Authorized Economic Operators

In the Islamic Countries:

Enhancing Customs-Traders Partnership

68

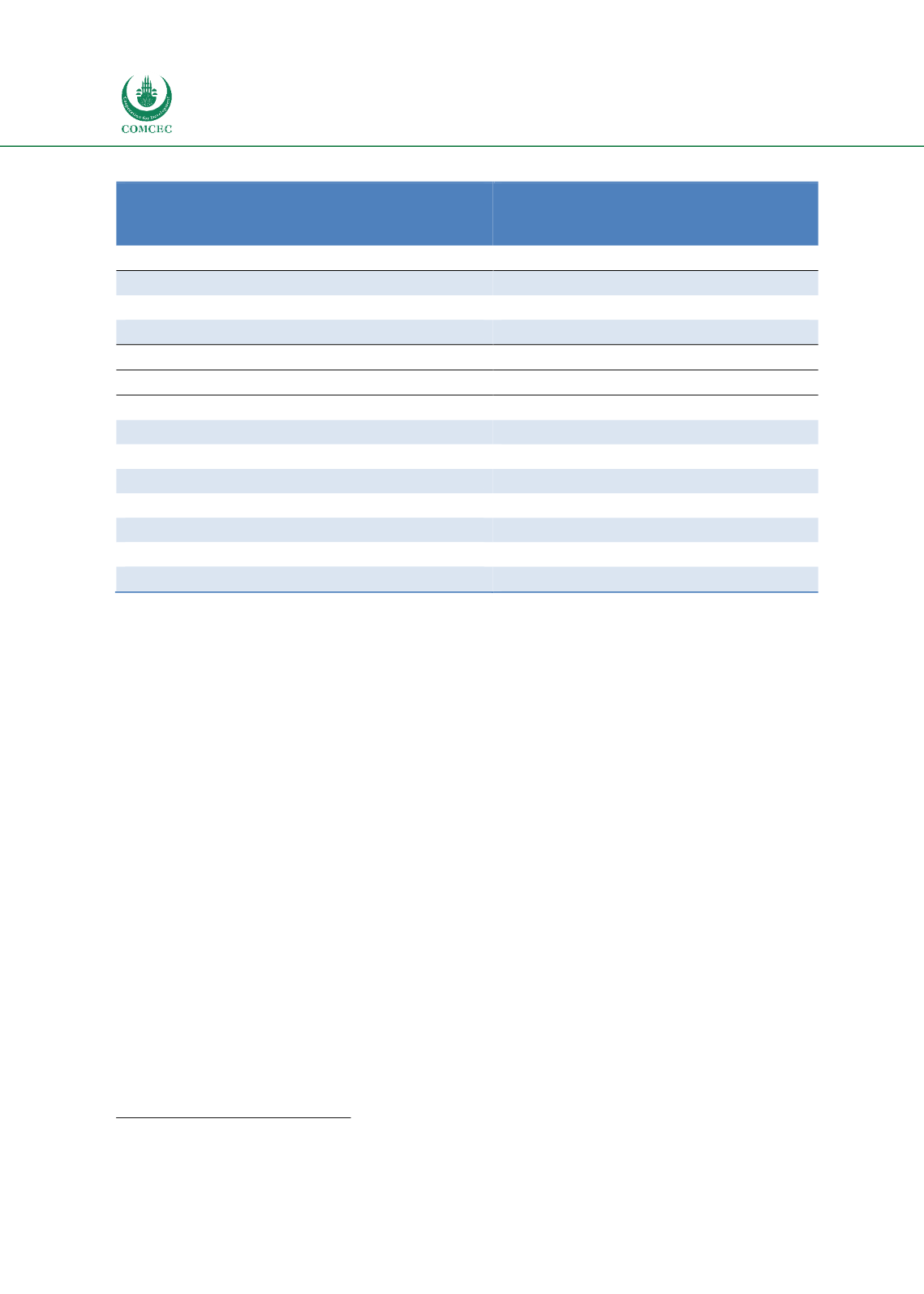

Table 3.15. Comparison of Length of Authorization Process: Best Practices and OIC Countries

Authorization Process

days, at least

Best Practice Countries

Canada

--

EU

90

Japan

30

OIC Countries

Egypt

60

Indonesia

60

Jordan

60

Morocco

240

Oman

30

Tunisia

120

Turkey

90

Uganda

900

Source: Authors’ compilation using survey data.

3.5 AEO Programs and Effectiveness of Customs

There are two pillars of the AEO programs: safe and secure trade and trade facilitation. In

other words by implementing the AEO programs Customs aim to divert their resources to high

risk transactions and become a more efficient organization. In this respect Table 3.16 provides

a comparison of trade costs and efficiency among countries with AEO programs and without

AEO programs, the World average and the best practices

7

. All the figures are the averages of

2016-2017 (except the EU and Iran, where 2017 data are not available; no data for

Turkmenistan and Yemen). The first column presents the burden of Customs procedure

indicator (from 1=extremely inefficient to 7=extremely efficient). The average efficiency of

Customs in the World is 4.1. The efficiency of best practice countries is much higher, around 5.

In the table, the most efficient Customs is Malaysia. The striking point is that in the OIC region,

the Customs implementing an AEO program is much efficient comparing to countries where

there is no AEO program. Though, due to limited time dimension, before and after comparisons

are not possible to conduct, hence it is hard to say that AEO brings efficiency as the causality

may run in two ways.

7

There are many factors that affect Customs efficiency and trade costs. However, the figures still indicate the difference

between AEO implementing countries and others on trade costs, time and efficiency.