Promoting Agricultural Value Chains

In the OIC Member Countries

93

often poorly organised and belong to the poorest segment of the population with a poverty

rate of 76 percent (GoG, 2010). This highlights the important role of groundnut production for

food security, as about 40 percent of the marketable groundnut crop is sold on the domestic

market, offering an important source of protein to the local population (National Planning

Commission, 2015).

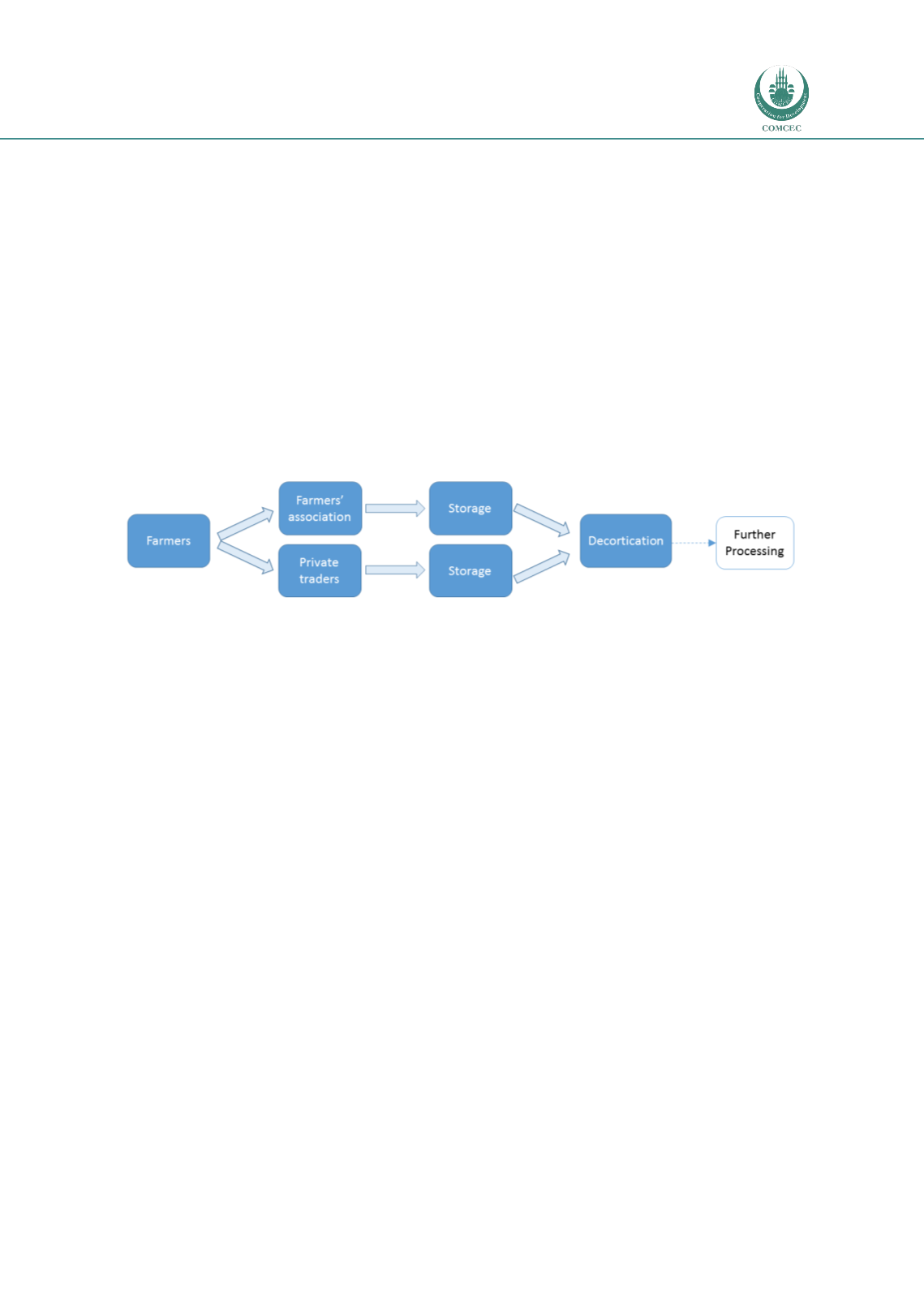

Both the value chain for the higher quality ‘handpicked selected’ nuts (HPS) and the ‘fair and

average quality’ nuts (FAQ) are similar. The current marketing system consists of a

countrywide network of farmers' associations, known as cooperative produce and marketing

societies (CPMSs), as well as private buying points operated by private traders (WTO, 2014).

Farmers can sell their produce through either of the two, and also contract credit for

production inputs (se

e Figure 5-12).

Figure 5-12 Groundnut value chain in the Gambia

Source: Authors’ elaboration

Until 2014, farmers were offered a guaranteed producer price set by the Government, which

was introduced through the 1999-03 Revitalization Strategy. The minimum price is coupled to

a price stabilisation fund. The purpose of the price determination mechanism and stabilisation

fund is to guarantee a floor price to farmers, calculated so as to provide them with a minimum

margin on their yearly investment, plus, depending on the circumstances, an upward

adjustment based on current market values (WTO, 2004). Farmers received between 60-65

percent of the export prices, depending on the parameters that were negotiated between the

stakeholders and the exchange rates prevailing at the time. However, since the abandonment

of the guaranteed price mechanism, prices for farmers seem to have dropped, which has

encouraged the smuggling of Gambian groundnuts into Senegal.

The CPMSs and private traders are responsible for the storage of groundnuts, and their sale to

industrial operators, who are involved primarily in decortication. Often traders are employed

by one of the industrial operators. Interviews revealed that from the 18 companies active in

the Gambia five years ago, only two are still operating; the rest left or quit due to extremely

high taxes, levies and other hidden trade barriers.

Only two industrial facilities to process groundnuts are currently in operation: the Denton

Bridge and Buniadu decorticating plants; both operated by the Government (WTO, 2004). This

showcases the continued dominant position of the Government in the groundnut value chain,

despite official encouragement of private sector involvement and investments. Observers

suggest that that the Government is enhancing its influence in key sectors, including groundnut

processing/manufacturing, as well as in more sensitive areas, such as television, radio

broadcasting and defence (US Department of State, 2015).