Promoting Agricultural Value Chains

In the OIC Member Countries

97

5.5

The palm oil value chain in Malaysia

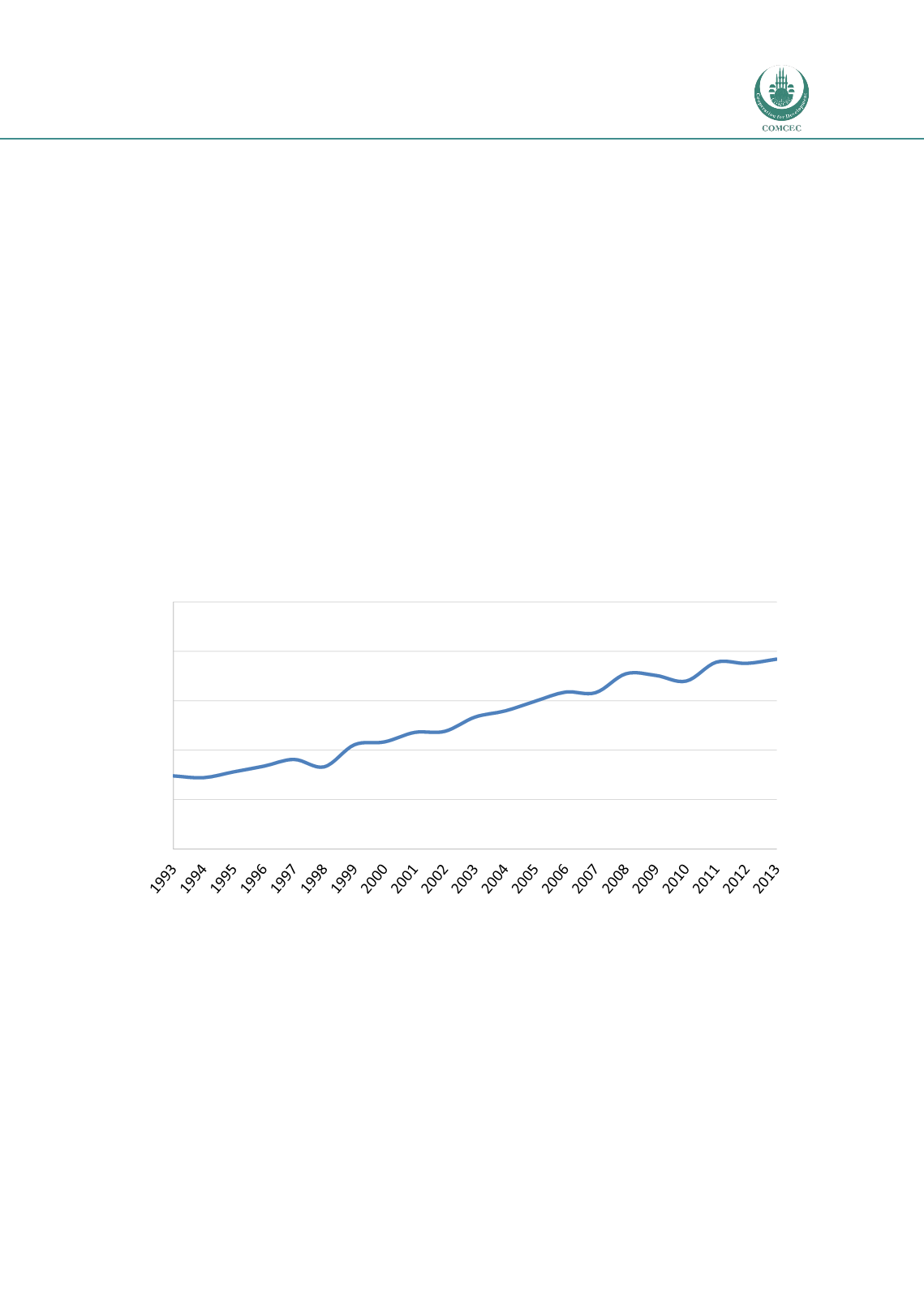

Since its introduction as an ornamental plant in 1875 and the start of the first commercial

plantation in 1917, palm oil has turned into a high value contributor to Malaysia’s

development and the backbone of the economy. Production has increased steadily over the

years by an average of 3.6 percent per annum up to a level of 19.8 million tonnes in 2014 with

an export value of US$ 11.6 billion (IndexMundi, 2015; Exim Bank, 2015) (see also

Figure 5-15). The sector’s contribution to GDP and annual export earnings is estimated at

approximately 5 percent each. More than 600,000 people are already employed by the palm oil

sector and another 60,000 people are expected to be employed in the near future through the

current expansion of the industry into biofuel applications (MPOC, 2013).

Malaysia currently accounts for 39 percent of world palm oil production and 44 percent of

world exports (MPOC, 2012). The country is the second largest producer of palm oil after

Indonesia and collectively the two countries account for 85 percent of worldwide production.

While monoculture plantations are the main production systems in Malaysia, about 40 percent

of total output comes from smallholder farmers.

Figure 5-15 Palm oil production in Malaysia, 1993-2013

Source: FAOSTAT, 2015

The confounding increase of palm oil production is connected to a growth in global

consumption by 7 percent per annum over the past 20 years (Exim Bank, 2015). By now, palm

oil constitutes the world’s most widely consumed vegetable oil. Both palm oil and palm oil

kernel have a wide range of applications: about 80 percent are used in food while the rest is

feedstock for a number of non-food applications, including cosmetics, detergents and cleaning

agents.

Global demand for palm oil is expected to continue to increase due to growing consumption in

emerging economies, notably in India and China. The high demand for palm oil is also

attributed to its relatively low price given the low production costs and high yields in Malaysia

and Indonesia (Exim Bank, 2015).

0

5

10

15

20

25

Million tonnes