COMCEC Financial Outlook 2018

22

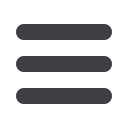

Figure 16: Global Sukuk Issuances

Source: IIFM

Islamic Funds

Islamic funds are investment vehicles that take the form of equal participating shares/units,

representing the shareholders’/unitholders’ share of the assets and entitlement to profits or

losses. There are many types of Islamic funds such as Islamic index funds, Shariah private equity

funds, Sukuk funds, Islamic equity funds etc.

Despite the decrease in the number of Islamic Funds in 2017 (1,161), assets under management

(AuM) increased 19%and reached USD 67 billion

20

. The top five jurisdictions accounted for 88%

of the industry’s AuM as at the end of 2017, i.e. Saudi Arabia (37.10%), Malaysia (31.66%),

Ireland (8.62%), the US (5.25%) and Luxembourg (4.76%). This indicates that the operations of

Islamic funds are still limited as key Islamic finance jurisdictions have deep-rooted Islamic

banking sectors (e.g. the UAE, Pakistan, Indonesia, Kuwait and Qatar). The remaining 12% of

AUM, with a USD 8.4 billion value, is distributed across 29 other jurisdictions (including offshore

domiciles) (IFSB, 2018).

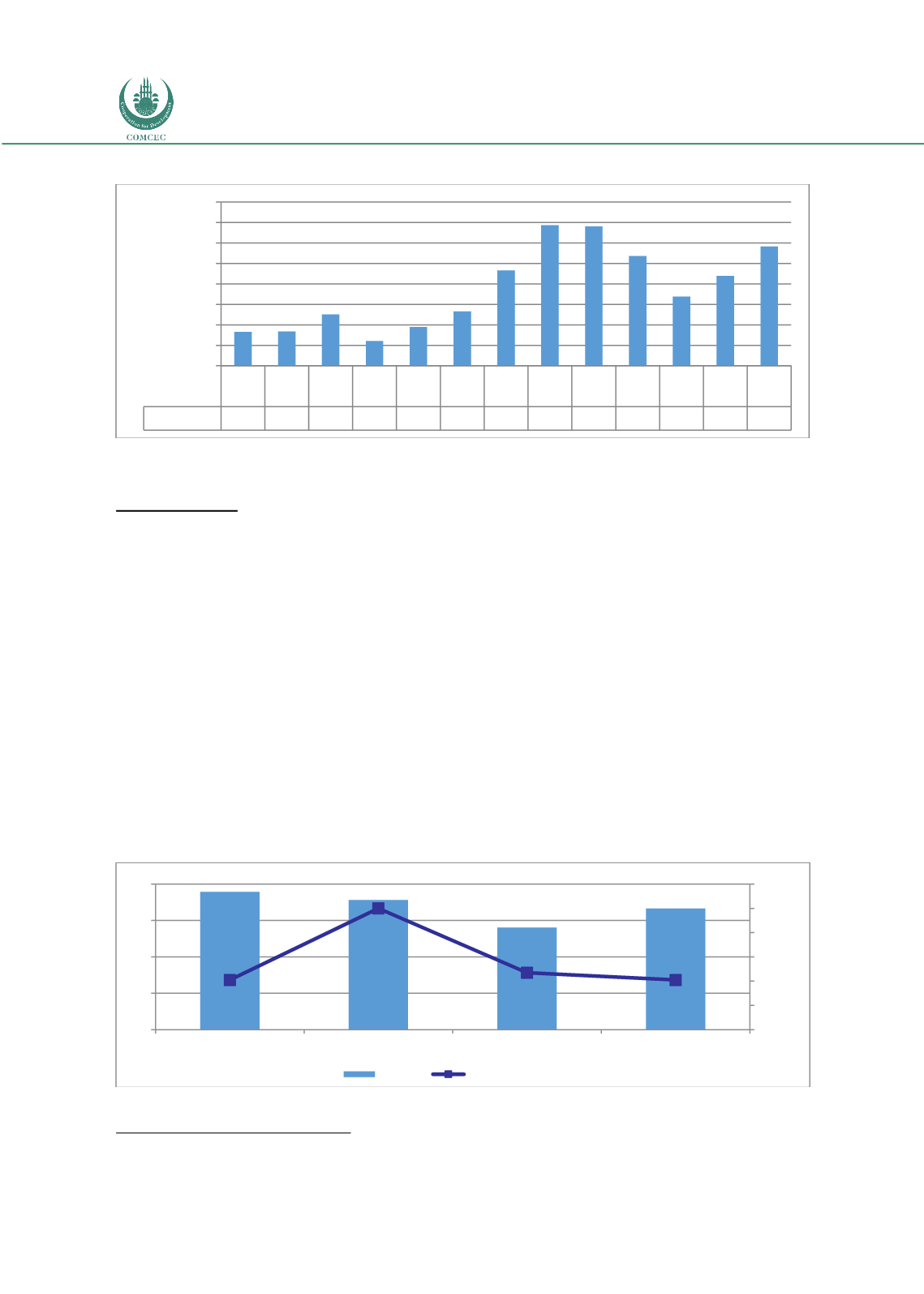

Figure 17: Assets under Management and Number of Islamic Funds (USD billion)

Source: IFSB 2018

20 Ibid.

2001-

5

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Million USD 33,2 33,6 50,2 24,3 37,9 53,1 93,2 137,6 136,3 107,3 67,8 87,9 116,7

0

20

40

60

80

100

120

140

160

56,1

66,7

1.161

1.220

1.167

1.161

1.120

1.140

1.160

1.180

1.200

1.220

1.240

0

20

40

60

80

2014

2015

2016

2017

Assets

Number of Funds (RHS)