COMCEC Trade Outlook 2017

45

associated with exporting, thereby increasing the number of firms which are export competitive

(Jayawera 2009). Spalla (2010) also suggests that FDIs contribute to international

competitiveness of the domestic firms through transfer of the know-how and technology.

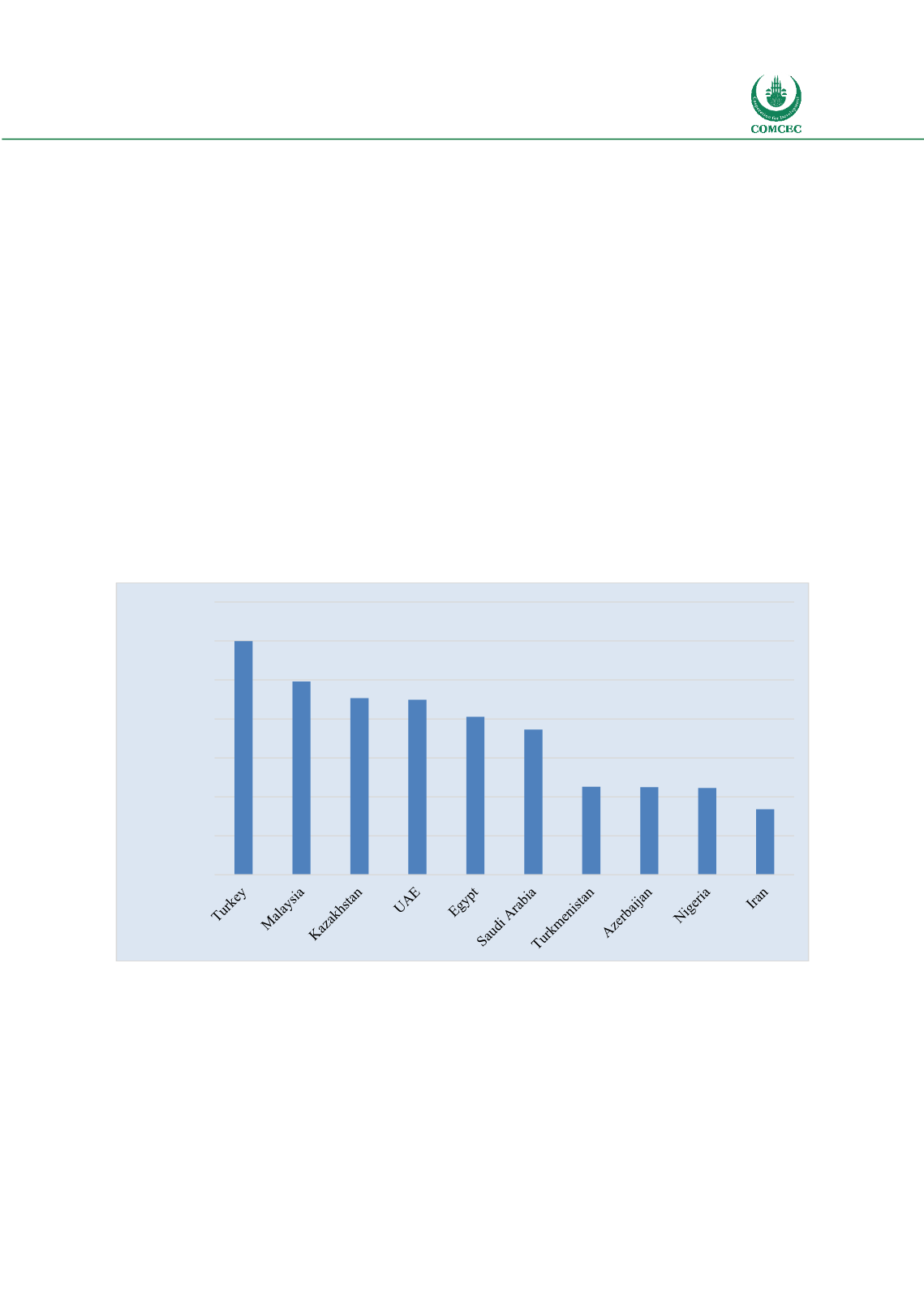

The performance of the OIC countries, except for a few countries in attracting the FDI, is low.

Figure 47 below gives the FDI inflows to top ten OIC Member States. FDI inflows to these

countries amounted to USD 72.4 billion in 2016 according to the UNCTAD, representing 75

percent of the total FDI inflows to the OIC Member States. The other remaining 47 countries

attracted nearly USD 24 billion FDI in 2016.

Another obstacle faced by most of the Member States is the concentration of the export oriented

FDIs on traditional sectors. Harding and Javorcik (2011) underlined that, if the FDI exports are

only products that the host country already exports intensively, the efficiency-seeking FDI could

move towards more specialized rather than more diversified exports. Thus, FDI does not

contribute too much to export diversification. For example according to UNCTAD (2011), which

investigated the sectorial distribution of the FDIs in LDCs, m

any large projects are in the form of

greenfield and expansion projects prospecting for reserves of base metals and oil. The study also

cited the lack of political stability and unavailability of skilled workers as main reasons for low

performance of investment in the manufacturing sector in Africa.

Figure 47: Top OIC Countries Receiving the Highest FDI Inflows in 2016

Source: UNCTADSTAT

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

Million Dollars