Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

122

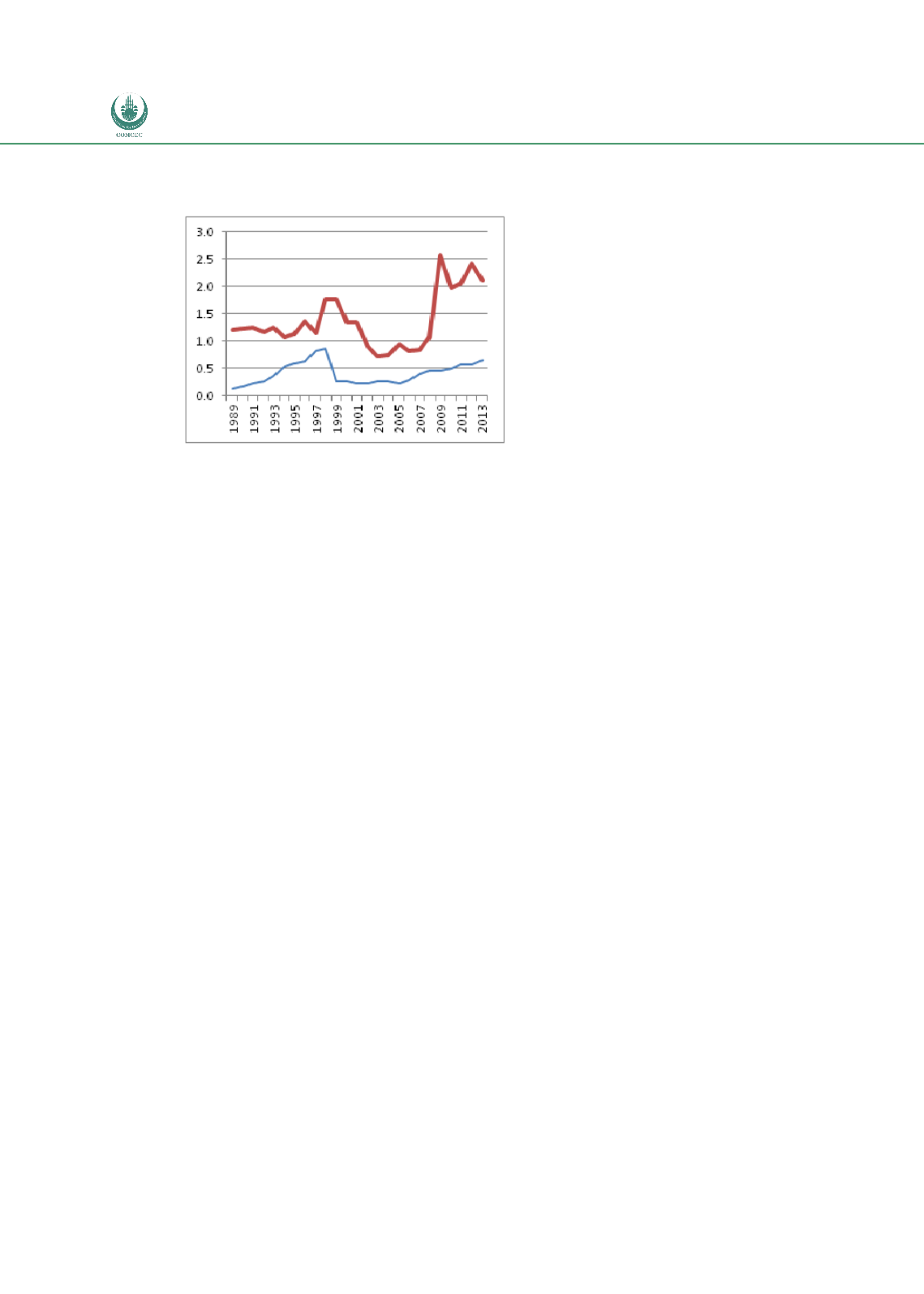

Figure 41:

Share of Egypt in Turkey’s Total Trade

Calculations based on Comtrade data

Gulf Cooperation Council

In December 2001, the members of the Cooperation Council for the Arab States of the Gulf

(GCC) Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and United Arab Emirates (UAE) signed the

Economic Agreement. It substantially revised the original Economic Agreement that was

originally signed in 1981, which laid down the ground for the economic relationship among

GCC members and established the GCC Free Trade Area. The 2001 agreement com- mitted to

create GCC customs union that as a minimum was meant to include a common external tariff

(CET), common customs regulations and procedures, single-entry point, elimination of all tariff

and non-tariff barriers, and national treatment provisions.

The GCC customs union commenced in 2003. There are no tariffs for goods circulation among

GCC members, but some products (around 1% of tariff lines) such as alcohol, pork, and related

products, etc. have a status of prohibited goods and cannot be traded (and produced) in GCC

countries. Members also generally have been applying the CET since 2003, although certain

differences remain until present, especially as regards treatment of prohibited and special

products (WTO, 2014a). The vast majority of tariff lines under GCC CET is set at 5%, with some

duty free lines. It is worth observing that at least for some countries (Saudi Arabia

-

see Table

21 below) adoption of the GCC CET implied substantial reduction of the average tariff

protection. Around 20 tariff lines on tobacco products are set at 100% or 100%/specific duty,

whichever is higher. For a number of tariff lines for "prohibited" and "special goods" there

remain differences in how these are applied between GCC countries (WTO, 2014a).