Promoting Agricultural Value Chains

In the OIC Member Countries

101

area planted) who deliver the produce to the nearest collection centres. Several NGOs, such as

Wild Asia, have programmes in place to provide technical support, training and capacity

building to groups of independent smallholders (Nagiah & Azmi, 2012).

The second category is comprised of slightly larger farmers who are often organised in

government schemes, such as FELDA (13 percent), FELCRA (3 percent) and RISDA (1 percent).

These also organise the collection and processing of palm oil from smallholders. Each of the

government schemes also operates large scale plantation companies in parallel, especially

FELDA who is the largest single upstream actor. The majority of production area, however, is

held by private estates (62 percent). These vary in size, from a few 100 ha to more than

100,000 ha (Cheng, 2002). High degrees of vertical integration can be observed, as all estates

have their own nurseries, R&D departments, and infrastructure for milling. Many of the

present day plantations have their beginnings in the colonial era but nowadays only very few

companies have substantial or controlling foreign ownership (Cheng, 2002). The main

companies are FELDA, United Plantations, IOI Corporation, and Sime Darby.

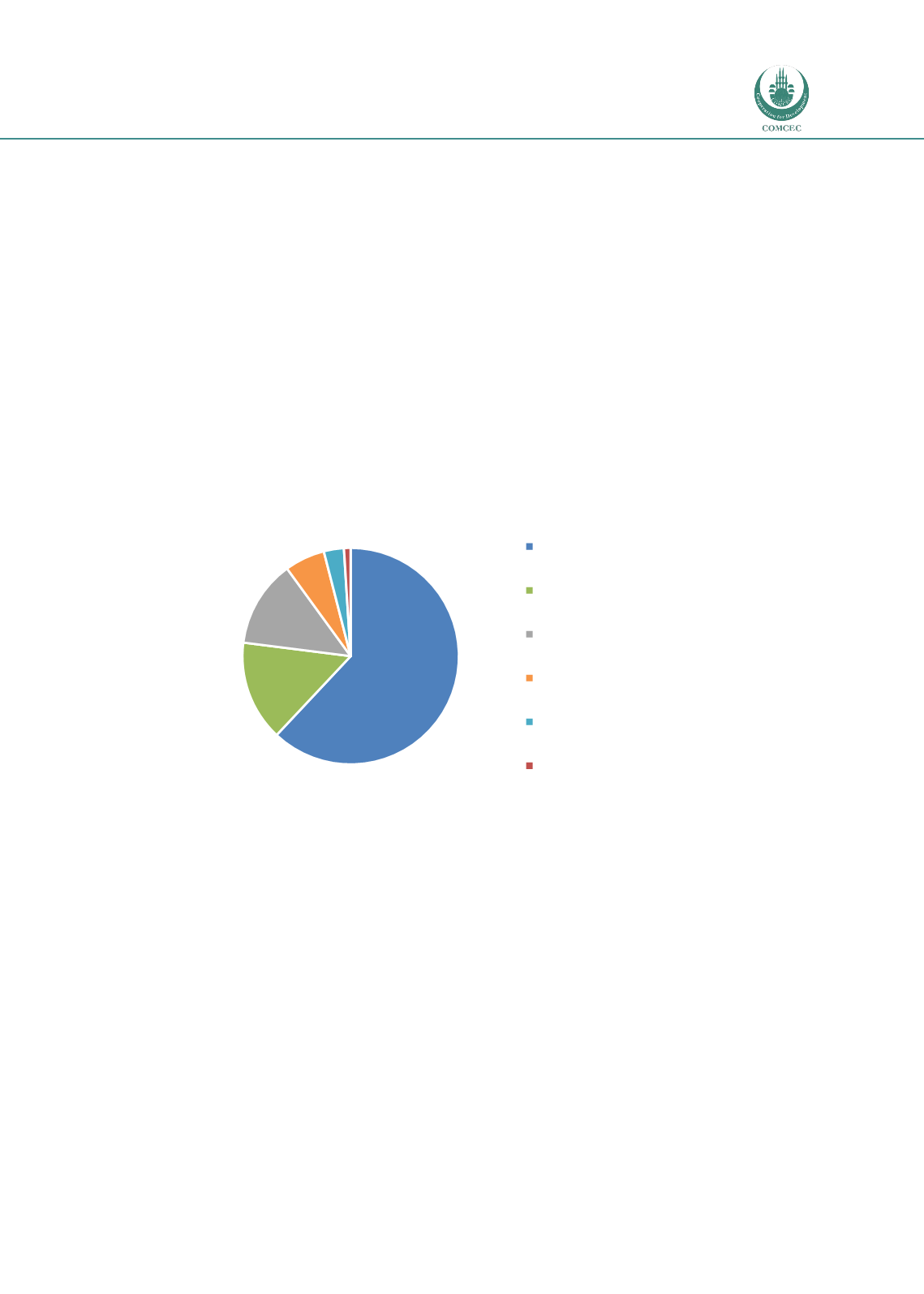

Figure 5-16 Distribution of oil palm on total planted area by category of growers, 2014

Source: MPOB, 2015

Abbreviations: FELDA: Federal Land Development Authority; FELCRA: Federal Land Consolidation and

Rehabilitation; RISDA: Rubber Industry Smallholders’ Development Authority

Several of the Malaysian estate companies have recently invested in downstream assets

abroad, initially in neighbouring countries such as Indonesia (where Malaysian firms now own

25 percent of the palm oil acreage) and Papua New Guinea. More recently there has been a

move to invest in plantations in West and Central Africa, such as Sierra Leone, Liberia, the

Democratic Republic of Congo, and Cameroon.

Besides the production of crude palm oil, many estate companies are also involved in the

downstream part of the chain, including palm oil refining, edible oil production, and

manufacturing of basic oleo chemicals. This is due to the higher margins which can be achieved

in the downstream value chain, as compared to the production level (e.g. El Fegoun, 2015).

Therefore, a shift can be observed from general refined products to more specialised value

added products. While downstream innovation used to be driven by oil refining hubs like the

USA, Singapore and Europe, Malaysian companies have recently started investing in R&D

centres at both firm and industry levels (Belai et al., 2011). Malaysian companies have also

62

15

13

6

3

1

Private estates

Independent smallholders

FELDA

State schemes/government agencies

FELCRA

RISDA