FACILITATING INTRA-OIC TRADE:

Improving the Efficiency of the Customs Procedures in the OIC Member States

73

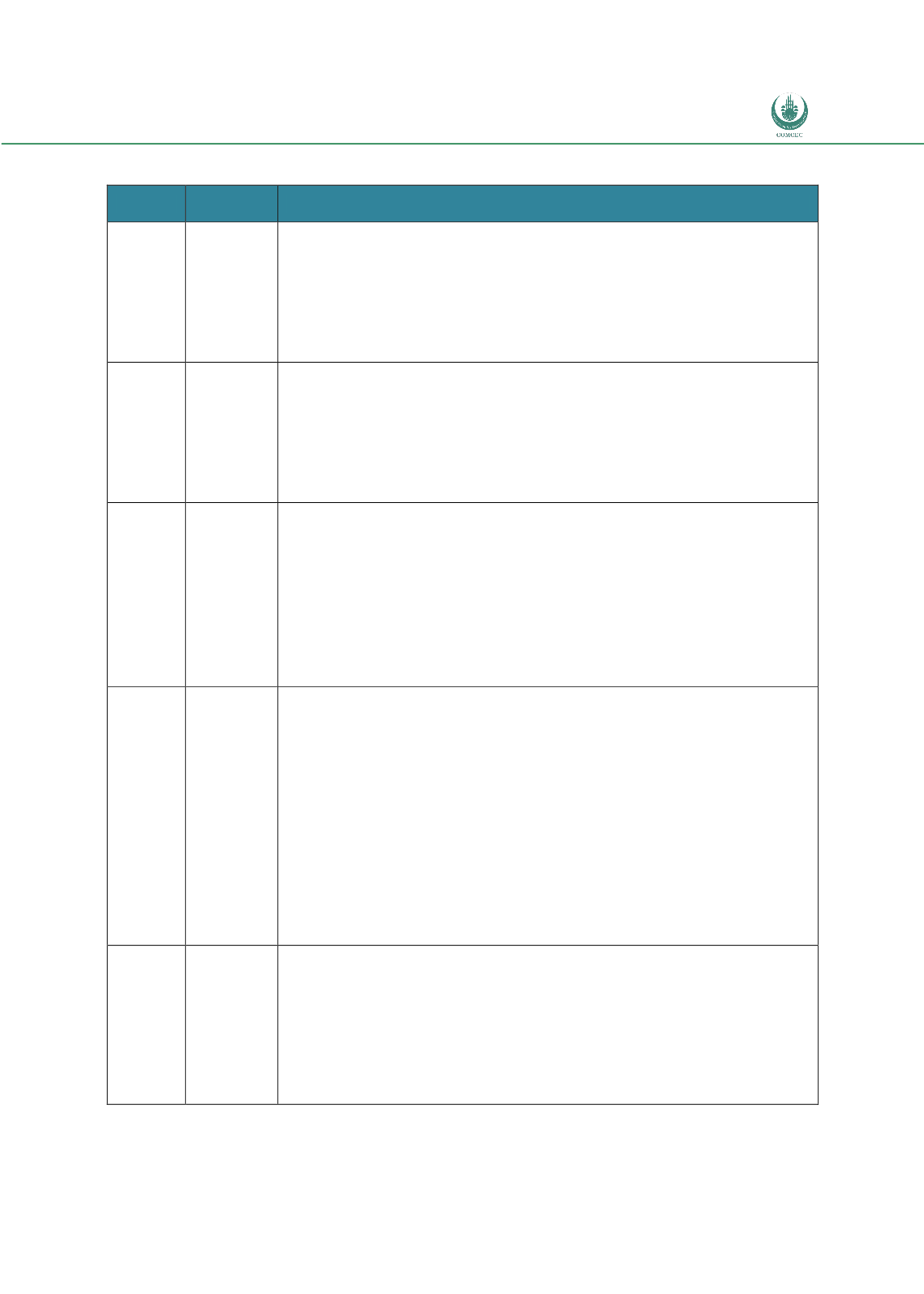

Table 15: ICT Systems Used in Some of the Member States

Country System

Features

UAE

MIRSAL 2

Pre-clearance of goods.

Electronic document submission

Paperless declarations available 24/7.

Time, effort and cost savings of up to 75%.

Consistency in treatment and risk management.

Availability of more than one method to process a clearance request

İnternet based

Brunei

E-customs

Ability to accept the submissions of applications electronically

Process applications received electronically

Automatic calculations of Customs Duties

Automated billing and tracking of Customs payment

Internet based

Able to interface with trading community

Certain functions such as e-mails, alerts and reminders to the client/users

Morocco

BADR

Accept submissions of applications electronically

Check the declaration circuit

Calculation of duties and taxes to be paid

Issuing certificates of conformity to standards (Department of Industry)

Post clearance certificate

Manage clearances authorizations

Prepare a payment processing sheet (invoice)

E-payment

Internet based

Bahrain

OFOQ

Integrated Risk Management

submission and management of electronic Customs Declarations and

Manifests

e-Payment

integration with other agencies

secure digital authentication and digital signatures

Customs clearance notifications

Automatic price valuation

Online Violations database for importers/passengers

Auditing

Comprehensive Valuation database with weighted average reference value

Complete customs process monitoring and feedback

Real-time Revenue, exemption and trade statistics figures

Turkey

BİLGE

Accepts submissions of summary declarations (before arrival of vehicle)

Accepts TIR Carnets

Accepts declaration for expedited shipments

E-signature

Calculation of taxes/other duties

Notifications to the users

Accounting module that records payment information and guarantees related

to taxes and other duties

Source: National Customs Websites