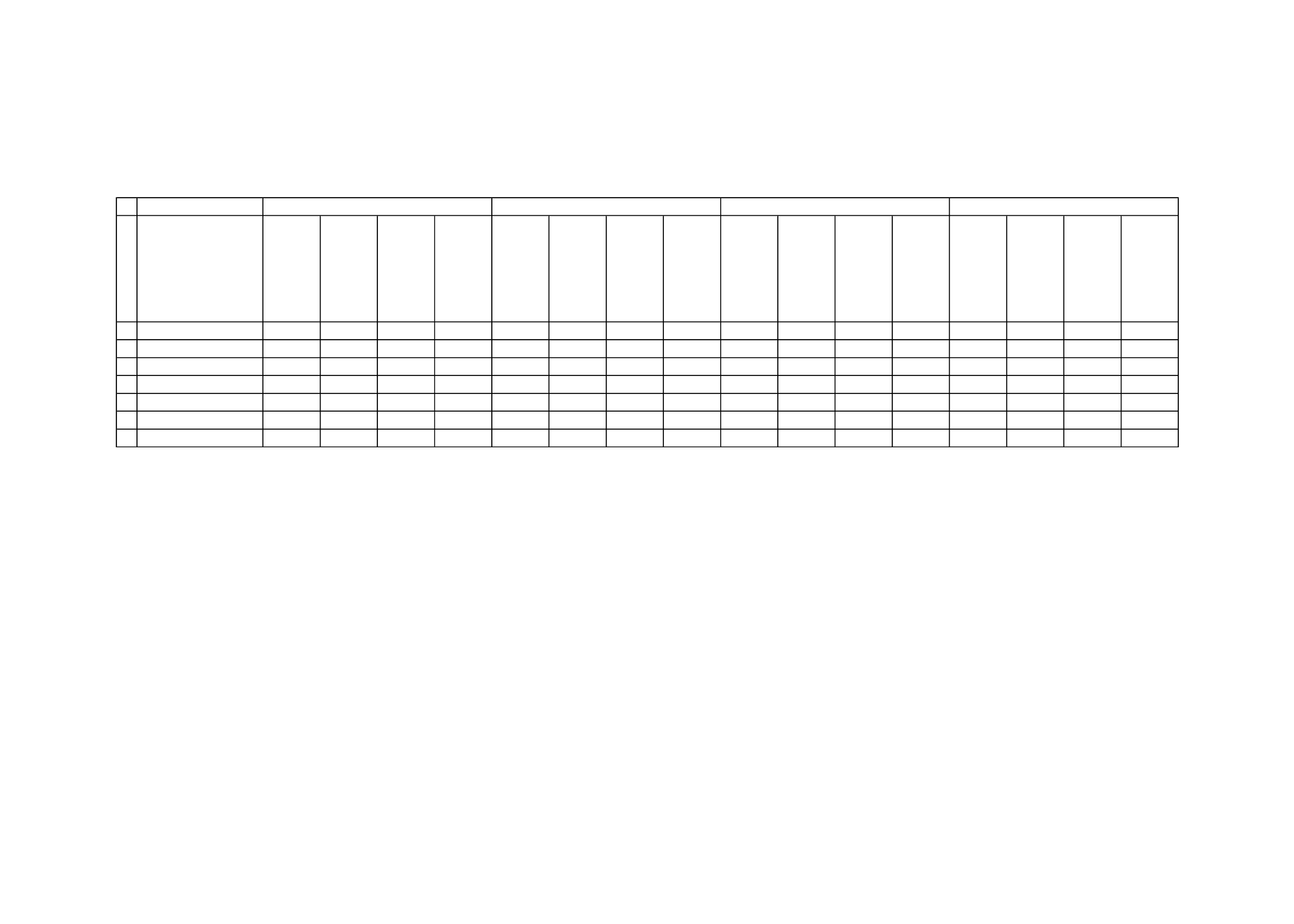

56

Table 14: Selected Financial Data on HIG-OIC Member States (2014)

Source: The World Bank Database

Categories

High-Income Group

(OIC-HIG)

Private

credit by

deposit

money

banks to

GDP (%)

Deposit

money

banks'

assets to

GDP (%)

Stock

market

capitalizat

ion to GDP

(%)

Stock

market

total value

traded to

GDP (%)

Bank

accounts

per 1,000

adults

Bank

branches

per

100,000

adults

Firms

with a

bank loan

or line of

credit (%)

Saved at a

financial

institution

in the past

year (%

age 15+)

Bank

lending-

deposit

spread

Bank

return on

assets (%,

after tax)

Bank

return on

equity (%,

after tax)

Stock

market

turnover

ratio (%)

Bank

nonperfor

ming

loans to

gross

loans (%)

Bank

capital to

total

assets (%)

Bank

credit to

bank

deposits

(%)

Bank

regulatory

capital to

risk-

weighted

assets (%)

1 Bahrain

65,1

91,3

65,4

2,0

-

-

-

34,7

4,9

1,3

10,0

3,3

4,6

12,2

92,2

18,3

2 Brunei Darussalam 32,4

36,5

-

-

1582,1 19,7

-

2,0

5,2

1,9

18,2

-

3,9

11,8

52,7

21,4

3 Kuwait

65,5

68,8

-

-

1160,0 15,2

-

25,5

2,2

1,1

9,0

-

2,9

11,1

95,4

16,9

4 Oman

44,0

52,0

46,0

7,1

-

14,5

-

-

3,1

1,6

12,3

15,6

1,9

13,1 121,2

15,4

5 Qatar

42,6

90,3

82,7

18,3 711,4

15,3

-

-

3,6

2,0

15,5

32,1

1,7

-

67,5

16,3

6 Saudi Arabia

42,2

52,7

63,1

61,6 835,8

8,8

-

15,5

-

2,1

15,5 119,3

1,1

13,8 129,0

17,9

7 United Arab Emirates

62,0

86,6

47,5

20,3

-

12,1

-

32,1

-

2,1

15,3

75,0

5,6

12,3

87,1

18,1

Financial Depth

Financial Access

Financial Efficiency

Financial Stability