COMCEC Financial Outlook 2018

21

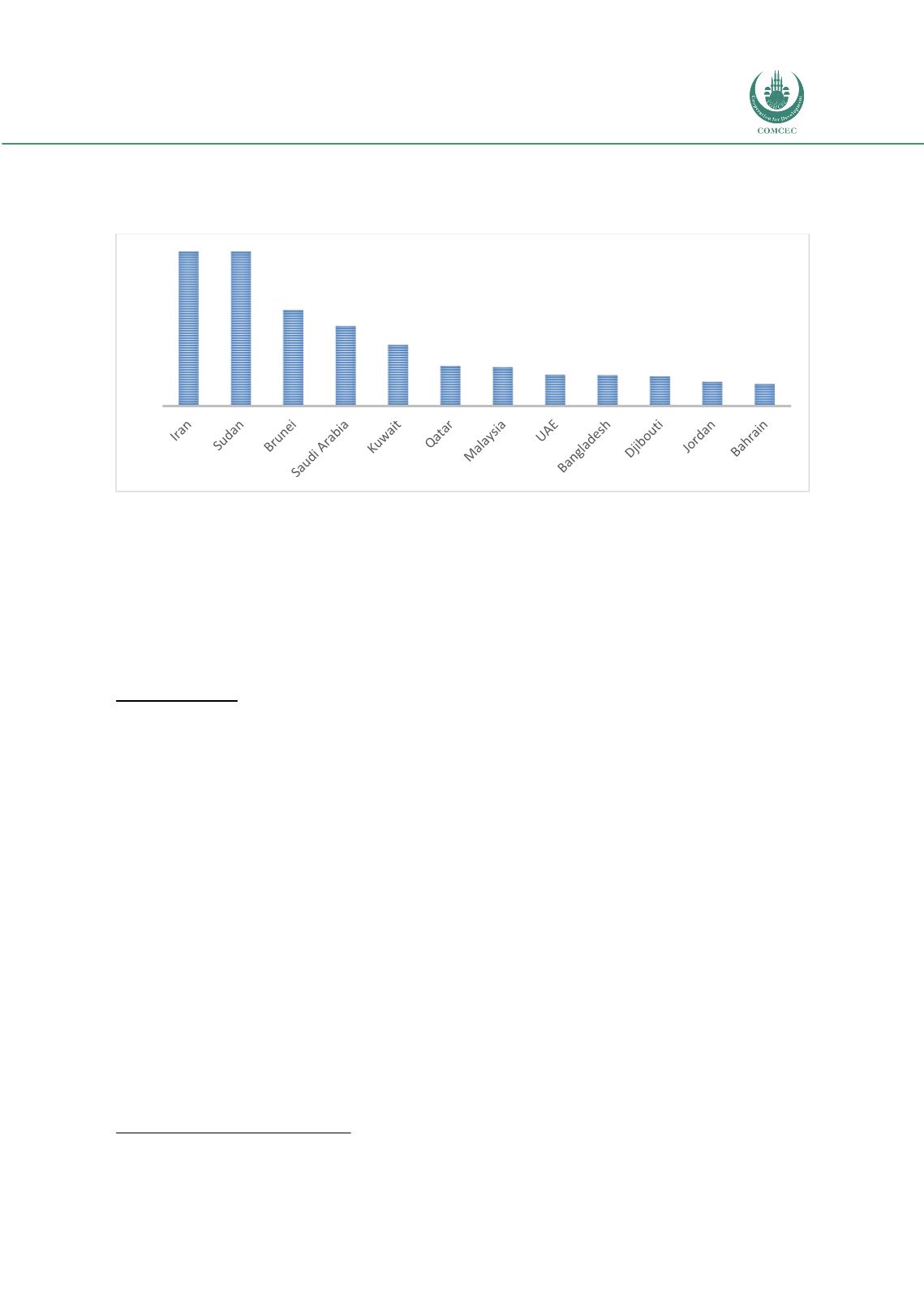

In 12 member countries, which accounted for 92% of the global Islamic Banking assets, Islamic

banking sector has reached systemic importance

19

in the Financial Sector.

Figure 15: Islamic Banking Share in Total Banking Assets (%)

Source: IFSB 2018

2.4

Capital Market Sector

In addition to the recovery in global economic conditions, the capital market has been triggered

since the beginning of 2017 with the reduction of global policy uncertainties. Optimistic global

financial and liquidity environment that emerged this year led to an increase in the risk appetite

of investors, strengthening of stock exchanges and a decrease in financial volatility.

Sukuk Market

Sukuk remained attractive to issuers as well as a wide range of investors in various regions and

financial hubs. Total global issuance has increased 32% in volume fromUSD 87.9 billion in 2016

to USD 116.7 billion in 2017.

In 2017, the increase in sukuk issuance was mainly driven by regular issuances in Saudi Arabia,

Asia, GCC, Africa and some other regions. Malaysia continues to dominate the sukuk market.

However, shares from countries such as Indonesia, United Arab Emirates (UAE) and Turkey are

close behind in value of shares.

19

Share of Islamic Banking Sector in Total Banking sector>15%

100 100

61,8

51,5

39,3

25,7 24,9

20 19,8 19 15,5 14,1

0

10

20

30

40

50

60

70

80

90

100