Facilitating Smallholder Farmers’ Market Access

In the OIC Member Countries

74

Access to savings services differed noticeably in rural and urban areas, however; a smaller

share of those surveyed in rural areas had an account at a bank or other formal financial

institution.

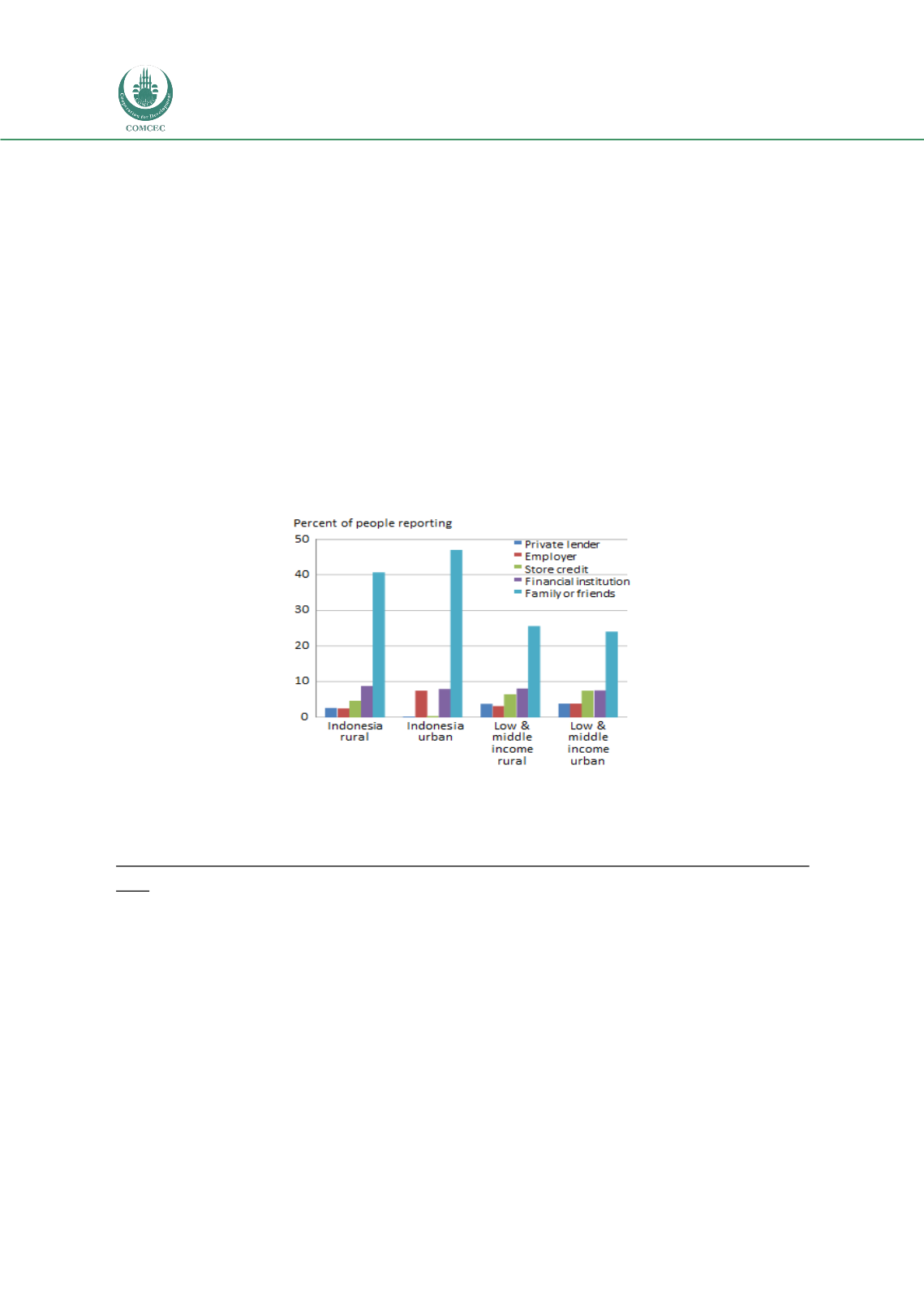

Figure 45shows sources of credit for rural and urban borrowers in Indonesia as well as in

low- and middle-income countries. Reliance on formal institutions in Indonesia is

relatively low, although consistent with averages across the low- and middle-income

countries. Rural Indonesians have more diverse sources of credit than urban dwellers—

rural households are more likely to obtain credit from an employer or receive store credit.

What sets Indonesia apart from other low- and middle-income countries, however, is the

level of borrowing from friends and family, which is 40–46 percent in Indonesia compared

to about 25 percent on average for low- and middle-income countries.

I

NCLUDING SMALLHOLDERS IN VALUE CHAINS FOR HEAVILY PROCESSED AGRICULTURAL GOODS

: T

HE EXAMPLE OF OIL

PALM

Many crops must be harvested and processed quickly before their quality declines and

makes them unsuitable for processing. Sugarcane is perhaps the most familiar crop in this

category, but another such crop is oil palm, which produces fruit that contains a kernel

that must be crushed to yield palm kernel oil. Aside from its use as a popular cooking oil,

palm oil can be processed into numerous specialized products used by agribusinesses and

other industries.

Because fresh palm fruit spoils quickly, and because large processing plants are more cost

effective, during the second half of the 20

th

Century oil palm was often grown on estates,

where the processing facility was surrounded by fields of oil palm owned by the same

FIGURE 45: CREDIT SOURCES IN RURAL AND URBAN INDONESIA AND LOW- AND

MIDDLE-INCOME COUNTRIES

Source:

Global Findex (World Bank 2014c).