Risk Management in Transport PPP Projects

In the Islamic Countries

31

management, which should follow the following steps: a profound effort to foresee risk

events (identification), a rigorous analysis of their implications (assessment of likelihood

and size of consequences if they materialize) and analysis and implementation of possible

mitigating measures or remedies.

Before presenting each of the six investment phases of the conceptual framework in detail in the

light of the relevant risk governance dimensions, a preliminary clarification on the

relevant

risks

is necessary. Building upon the synthetic typology of risks affecting PPPs proposed by

Burger et al. (2009) and after adjusting and enriching it based on additional literature and

transport-specific considerations (especially from the database on risks presented in Global

Infrastructure Hub, 2016; see also The Economist Intelligence Unit, 2013), an ad-hoc

classification of risks has been developed, which is presented in the following Table. It is based

firstly on a macro-distinction between context-related and project-related risks, and secondly

on further risk categories, under which actual risks have been listed, aiming to provide a

practical overview of the threats characterizing transport PPPs, i.e. the reasons why a proper

risk management is indispensable.

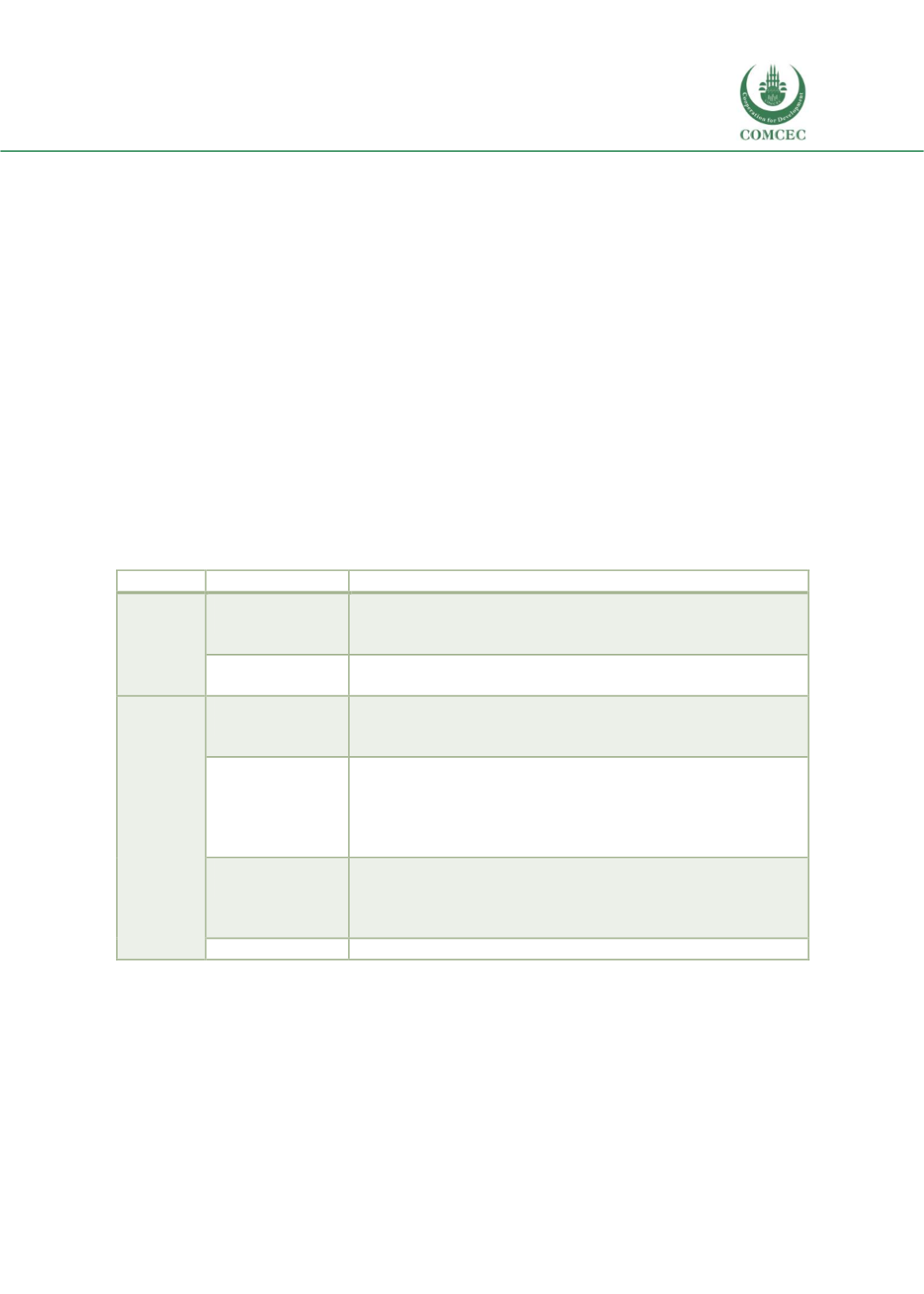

Table 6: Typology of risks affecting transport PPPs

Risk type

Risk category

Risks

Context-

related

risks

Political and legal

risks

Different investment preferences of alternating governments,

expansionary policies raising the cost of financing, risk of

expropriation, changes in law, corruption risk, fiscal risk

Macroeconomic

risks

Liquidity risk, exchange and interest rate risk, currency inflation

Project

risks

Financial credit

risks

Cost of financing, credit risk of the Special Purpose Vehicle (SPV), credit

risk of the construction and operating company, credit risk of the

financial institution, sovereign risk, transaction costs

Design,

construction and

operation risks

Site risks (availability of the site, permits, ground conditions),

construction costs, contractor failure risk, delays at various stages,

maintenance risk, environmental risk, technology risk, disruptive

technology risk, public acceptance, security risk, subcontractor

disputes/insolvency, renegotiation risk, residual value risk

Financial

sustainability risks

Revenue risks (demand/usage risk - in user-pays and volume payment

mechanisms, price or tariff risk - in user-pays mechanisms, availability

and quality risks, third party revenue risks, etc.) and demand risks

(traffic volume, toll fee level, toll fee acceptability)

Other risks

Force majeure and early termination risks

Source: Authors.

The different risks can be relevant at different investment phases and have different potential

impacts on the performance of transport PPPs. Risks may also mutually reinforce each other.

Crucially, anyway, while every risk may require a tailored approach and management, no one

can be managed outside of an integrated risk governance framework, which commands a

holistic approach.