Facilitating Smallholder Farmers’ Market Access

In the OIC Member Countries

73

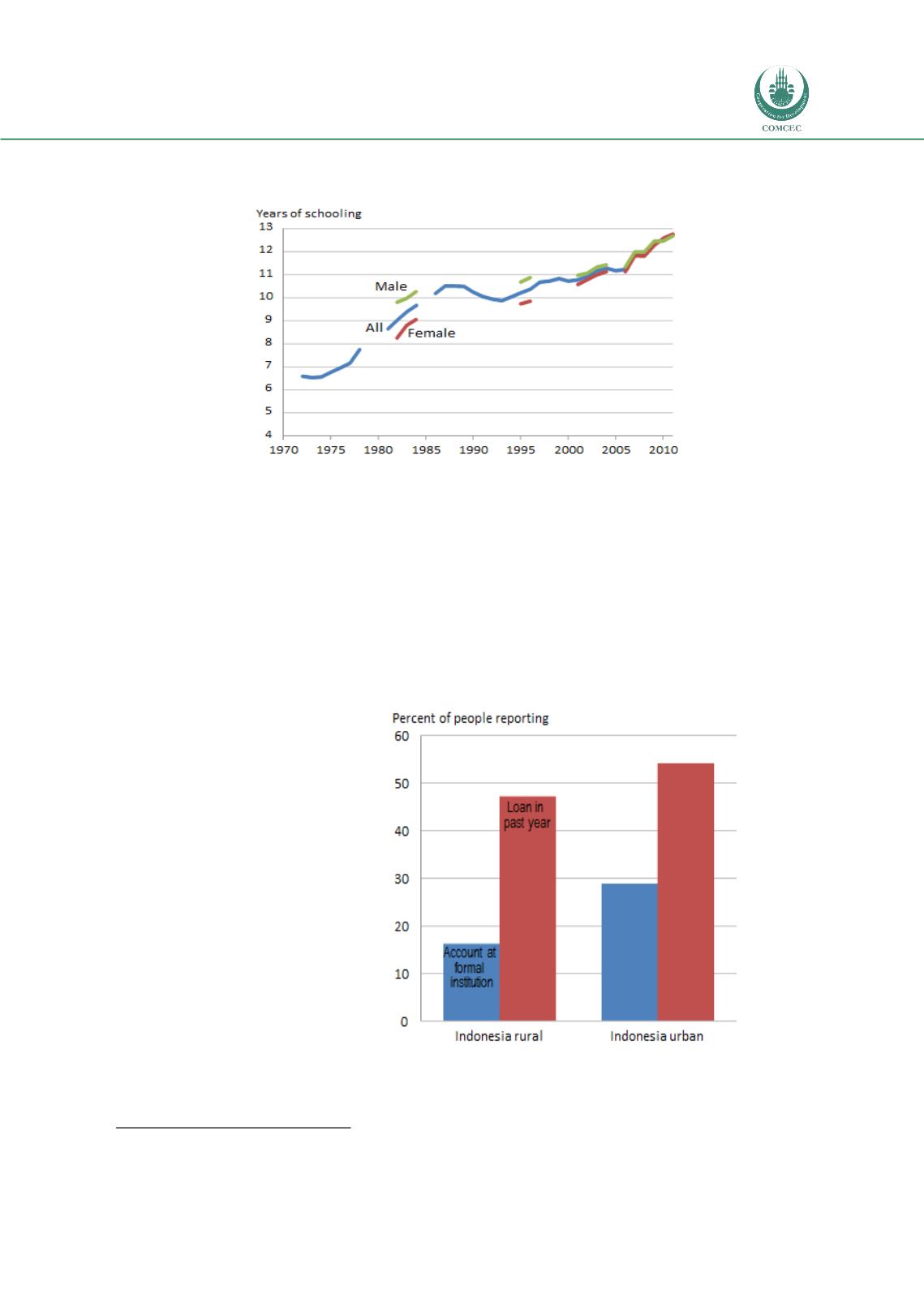

Access to finance

As indicated in

Table 13,Indonesia’s financial sector has a relatively strong capacity to

provide credit. Rural and urban households appear to have significant scope to tap into

credit markets, although access to credit and financial services in rural areas lags access in

urban areas.

Based on the World

Bank’s Global Financial

Inclusion database,

134

Figure 44depicts the

share

of

surveyed

individuals who had an

account at a financial

institution

and

the

share

of

surveyed

individuals (age 15+)

who had taken out a

loan. In rural and

urban

areas,

a

relatively high share of

individuals

had

recently

borrowed

money. Just under 50

percent

of

those

surveyed in rural areas

had obtained a loan in the past year, compared to just over 50 percent in urban areas.

134

Global Findex (World Bank 2014c).

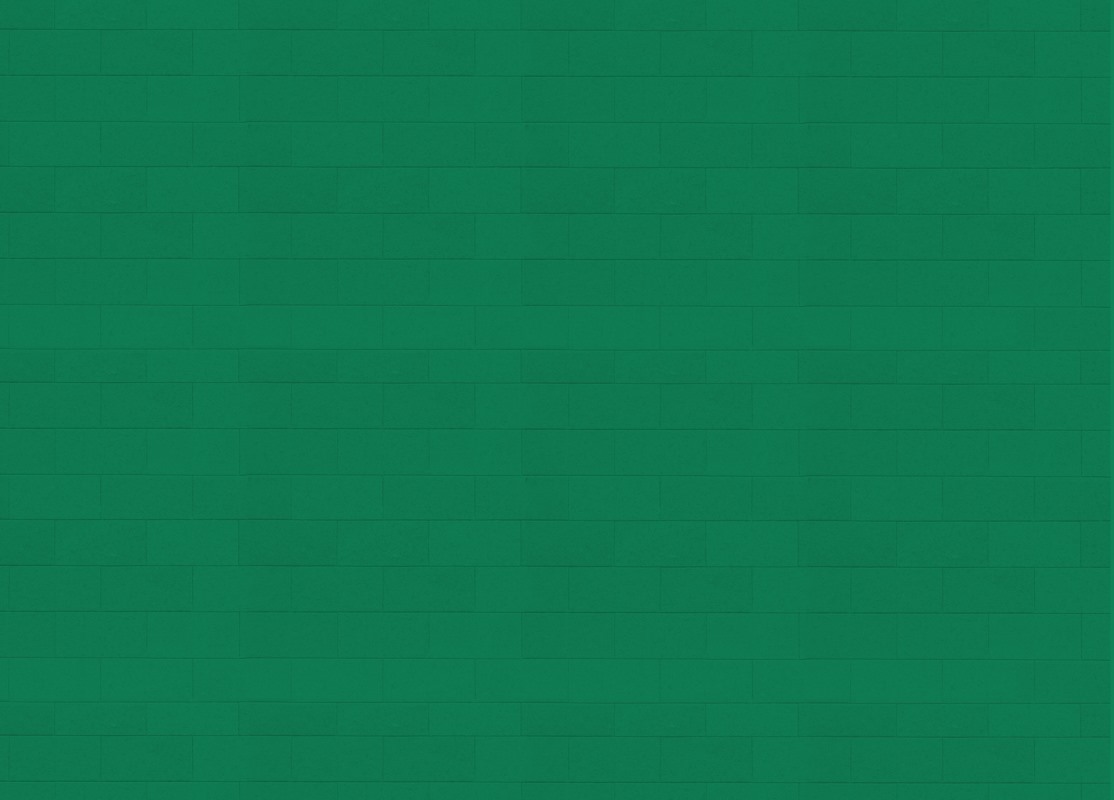

FIGURE 43: EXPECTED YEARS OF SCHOOLING, INDONESIA

Source:

World Development Indicators (World Bank 2014h).

FIGURE 44: FINANCIAL SERVICES IN RURAL AND URBAN

INDONESIA

Source:

Global Findex (World Bank 2014c).