Authorized Economic Operators

In the Islamic Countries:

Enhancing Customs-Traders Partnership

66

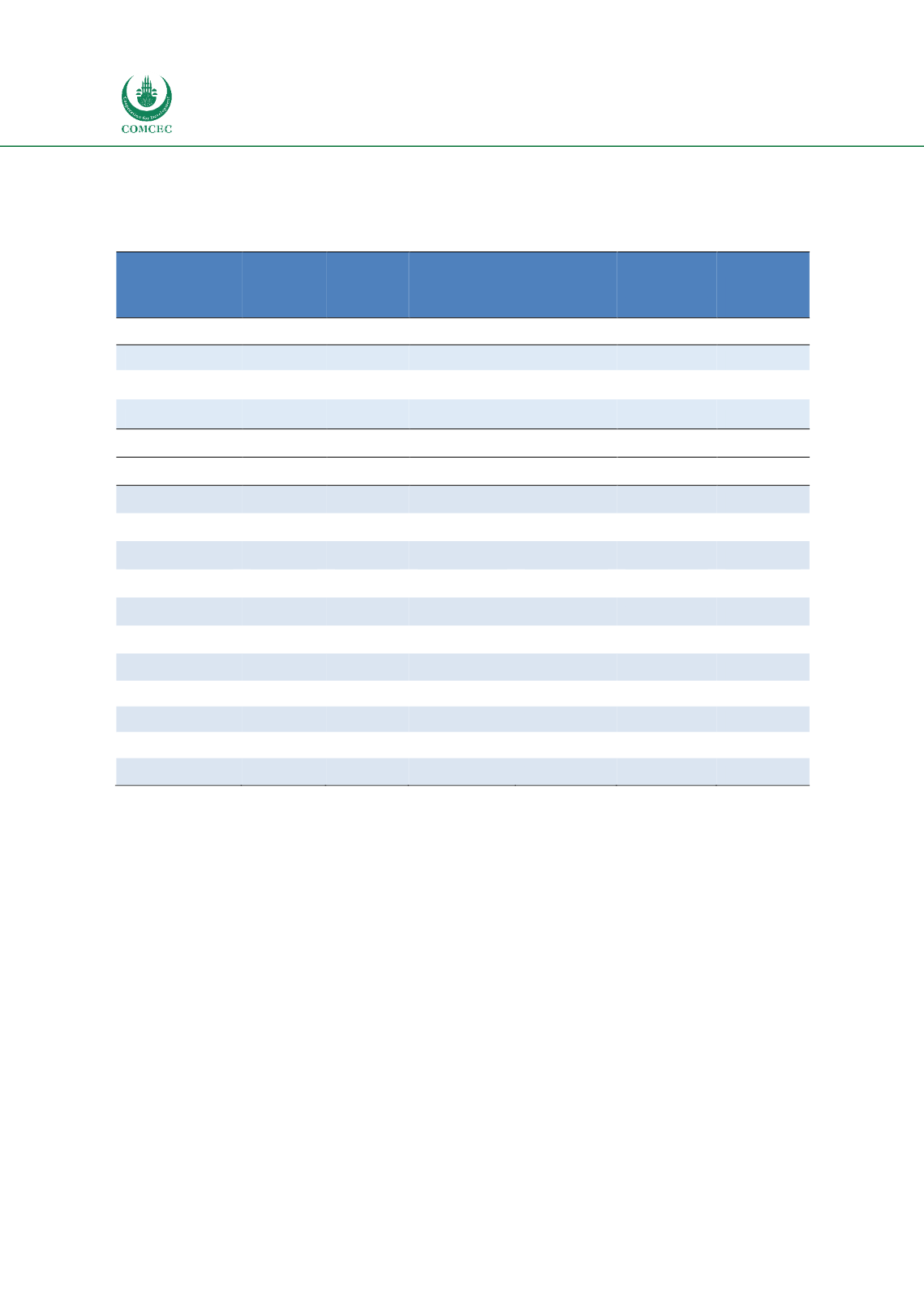

Member States only half of them include all the supply chain (except QIZ) into the AEO

programs.

Table 3.13. Comparison of the Types of AEO operators: Best practices and OIC countries

Importer

Exporter

Transporter

Warehouse

Qualified

Industrial

Zone (QIZ)

Customs

Broker

Best Practice Countries

Canada

EU

Japan

OIC Countries

Azerbaijan

Egypt

Indonesia

Jordan

Malaysia

Morocco

Oman

Saudi Arabia

Tunisia

Turkey

Uganda

Source: Authors’ compilation using WCO (2018) data

Table 3.14 presents a comparison of the benefits provided to AEO holders in OIC countries and

best practices. The best practice countries, namely Canada, the EU and Japan, provide less

benefits compared to the OIC countries on average. There may be several reasons behind this:

(i) The operators in the best practice countries may be more prone to follow the practices of

the Customs compared to the ones in the OIC region, (ii) The cost to companies would be lower

in the best practice countries as they may already satisfy the compliance requirements.

Therefore, limited benefits would still cover the costs, (iii) Trade volumes of the companies in

the best practice countries may be so much higher that limited benefits provided by the AEO

programs would be cost- and time-efficient.