COMCEC Transport and Communications

Outlook 2018

45

5.

PRIVATIZATION IN TRANSPORT

Network industries necessitating big infrastructure investments such as transportation,

telecommunication, energy, and water and sewerage have been traditionally state-owned and

-operated for two major reasons. Firstly, huge initial investments created a barrier to entry for

private investors. Secondly, because of the economic and social importance of such industries,

governments preferred to keep them under state ownership. However, poor performances of

state ownership and operations, such as low operating efficiency, labour redundancy, politically

motivated tariff setting, and underinvestment, initiated a tendency to appeal to private finance

and management.

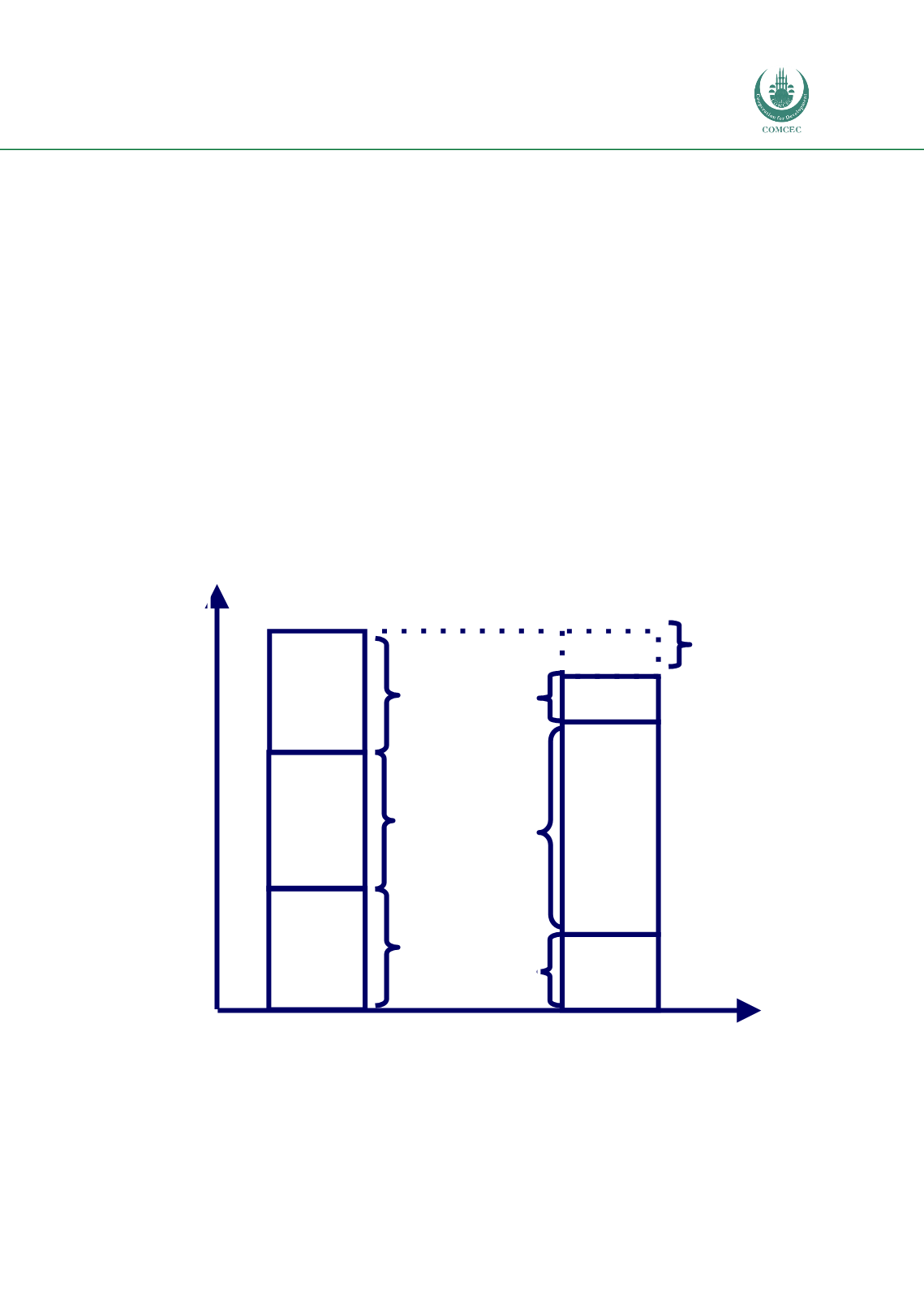

Where the real benefit of a PPP project lies?

To make a comparison between the traditional public procurement and public procurement

through PPP models, we can divide the total value of a project into three: (1) the cost of services

provided, (2) the cost of capital, and (3) the risks assumed by the government (Figure 24).

Figure 24: The comparison of traditional public procurement with PPP procurement

Source: Moriarty (2006)

Regarding cost of capital, state procurement is generally more advantageous than PPP-type

procurement because cost of borrowing of a private entity is generally higher than that of public

sector, given generally high risks inherently involved in PPP projects. On the other hand,

Risks assumed

by the

government

Procurement

through PPP

Value for

money

Value

($, €, £)

Cost of capital

Cost of services

provided

Traditional

procurement

method