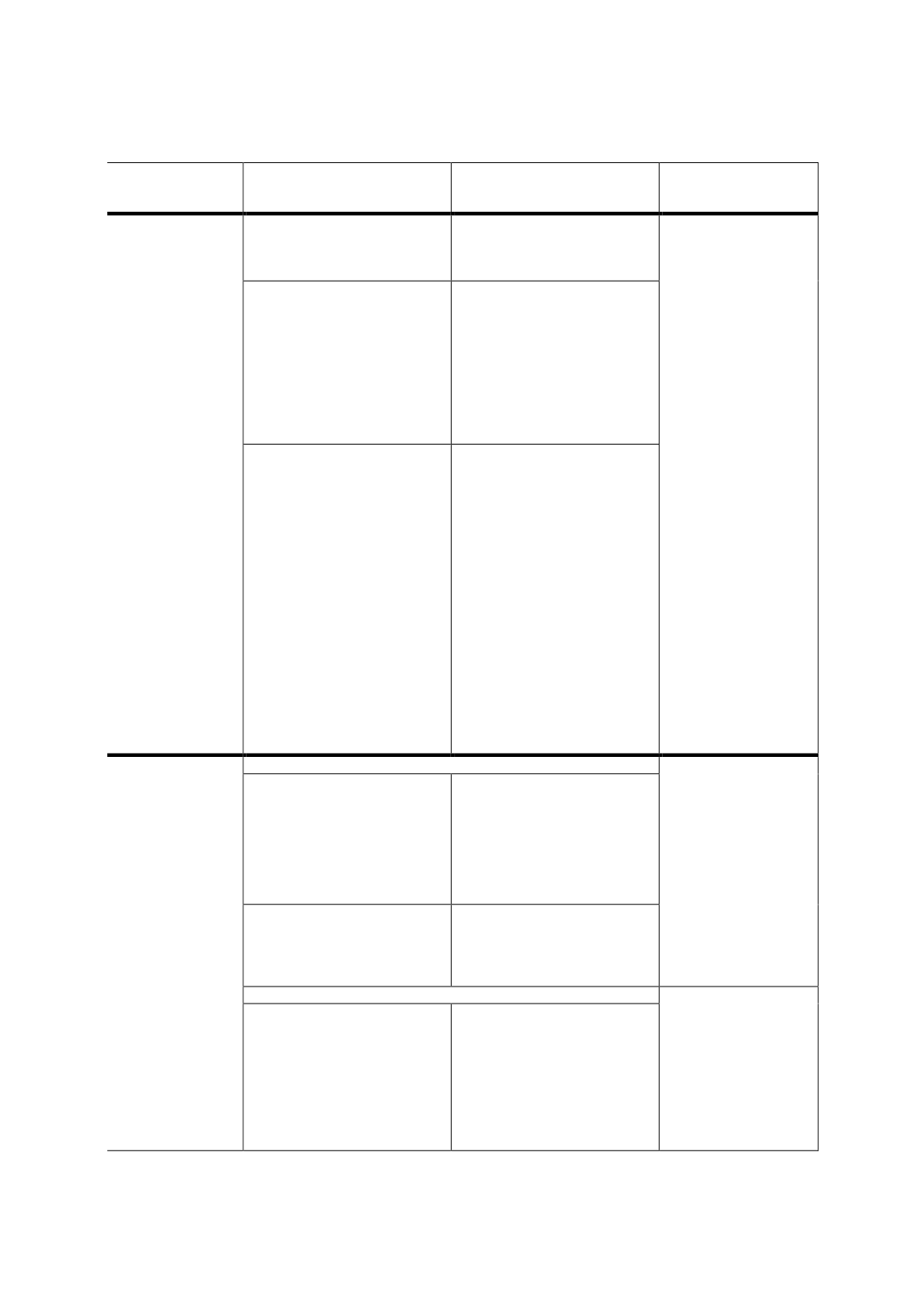

Stage of sukuk

market

development

Issues and challenges

Key recommendations

Rationale

prioritise raising funds

via sukuk instead of

bonds to finance their

budget deficits.

encourage

”crowding in”

instead of ”crowding

out”.

To increase funding

efficiency and

alleviate the

negative economic

and financial effects

of heftier

government debt,

including the

crowding out of

banking credit to the

private sector.

Shortage of long-term

sukuk issues that cater to

the needs of long-term

investors such as pension

funds as well as insurance

and

takaful

companies.

To issue sukuk with

longer maturities,

especially by government,

to fund infrastructure

projects and provide the

necessary benchmark

yield curves that will

enable local corporations

to raise longer-term

sukuk.

Lack of diversification

in investor base –

concentration on

banking institutions

with less

intermediation from

NBFIs.

To increase demand from

various investors,

including:

-

Institutional investors

that need long-term

investments, such as

insurance companies

and pension funds.

-

High–net-worth

individuals who are

currently investing

more in equities and

real estate.

-

To encourage

sovereign wealth funds

to invest in their

domestic bond

markets.

-

Retail investors.

Developing

(Intermediate and

Beginner)

(examples of OIC

countries include

Indonesia and

Turkey)

Legal and regulatory framework

To provide a conducive

environment for the

ICM to prosper.

Local companies prefer to

issue FCY conventional

bonds to fulfil their

financing needs due to the

macroeconomic

conditions of the market

(i.e. high inflation rate and

volatile local currency).

At the government and

monetary policy levels,

efforts should be made to

improve/attain

macroeconomic stability.

Limitations and/or

restrictions within the

capital markets.

To revise some

regulations to allow

multinationals to issue

LCY and FCY sukuk in the

domestic market.

Market and infrastructure development

To create more efficient

capital-market

intermediation and

encourage the issuance

of more sukuk as a

credible source of

funding.

To level the playing

field between sukuk

Lack of awareness among

key market stakeholders:

service providers (e.g.

investment banks,

securities companies,

advisory houses, brokers,

traders, rating agencies),

banking institutions and

NBFIs.

To increase knowledge on

the importance of sukuk

as an alternative source of

funding, and promote

market awareness on the

process of structuring,

issuing and investing

among different market

segments.