Promoting Agricultural Value Chains

In the OIC Member Countries

45

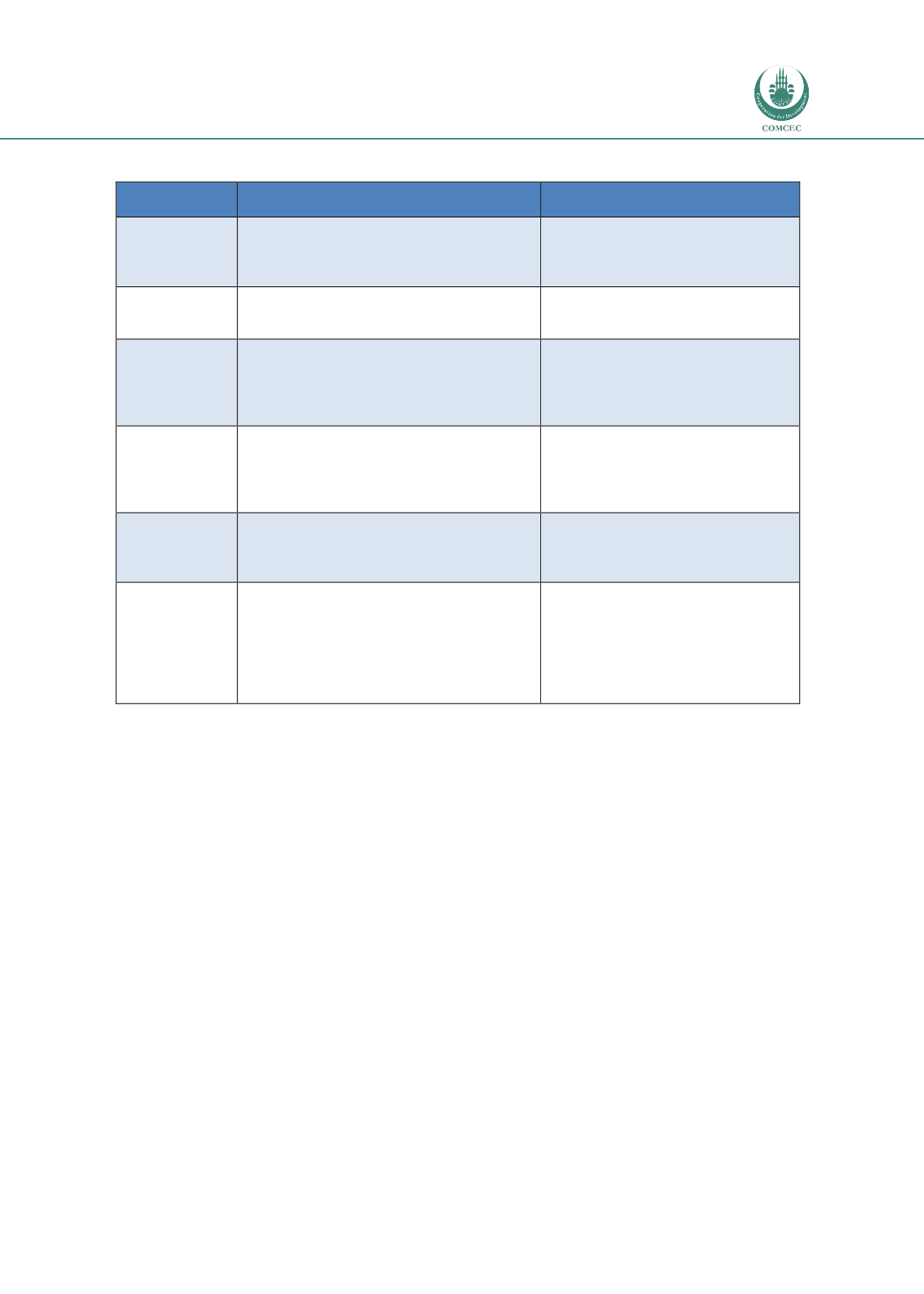

Table 3-3 Impact of Halal requirements on the value chain

Food industry

segment

Halal process impact

Main companies and other

organisations

Core suppliers

Core feeding, slaughtering and handling of

animals and animal products that adhere to

Islamic rulings. Halal certification of core

food preservatives and other ingredients.

Brazil Food Company (Brazil)

Allanasons (India)

American Foods Group (USA)

Cargill (USA)

Technology

Specialised technologies to facilitate

slaughtering of animals and related

management technologies.

Food processing Halal certification of sourced food supplies

and all ingredients used in producing and

managing the food.

Nestlé (Switzerland)

Al Islami (UAE)

Saffron Road (USA)

Tahira Foods (UK)

Arman (China)

Channels

Retailers focus on creating space and

positioning of halal food products. This is

especially relevant in markets where

Muslims are not a majority.

Tesco (UK)

Carrefour (France)

BIM (Turkey)

Marrybrown Sdn Bhd (Malaysia)

Lulu (UAE)

Logistics

An important aspect of ensuring the purity of

the halal concept is making sure that the

global distribution of halal food is kept pure

and not in contact with non-halal food items.

Eco-system

Training, R&D, marketing, financial services,

regulations, and compliance are all need to

address halal needs.

SMICC (OIC / Turkey)

International Halal Integrity Alliance

(Malaysia)

JAKIM (Malaysia)

IFANCA (USA)

ESMA (UAE)

MUI (Indonesia)

Source: Reuters & Dinar Standard, 2015

There is still a long way to go, but there are signs of increased scrutiny by OIC governments on

the Halal integrity of food products. In October 2014, for example, Qatari authorities pulled

several American-branded, pre-packaged meat products from the shelves, claiming they were

un-Halal. They removed products including well-known brands such as Sara Lee’s Cracked

Pepper Turkey Breast, Ball Park’s Beef Franks and Hillshire Farm’s Turkey Lit’l Smokies

(Reuters & Dinar Standard, 2015).

3.4Participation in global value chains

Overall, trade in agricultural products in OIC Member Countries has grown tremendously from

2002 to 2012. Total agricultural product exports increased from US$ 33.8 billion in 2002 to

US$ 132.7 billion in 2012. At the same time, agricultural product imports rose from US$ 53.5

billion in 2002 to US$ 208 billion in 2012. As imports are higher than exports, the OIC is a net

importer of food products. It is noteworthy that no less than 85 percent of OIC countries’ meat

and live animal imports come from non-OIC countries (Reuters & Dinar Standard, 2015).

There are, however, big differences between countries when it comes to trade deficits and

surpluses. Typically, Arab countries are importers of agricultural products, comprising 50

percent of OIC import value, followed by Asia, with 41 percent. Asian OIC countries are the top

exporters, with 75 percent, followed by Arab countries, with 15 percent (se

e Figure 3-12). As a

group, Asian OIC countries are net exporters. Arab and African are net importers.