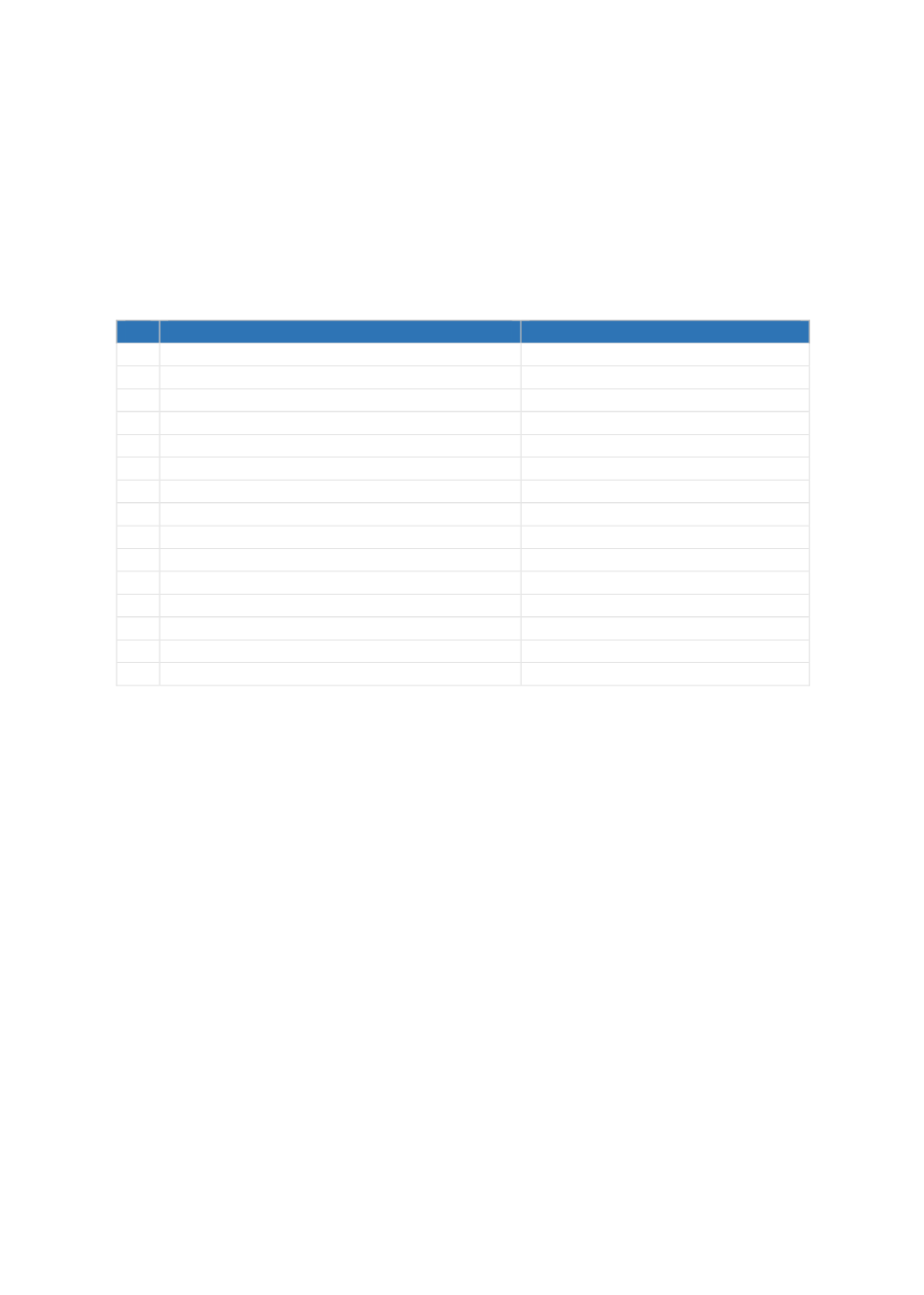

75

Furthermore, as of May 2019, there are 15 TOs in Malaysia licensed under BNM (se

e Table 8 ).

Malaysia’s growth rate in this sector has been increasing since 1984. Over the past 40 years, the

number of TOs has climbed from two operators back in 2003 to fifteen operators, reflecting the

growing popularity of

Takaful

sector and its increasing importance to the development of

Islamic finance.

T

ABLE

8: L

IST OF

T

AKAFUL

AND

R

E

-T

AKAFUL

O

PERATORS IN

M

ALAYSIA

No. Name of the

Takaful

Operator

Name of the

Re-Takaful

Operator

1

AIA Public

Takaful

Bhd

ACR

Re-Takaful

Berhad

2

AmMetlife

Takaful

Bhd

Malaysian Reinsurance Bhd

3

Etiqa Family

Takaful

Bhd

Munich Re

Re-Takaful

4

Etiqa General

Takaful

Bhd

Swiss Reinsurance com

5

FWD

Takaful

Berhad

6

Great Eastern

Takaful

Bhd

7

Hong Leong MSIG

Takaful

Bhd

8

Prudential BSN

Takaful

Bhd Local

9

Sun Life Malaysia

Takaful

Bhd Local

10 Syarikat

Takaful

Malaysia AM Bhd Local

11 Syarikat

Takaful

Malaysia Keluarga Bhd Local

12

Takaful

Ikhlas Family Bhd Local

13

Takaful

Ikhlas General Bhd Local

14 Zurich General

Takaful

Malaysia Bhd Foreign

15 Zurich

Takaful

Malaysia Bhd Foreign

Source: BNM (2019)

Family

Takaful

business has shown a double-digit growth (see

Table 9

). The total new business

contributions increased from MYR 4.35 billion in 2017 to MYR 4.91 billion in 2018. For new

business single contributions, Family

Takaful

products contributed from MYR 3.12 billion to

MYR 3.64 billion. Meanwhile the new business annual contributions in 2017 have increased

fromMYR 1.22 billion toMYR 1.27 billion in 2018. The demand for Family

Takaful

has increased

rapidly over the years (MTA, 2018).