Facilitating Smallholder Farmers’ Market Access

In the OIC Member Countries

122

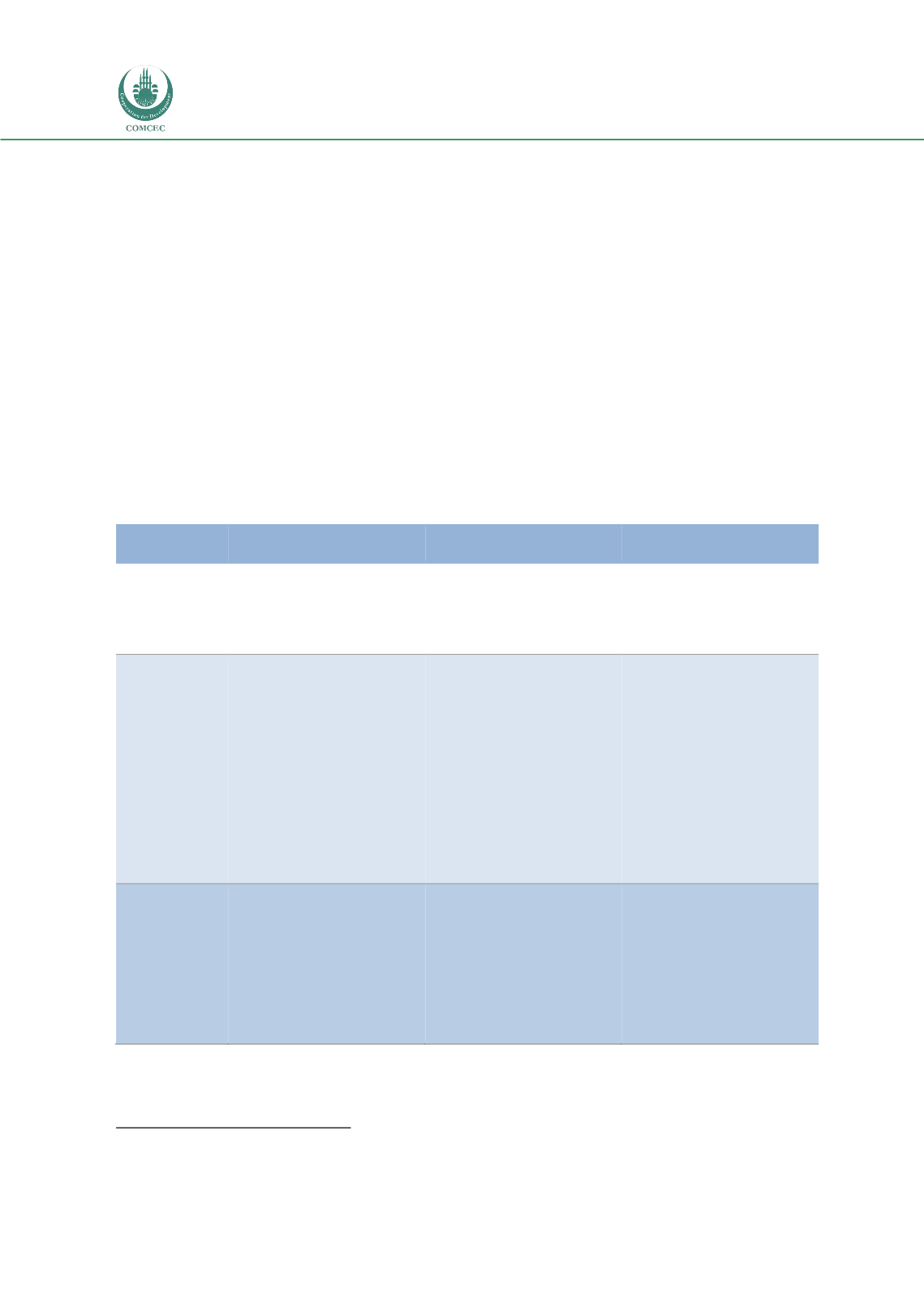

Poor access to agricultural finance is a major reason for smallholders’ suboptimal

production mix, adoption of low-risk/low-yield production patterns, limited use of inputs,

and inevitably smaller yields and poor quality produce. The lack of credit can also limit

farmers’ marketing options, forcing them to become price takers at the farm gate

(Table 24).

Ordinarily, banks will not invest adequately in understanding the nature of demand from

the agricultural sector and the nuances of the different value chains. This lack of

information leads banks to design financial products that are inappropriate to most rural

activities. For that reason, even when formal finance is available, the products on offer

may not match producers’ needs and tend to have heavy collateral requirements.

Wealthier farmers can obtain larger loans at lower costs from formal lenders because they

can credibly pledge assets or future cash flow—an option that is usually not available for

poorer smallholder farmers. Farmers who qualify for formal loans may still turn them

down, because they do not want to lose collateral.

196

TABLE 24: IMPACTS OF POOR ACCESS TO FINANCE ON VALUE CHAIN PARTICIPANTS

Impact on the processor

Impact on the producer

Impact on the input

provider

Lack of credit

for the

processor

•

Cannot secure sufficient

volumes.

•

Cannot hold stocks in

order to operate most

efficiently.

•

Delays in milling and

processing, resulting in

storage costs and

potential sales losses.

•

Producers cannot create

high-quality goods, so

lack incentives to utilize

inputs.

Lack of credit

for the

producer

•

Volume shortfalls,

resulting in running

factory inefficiently.

•

Lack of economies of

scale.

•

Difficulty in obtaining

standard grades.

•

High cost of capital per

production unit.

•

Limited capacity to

absorb fixed costs

associated with

processing.

•

Suboptimal production

mix.

•

Adopts low-risk, low-

yield production pattern.

•

Asymmetric price

information causes

producers to be price

takers at the farm gate.

•

Limited use of inputs,

lowering yield and

quality.

•

Reduced demand for

inputs by producers.

Lack of credit

for the input

provider

•

Volume shortfalls,

resulting in running

factory inefficiently.

•

Lack of economies of

scale.

•

Difficulty in obtaining

standard grades.

•

High cost of capital per

production unit.

•

Has to buy inputs

expensively due to the

high costs of inputs,

uncertainty regarding

sales volume, and high

risk associated with

selling on credit.

•

Provide inputs

expensively due to the

high costs of inputs.

•

Difficulty maintaining

adequate stock,

uncertainty regarding

quantity to be sold.

Source:

AfDB 2013.

196

World Bank (2007).