22

[131.86], followed by Saudi Arabia [56.08], Turkey [21.32], and the UK [14.68]; however, all of

these countries have higher scores compared to the global average [10.46]. Meanwhile, the

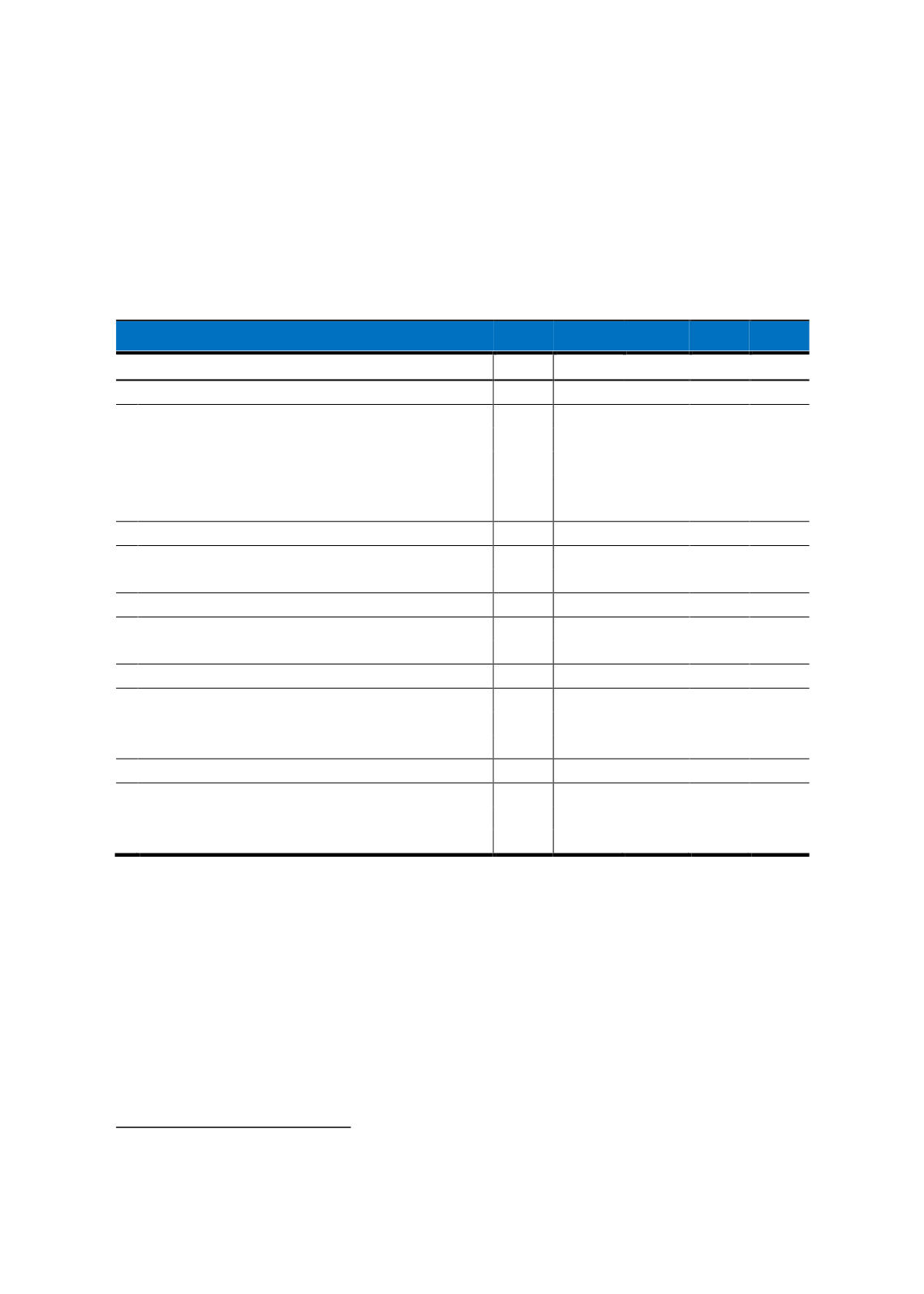

Takaful

industry is more advanced in Saudi Arabia [92.92], followed byMalaysia [41.63], Turkey

[21.71], and the UK [0.21]. Except for the UK, the sample countries maintain higher than global

average

Takaful

development score [5.29].

5

T

ABLE

2:

S

ELECTED

I

SLAMIC

F

INANCE

D

EVELOPMENT

I

NDICATORS

(IFDI)

INDICATORS (2018)

GA

MY

SA

TR

UK

Islamic Finance Development Indicator (IFDI)

10.46 131.86

56.08 21.32 14.68

1. QUANTITATIVE DEVELOPMENT

5.85

98.50

56.80 12.28

4.30

Islamic Banking

9.49

66.70

58.05 18.96

2.08

Takaful

5.29

41.63

92.92 21.71

0.21

Other IFIs

5.78 102.93

38.27

1.54

0.69

Sukuk

3.99 182.29

42.82 15.08

5.08

Funds

4.68

98.96

51.93

4.11 13.45

2. KNOWLEDGE

9.36 228.37

42.89 15.32 15.48

Education

9.84 156.73

31.23 10.61 21.72

Research

8.87 300.00

54.54 20.03

9.23

3. CORPORATE SOCIAL RESPONSIBILITY (CSR)

8.08

42.19

83.92 33.31 28.36

CSR Funds Disbursed

5.48

33.88 139.39

1.80

0.00

CSR Disclosure

10.69

50.50

28.45 64.82 56.72

4. GOVERNANCE

13.01

87.91

37.80 23.83 20.15

Regulation

17.68 100.00

33.33 33.33

0.00

Shari'ah

Governance

12.95 103.89

51.51 14.91 13.55

Corporate Governance

8.40

59.85

28.54 23.25 46.88

5. AWARENESS

15.99 202.31

59.00 21.84

5.10

Seminars

7.70 181.69

8.62 11.20

4.58

Conferences

7.61 156.59

14.58 37.86

6.19

News

32.65 268.66 153.81 16.46

4.53

Notes: GA – Global Average, MY – Malaysia, SA – Saudi Arabia, TR – Turkey, UK – United Kingdom.

Source: Thomson Reuters (2018)

5

For more detailed information, please refer t

o Table 28 in the

Appendix

.