Facilitating Trade:

Improving Customs Risk Management Systems

In the OIC Member States

158

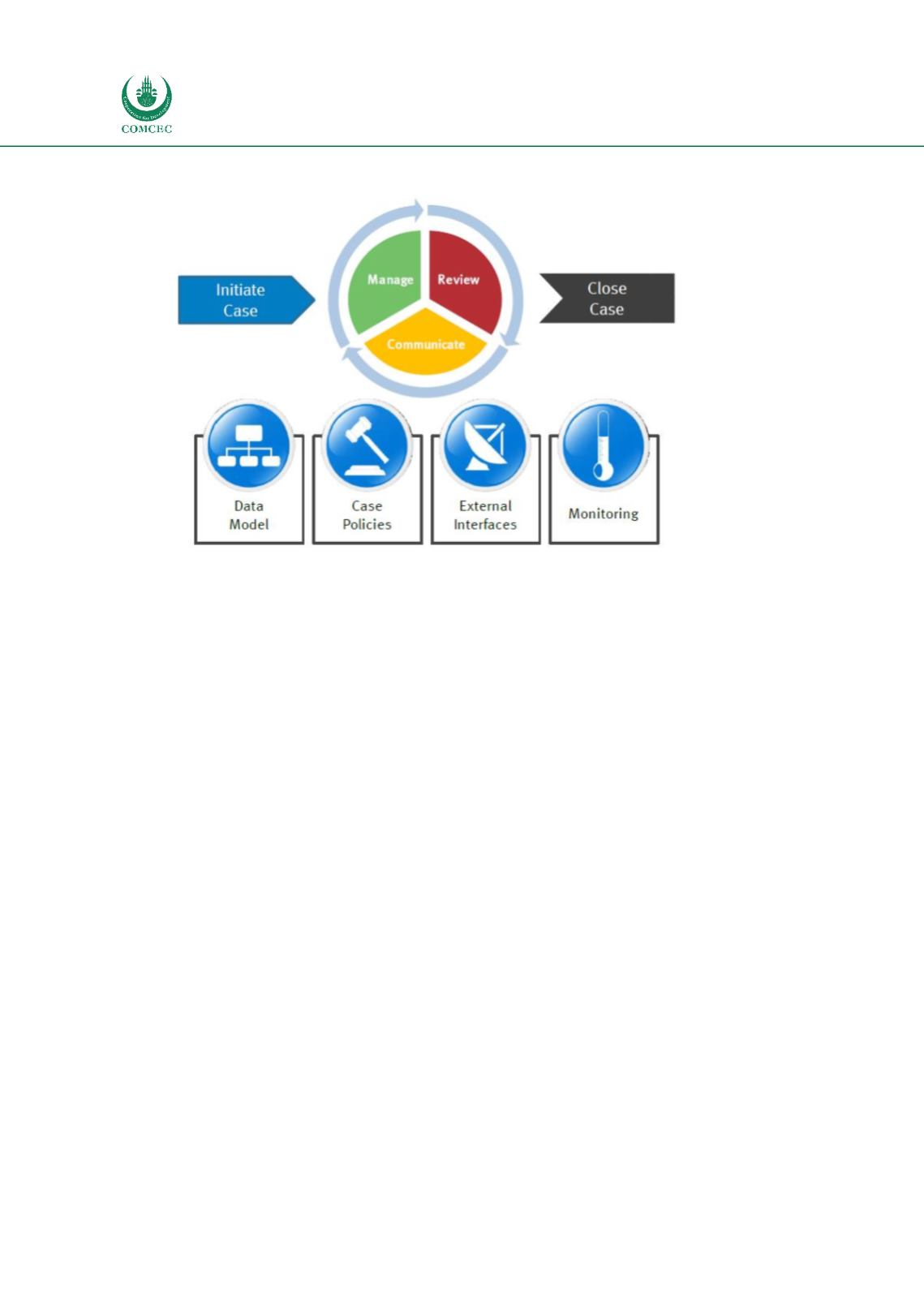

Figure 54: LE IT System Logical Model

Author’s compilation

Policy Option 4: Using Integrated CRM system including Data Warehouse, Business

Intelligence, and Data Mining

; The Integrated Customs Risk Management System (ICRM) is

the principal mechanism that should provide a high level of coordination of the CRM between

customs, tax, Single Window, government agencies and institutions competent in import, export

and transit procedures. The ICRM can provide an effective risk assessment service, based on

scientific methods, which will complement and enhance the currently embedded CRM system in

the CDPS. The ICRMwill not attempt to replace the current workflow; it will complement current

and future CRM systems, and it will assist “human controllers” in OIC MS by developing a web-

based risk assessment service that will enhance the identification of risk profiles through the

utilization of data mining and statistical algorithms techniques. The ICRMwill allow the customs

and other agencies to most effectively deploy their limited resources. The ICRM addresses the

following key issues of concern in the area of CRM:

Limited administrative resources for control;

Need for more effective and efficient risk management in customs control;

Insufficient technology support within customs and agencies;

Higher trade costs for importers /exporters;

Revenue losses and negative impact on national economic growth,

Low level of trust in customs services and agencies.

The ICRM will aim to optimize the control processes by addressing the issues of concern

mentioned above, and by developing advanced risk assessment accessible by the customs

administrations and agencies. The advanced risk assessment should base its assessments using

automated analysis of past detections of irregularities and non-compliance in trading, and,

hence, it will complement any current risk assessment methodology or tool currently used;

The risk assessment service should be able to “learn from experience,” using feedback

and self-learning module (data mining);