Facilitating Smallholder Farmers’ Market Access

In the OIC Member Countries

23

CHAPTER 2: CASE STUDIES ON LINKING SMALLHOLDER

FARMERS TO MARKETS IN OIC MEMBER COUNTRIES

This chapter presents the case studies from eight OIC member countries. The case studies

focus on the extent to which smallholder farmers participate in different crop-related

markets and highlight factors that limit or enhance their participation in those markets.

Mozambique

Competitiveness and sustainability issues

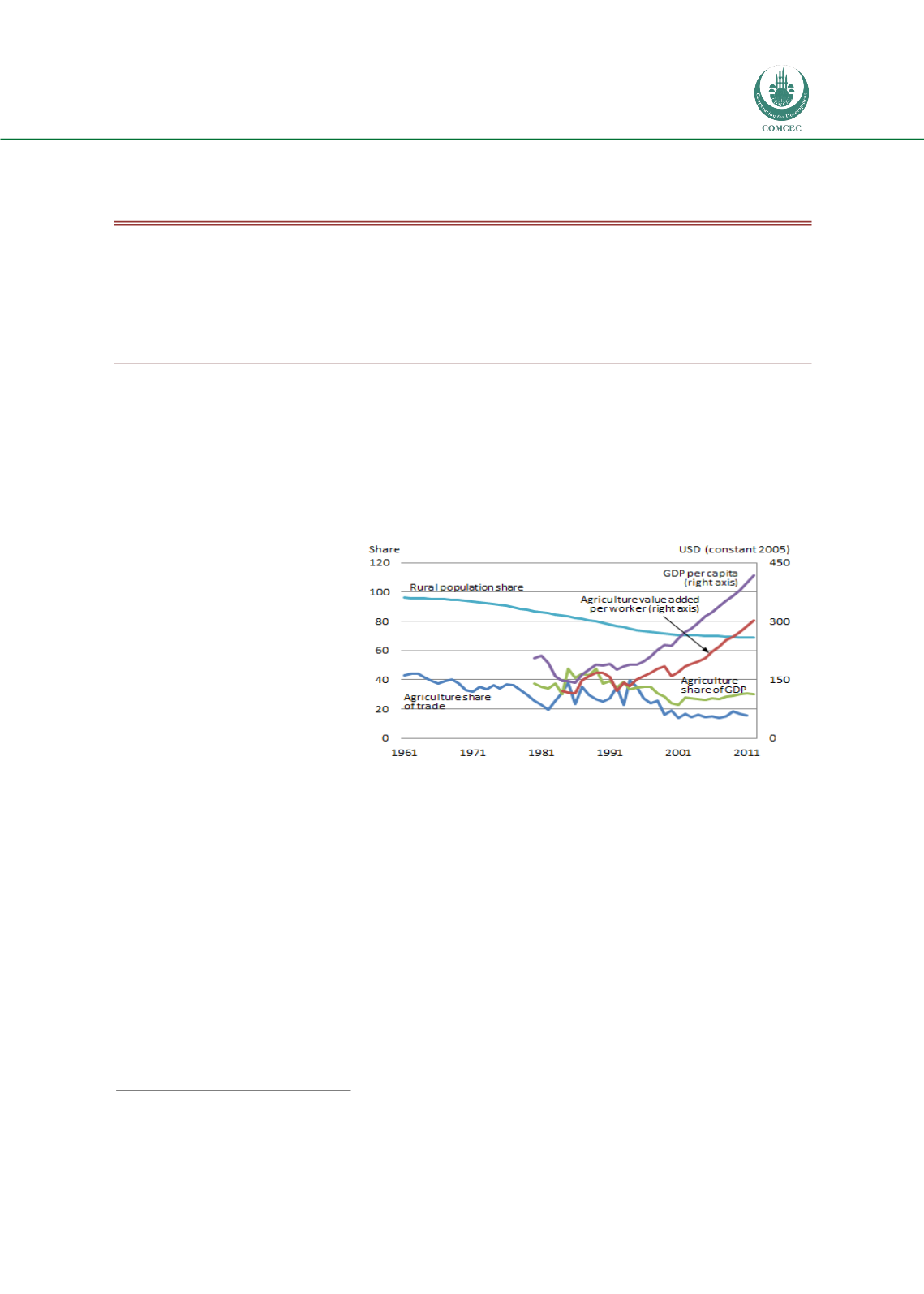

Agriculture is the second-largest sector in Mozambican economy, contributing 24 percent

of GDP and employing 78 percent of the workforce in 2011

(Figure 9). Growth in the

agricultural

sector

has

averaged about 7 percent

annually since 2003 and has

contributed significantly to

overall economic growth,

although agriculture’s share

of the economy has been

declining since the 1980s

30

.

Growth in agriculture has

been driven mainly by the

expansion in cultivated area

and labor after the extended

civil conflict ended and

refugees

resettled

rural

areas.

31

Agricultural incomes

are growing, but so is the gap

between

agricultural

incomes and incomes in other sectors.

This vast country has more than 3.8 million farming enterprises, of which 71.6 percent are

smaller than 2 hectares

(Figure 10). The average cultivated area per household is only

about 1.4 hectares. The wide variety of regional cropping patterns reflects large regional

differences in rainfall, temperature, soil types, and market access. The country’s 10

agroecological zones can be broadly divided into three geographical regions: the North

(Niassa, Cabo Delgado, and Nampula), Center (Zambézia, Tete, Manica, and Sofala), and

South (Inhambane, Gaza, and Maputo Province). Mozambique’s climate ranges from arid

and semi-arid (mostly in the South and Southwest) to subhumid (mostly in the Center and

North) and humid zones (in the highlands, mostly in the Center). The arid southern and

southwestern parts of Gaza Province are suitable only for livestock production.

32

30

World Bank (2014h).

31

World Bank (2012b).

32

World Bank (2006b).

FIGURE 9: STRUCTURAL CHANGE AND THE MOZAMBICAN

ECONOMY, 1960–2012

Source:

World Development Indicators (World Bank 2014h).