50

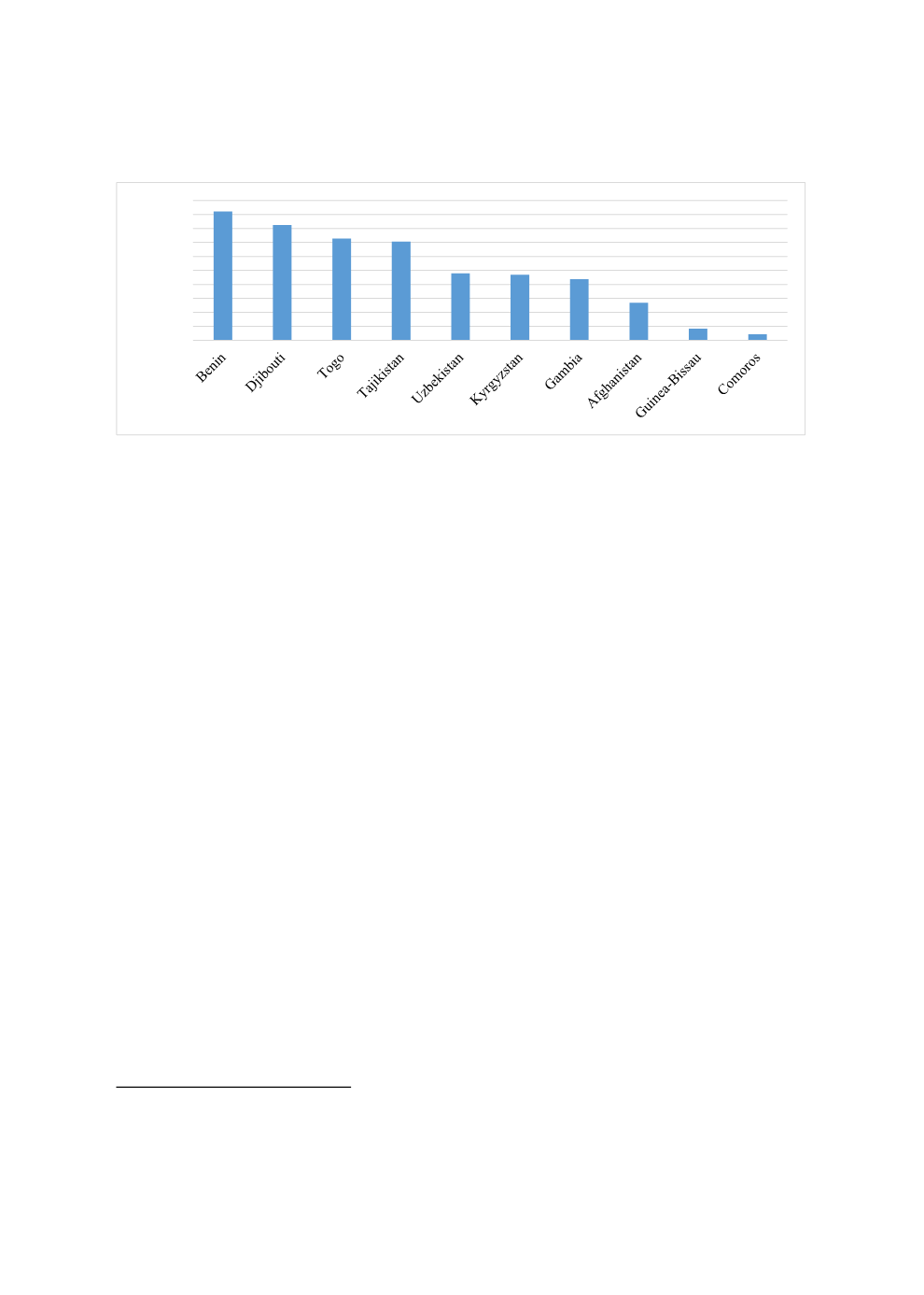

Figure 59: OIC Countries Receiving the Lowest FDI Inflows in 2017

Source: UNCTADSTAT

Trade Finance:

Trade finance is a general term used for financing of the international trade. Some 80 to 90

percent of the world trade relies on trade finance (trade credit and insurance/guarantees),

mostly of a short-term nature.

31

Exporters usually get payments after delivering the goods to the importers. During this period,

which may take several months, the exporter may need financing for delivering the orders on a

timely manner. Therefore, financing is needed not only for the import-export process itself, but

also for the production of the goods and services to be exported, which often includes imports

of machinery, raw material and intermediate goods

32

.

Available trade financing within a country increases the competitiveness of firms to compete in

international markets and encourages the firms especially the SMEs to export. Thus, it helps to

diversify the exports of the country. UNESCAP

33

classified the trade finance methods and

instruments into the following three categories:

1)

Methods and Instruments to raise capital,

2)

Methods and Instruments to mitigate risk,

3)

Methods and instruments to effect payment.

With regards to raising capital, firms need financing to ensure adequate production to meet the

orders of the commercial transactions on time. They may need to import inputs, hire more

workers and etc. In this context pre-shipment and post-

shipment financings provide the exporting firms with the

ability to cover their expenses until they get the

payments from the importers.

There are various risks faced during the international

trade such as political and commercial risks. These risks

are covered by export credit insurance and export guarantee programs. While export credit

insurance protects exporters, guarantees protect banks offering the loans.

34

31

WTO 2013

32

UNCTAD 2012

33

UNESCAP 2005

34

UNESCAP 2002: 61

0

20

40

60

80

100

120

140

160

180

200

Million Dollars

“Firms face difficulties in

financing trade in many

developing countries”