Improving Transnational Transport Corridors

In the OIC Member Countries: Concepts and Cases

133

corridor and hinterland will impact positively on these factors. The main question is whether

Africa really is a low-cost site from which to run a business. According to the World Bank

62

,

although data on production costs are not easily available, a number of reports and anecdotal

evidence clearly show that Africa is far from being a low-cost production site. A combination of

factors linked to the institutional and physical business environment make the African

continent one of the most expensive places in the world to produce. By some estimates as

much as 25 percent of sales of firms in some African countries are lost because of impediments

of the investment climate such as unreliable infrastructure, contract enforcement difficulties,

crime, corruption, and poor regulation. These losses are, at times, much higher than taxes paid.

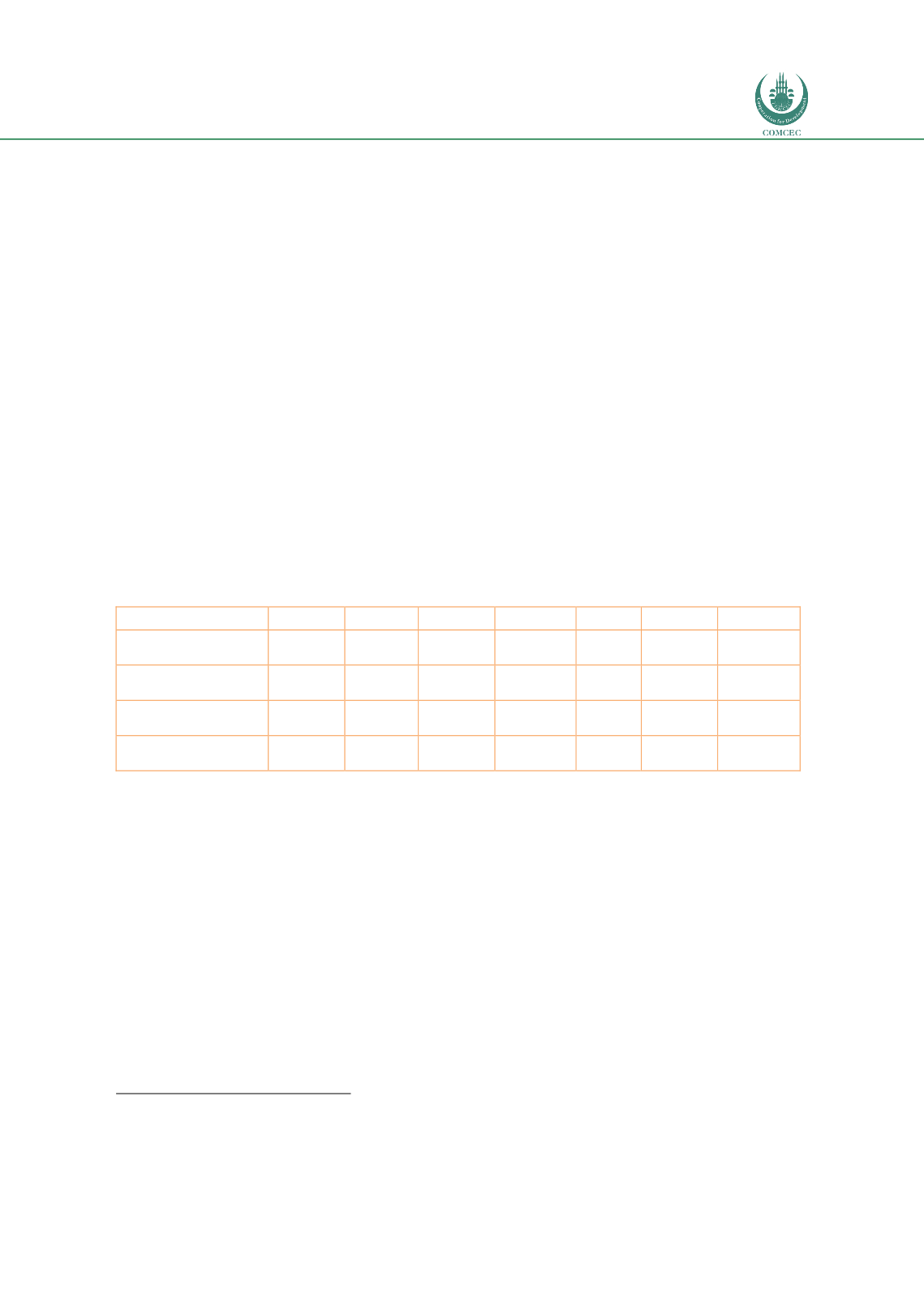

A compilation of prime costs in the economies of each corridor country is given in

Table 42.The cost of investment is indicated by the prevailing base interest rate in each country. Rates

are well above those in Europe and USA. Rates are lowest in Rwanda, a country that is making

rapid progress to reform and modernize but they are highest in the DRC, which has the least

reformist government. Labor rates in Africa are generally low at about 180 USD per month

(2008). However, value added and productivity is also low, making low labor rates costlier

than generally apparent. The rates shown in the table are current and indicate that African

labor rates are relatively low.

Table 42: Examples of prime costs in corridor countries

Cost Item

Uganda

Rwanda Burundi

Kenya

DRC

S. Sudan

Tanzania

Cost of investment -

Base Rate of Interest

11%

6.25%

7.17%

10%

14%

12.50%

12%

Median cost of labor

(USD net per hour)

0.4

0.65

0.43

1.26

0.64

0.35

0.92

Cost of industrial

land (USD per Ha)

650,000

620,000

N/A

650,000

850,000 N/A

640,000

Cost of energy

(USD per KWh)

0.15

0.22

0.11

0.03

0.048

0.42

0.17

Source: Fimotions (2017), from various sources.

Notes to table:

i.

Interest rates are current to 2017

ii.

Cost of labor is inflated to current prices using latest exchange rates from latest available data

iii.

Industrial Land is generally close to the capital city

iv.

Energy prices are current to 2017

The cost of industrial land is rather similar in corridor countries, which may provide an early

sign of leveling due to improvements in accessibility since land prices and location are closely

linked. The price of energy varies a lot between TTCANC countries. The reasons is that energy

markets remain firmly controlled by government, transmission and distribution networks are

not linked and the energy sector is not commercialized / privatized. Agreements are in process

to commercialize and regionalize energy generation and supply networks.

62

http://siteresources.worldbank.org/EXTAFRSUMAFTPS/Resources/chapter4.pdf