Facilitating Smallholder Farmers’ Market Access

In the OIC Member Countries

116

Macroeconomic factors, enabling policies, and governance

Exchange rate, trade, and price policies all substantially affect the extent to which

smallholder farmers participate in and benefit from agricultural markets. Historically such

policies tended to tax agricultural producers through overvalued currencies and direct

taxation of commodities. Reforms in the 1980s and 1990s reduced direct and indirect

taxation.

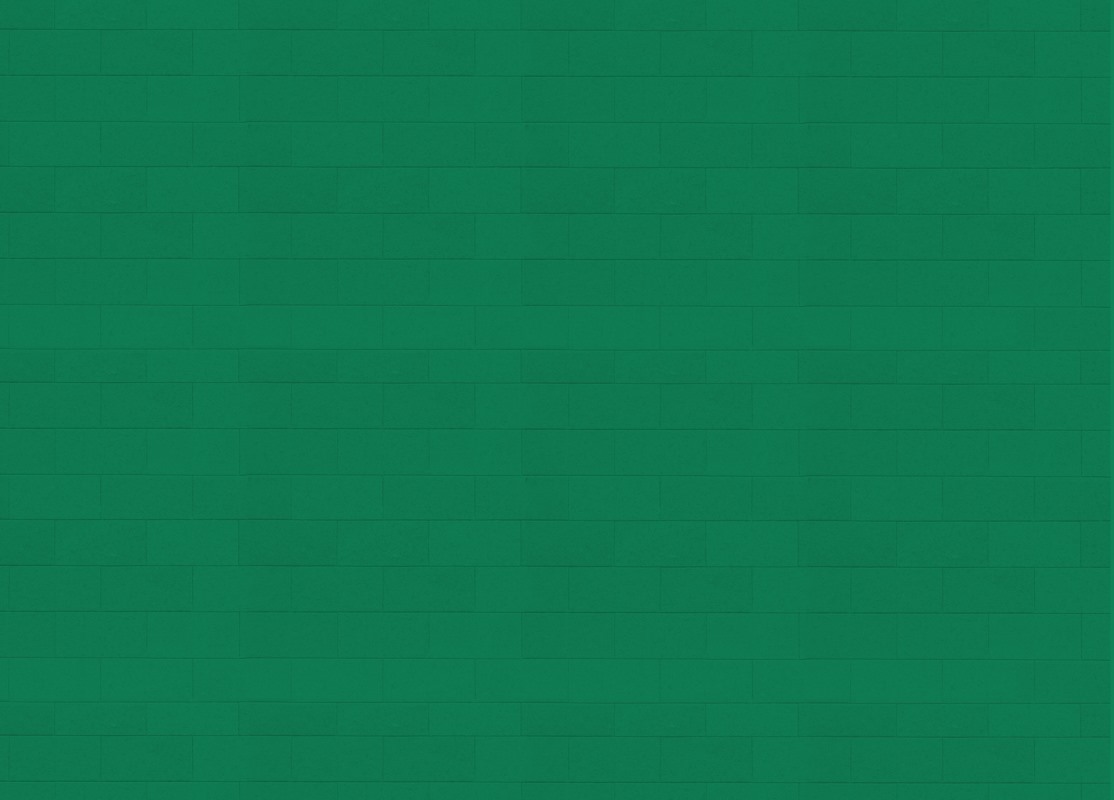

Table 23 presents data on the nominal rates of assistance to agriculture for a

subset of OIC member countries for which comparable data are available. While some

countries such as Mozambique have gone from taxing to supporting farmers on average,

others such as Côte d’Ivoire still tax farmers heavily.

Aggregate nominal rates of assistance mask significant differences in taxation and

protection between agricultural imports and exports and among products. An average

nominal rate of assistance close to zero at the country level simply indicates no net

taxation, but it could be the result of large import tariffs offsetting large export taxes.

192

In

some countries exports are still heavily taxed, while imports are protected. This is the case

in Mozambique, where food crops such as cassava and maize have received hardly any

government support or intervention, whereas others, such as cashews, have been subject

to heavy intervention.

TABLE 23: NOMINAL RATES OF ASSISTANCE TO AGRICULTURE

Country

1975–79

1980–84

1985–89

1990–94

1995–99

2000–04

Bangladesh

1.4

–3.3

11.7

–1.5

–5.2

2.7

Cameroon

–14.4

–11.2

–2.4

–1.1

–1.3

–0.1

Côte d'Ivoire

–30.8

–32.2

–24.3

–19.5

–20.0

–24.5

Egypt, Arab Republic

–15.9

–9.2

56.6

–6.1

4.0

–6.1

Indonesia

9.3

9.2

–1.7

–6.6

–8.6

12.0

Malaysia

–13.0

–4.6

1.3

2.3

–0.2

1.2

Mozambique

–34.5

–25.2

–32.0

–2.7

3.9

12.4

Nigeria

6.3

9.4

8.2

3.9

0.4

–5.4

Pakistan

–8.5

–6.4

–4.0

–6.9

–1.6

1.2

Senegal

–22.7

–20.5

4.7

5.6

–6.1

–7.5

Sudan

–24.3

–29.3

–35.4

–47.8

–24.5

–11.9

Turkey

–8.0

–30.0

4.0

20.0

21.0

20.0

Uganda

–-17.6

–6.2

–6.8

–0.6

0.5

0.4

Source:

Anderson and Martin 2007; Anderson and Masters 2007; Burrell and Kurzweil 2007

.

In addition to macroeconomic and trade policies, the quality of policies and regulations

related to agricultural inputs (seed, fertilizer, irrigation, and drainage), land, natural

resources, domestic marketing, agricultural R&D, extension, food safety, biosafety, grades

and standards, plant protection, and animal health measures all influence the effectiveness

and efficiency of markets and the extent to which smallholders access and benefit from

markets (for an example from Chile, see

Box 3). Policies intended to prop up traditional

crops or to anticipate emerging winners will likely fail, but policies that support farmers

and investors along the value chain can provide a framework that promotes adaptation

and success for the sector as a whole. Beyond these considerations, a country’s contract

192

World Bank (2007).