4

this regard, it is interesting to note that, in a few countries, such as Italy, medium-sized firms exhibit a

propensity to export that is to the one of large corporations.

Figure 1.1 Export Propensity, by firm size, 2008

Source: OECD TEC database.

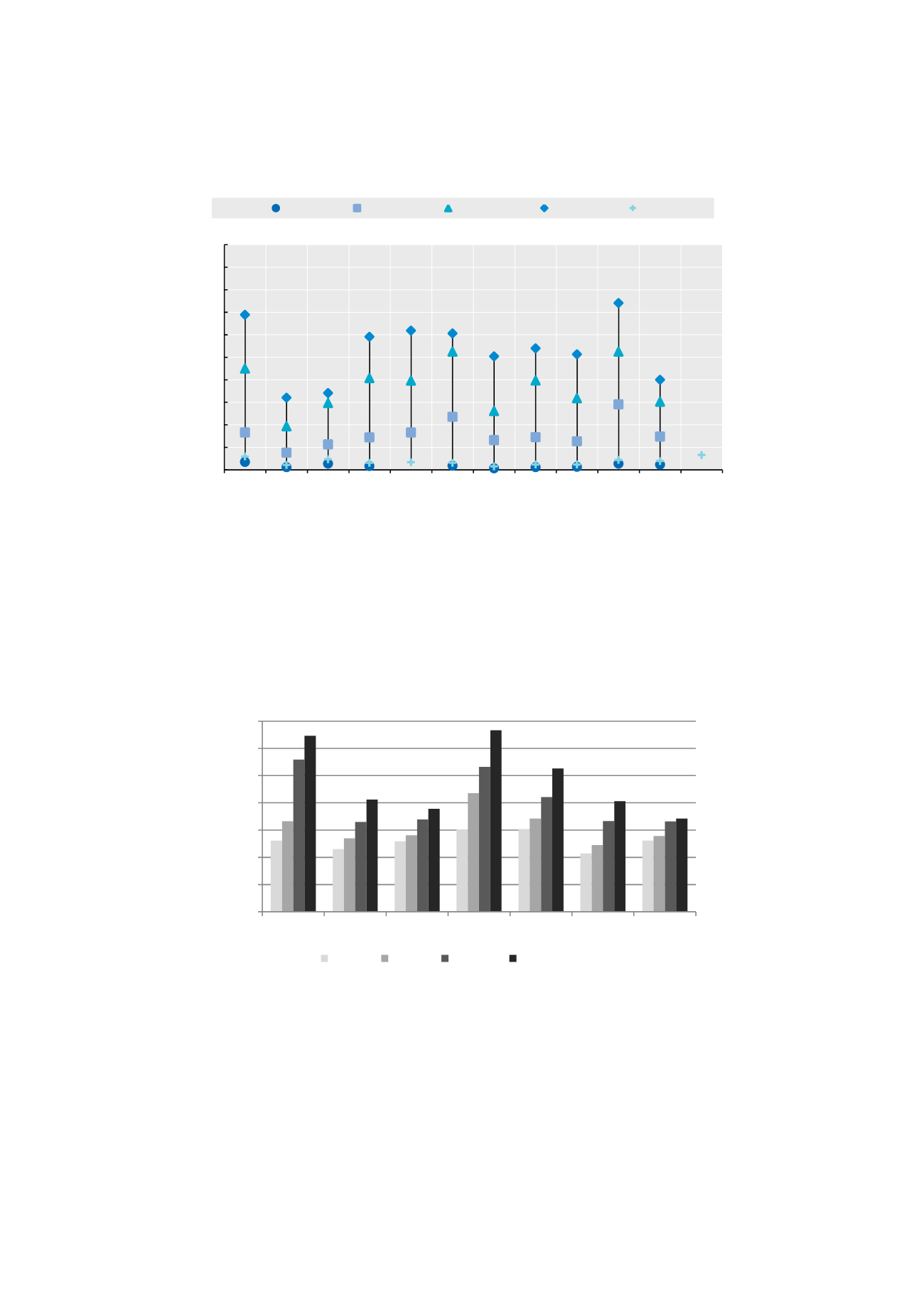

The large firms’ dominance in internationalisation is confirmed when looking at the intensive margin

of exports, i.e. the share of firm turnover which is sold in foreign markets. Figure 1.2 illustrates the

export share of firms located in several European countries and shows that the export share of large

firms is about twice that of micro firms, while medium-sized firms still export around 50% more of

their turnover than firms with less than 20 employees (OECD, 2013). However, the above figures may

hide the role SMEs play as intermediary suppliers to larger firms exporting goods for the end-user.

Figure 1.2. Share of exported turnover, by firm size

Source: Barba Navaretti et al. (2011).

The propensity of SMEs to undertake FDI is even lower than their participation in exporting. For this

mode of internationalisation, which entails the highest fixed costs, the share of large firms with

affiliates is far greater than that of micro, small or medium sized firms. In the UK for example, the

share of large firms with affiliates abroad is twice that of medium sized firms, while in Italy and

Germany the difference is roughly fourfold (OECD, 2013).

0

10

20

30

40

50

60

70

80

90

100

United

States

United

Kingdom

Sweden

Spain

Portugal

Poland

Italy

France

Finland

Estonia

Canada

Austria

%

0-9

10-49

50-249

250+

Total

0%

10%

20%

30%

40%

50%

60%

70%

Austria France Germany Hungary Italy Spain UK

10-19 20-49 50-249 more than 249