78

investment funds in the contract. Under the new proposed model, when the TOs manage

additional funds, they must determine the policy required to establish and integrate those funds

taking into consideration the sustainability of the funds and fair treatment of

Takaful

policyholders.

In conclusion, TOs may decide to offer internal transaction cross trading, which involves an

arrangement where the TOs offer simple products to underserved Malaysians particularly the

household from the bottom 40% (B40) group. Currently, there are ten insurers and TOs who

offer Perlindungan Tenang – affordable, accessible and simple Takaful products. For this unique

product, the contributions for the family Takaful product is between MYR 5 and MYR 13 per

month for the total sum insured between MYR 15,000 to MYR 33,000. Currently, more than

29,500 policies and certificates have been sold under Perlindungan Tenang products. After the

announcement from of Budget 2019, the cost of Perlindungan Tenang products is expected to

decrease when a two-year stamp duty exemption is enforced. In addition, the B40 groups also

have a long-term security and protection fund to protect and support them from the

insurance/Takaful market. The fund can also enable B40 groups who purchase the policy to

understand and experience insurance and Takaful.

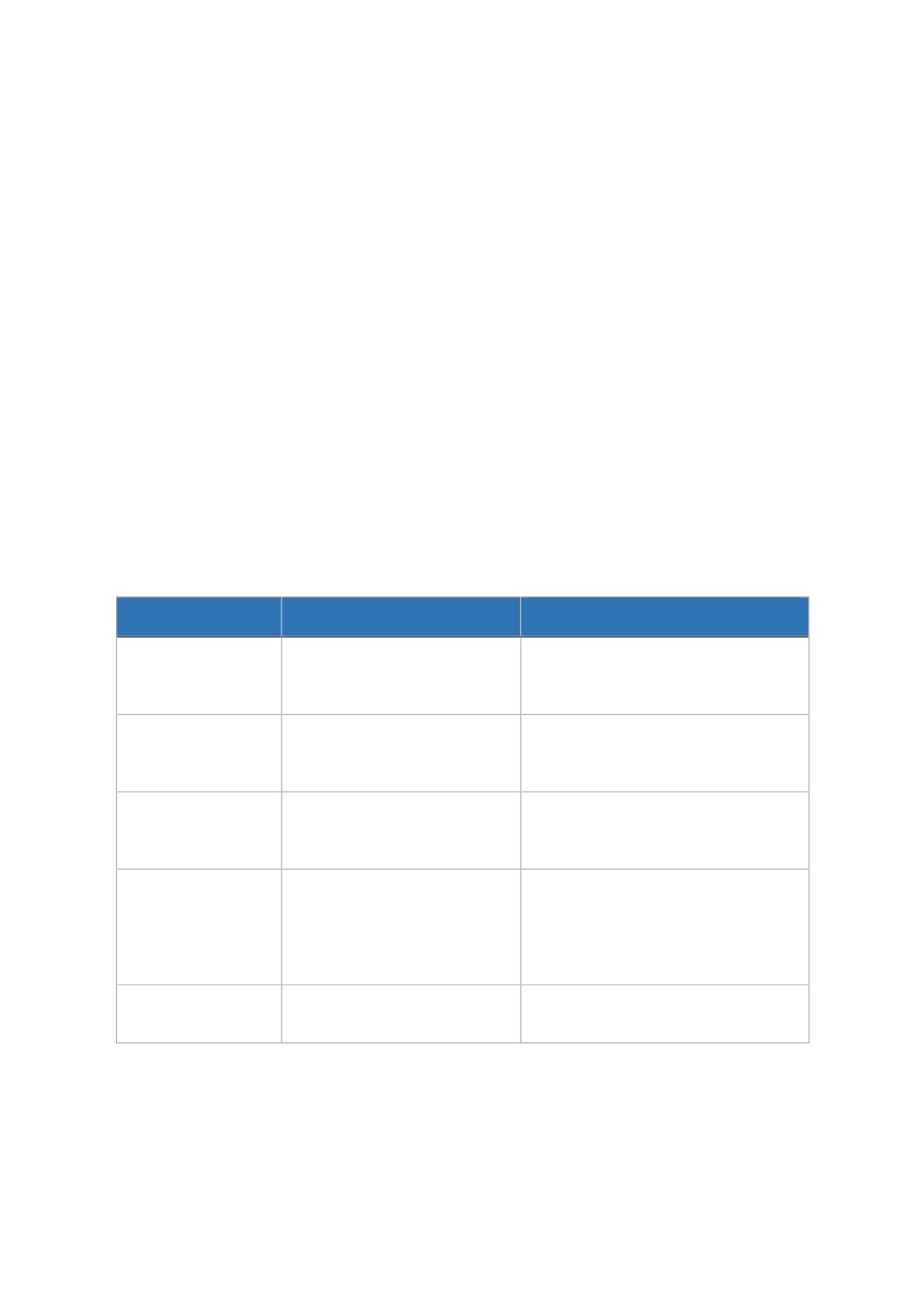

T

ABLE

11: P

ROPOSED

E

NHANCEMENTS TO THE

T

AKAFUL

O

PERATIONAL

F

RAMEWORK OF

M

ALAYSIA

Dimension

Existing requirements

Proposed enhancement to the

framework

Takaful

model

Solely premised on agency

contract while the TO plays the

role of a manager and

administrator of

Takaful

fund

Explicit flexibility to adopt new

Takaful

models such as risk-sharing

arrangements

The requirement

for

Takaful

Specific

Shari'ah

Contracts

Solely premised on agency

contract while the TO plays the

role of a manager and

administrator of

Takaful

fund

Outlines specifics of operational

requirements for the provision of

tabarru’

,

qard

,

hibah

in product

structuring and legal documentation

Establishment and

management of

funds

No differentiation between

savings and investment funds

Provides clear demarcation between

savings and investment to reflect the

relevant

Shari'ah

contracts used for

each fund

Management of

additional funds

Limited policy expectations and

options for consolidation of

additional funds

Outlines policy requirement on the

establishment and consolidation of

additional funds, taking into

consideration the sustainability of the

funds and fair treatment to

Takaful

participants

Inter-fund cross

trading

No specific requirements for

inter-fund cross trading

Set out the regulatory expectation for

internal controls and TO’s conduct on

inter-fund cross trading

Source: Financial Stability and Payment Report (2018)