188

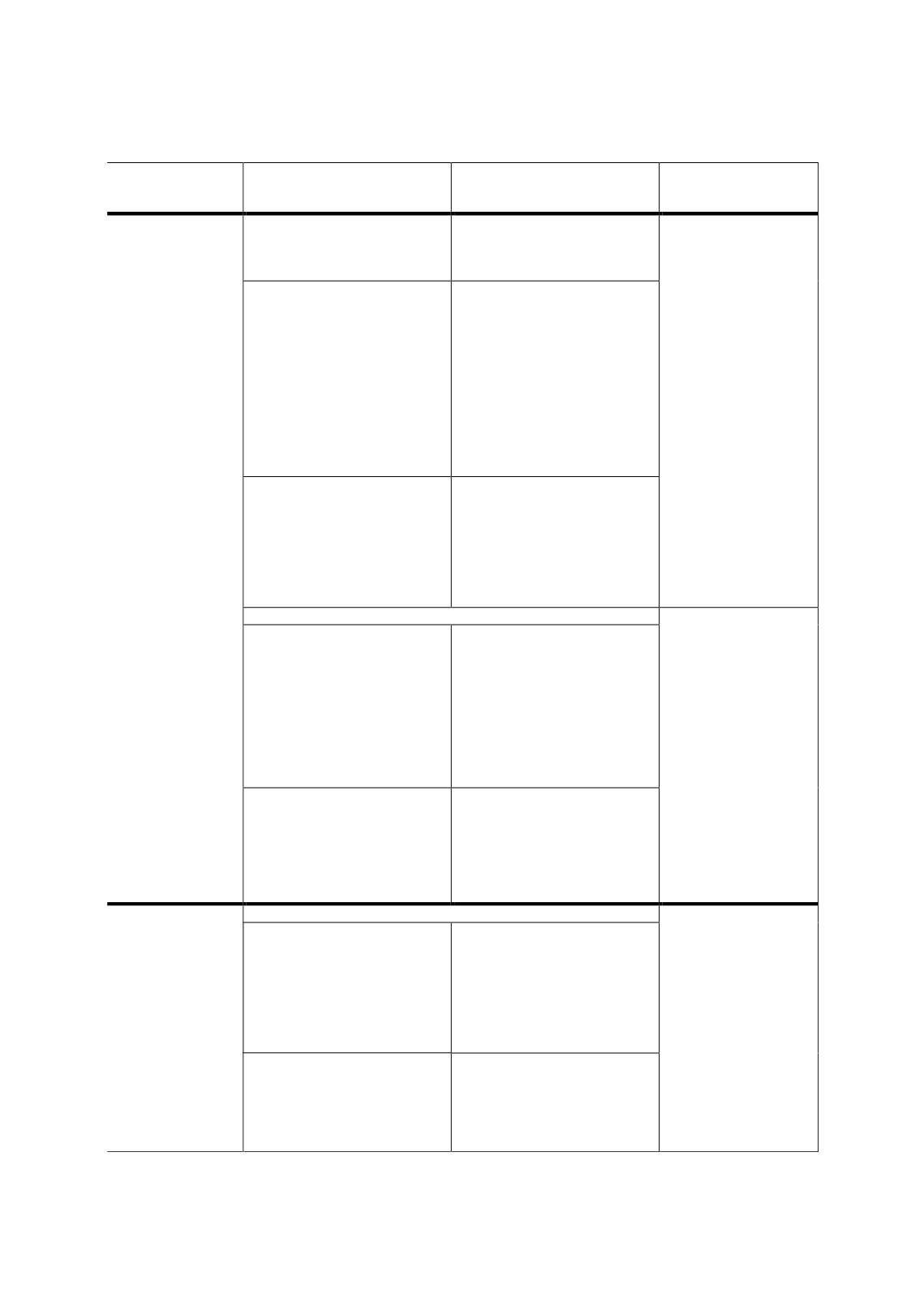

Stage of sukuk

market

development

Issues and challenges

Key recommendations

Rationale

Lack of secondary market

trading due to ineffective

and inefficient platforms.

To develop an effective

trading platform with

efficient clearing

settlement systems.

and conventional bond

bonds, thereby

ensuring greater

outreach to market

players.

Lack of tax incentives that

motivate sukuk issuance

and investors to invest in

them, as opposed to

conventional bonds.

To offer tax neutrality for

sukuk and introduce

more tax incentives (such

as withholding taxes and

deductions for issuance

costs) to facilitate a

greater flow of

investments into the

capital markets and level

the playing field between

sukuk and conventional

bonds.

Shortage of attractive

sukuk structures that

cater to the distinct

requirements of Shariah-

based institutional

investors.

To encourage innovation

in sukuk structures (e.g.

waqf

-linked sukuk) to

entice religious

institutional investors

(e.g.

waqf

and

hajj

funds)

to tap the sukuk market.

Diversified market players on the supply and demand sides

To provide more

investment

instruments to

banks and NBFIs.

To strengthen the

diversification of

investor bases.

Non-

existent/inadequate

long-term issues that

fund infrastructure

projects to cater to

the needs of long-

term investors.

To encourage SOEs and

blue-chip corporates,

particularly utilities-

backed companies (e.g.

telecommunications,

electricity, water, power)

or corporates with

infrastructure projects

(e.g. municipality

company) to issue sukuk.

Lack of cornerstone

institutional investors.

To enforce a mandatory

retirement/pension

scheme or national

savings strategy that will

boost the setting up of

pension funds.

Infancy

(examples of OIC

countries include

Nigeria and most

African countries

that have newly

tapped the sukuk

market)

Legal and regulatory framework

To facilitate a

smoother and

faster approval

process for sukuk

issuance.

To simplify the

listing process for

sukuk.

The need for a robust legal

and regulatory

framework.

Amendment of relevant

laws (e.g. land law) to

facilitate the process of

perfecting and transfer of

legal title, thus making the

creation of mortgages less

cumbersome.

Social discontent. As a

multi-ethnic society with

diverse religious beliefs,

minority interests or fears

based on diversity are a

source of discontent.

Government needs to take

proactive measures in

addressing social, political

and economic challenges.