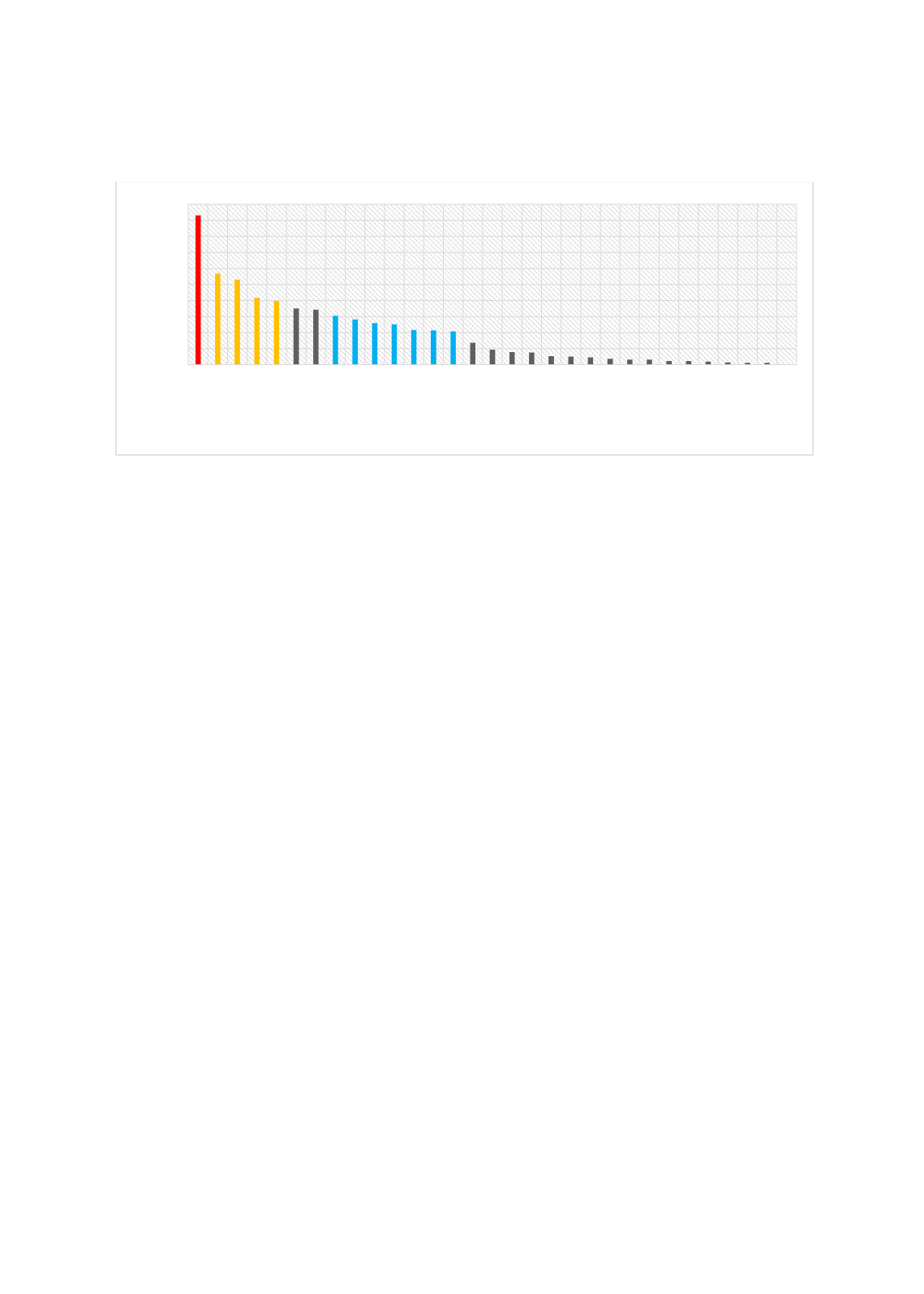

21

F

IGURE

1:

T

AKAFUL

I

NDUSTRY

D

EVELOPMENT

S

CORE

Source: IFDI

First, to select three OIC countries as a sample for this study, we have categorized them into

three groups based on IFDI score (see

Table 2 below): 70-above, 40-60, and 20-30 (Se

e Figure 1 ). Obviously, Saudi Arabia is a leading country in terms of

Takaful

industry development, the

only country which falls under the first group. Next, four countries - Iran, Bangladesh, Malaysia,

and Indonesia - fall under the second group. Therefore, to choose a country, we apply the second

criterion (se

e Table 30in the Appendix) and select Malaysia as a group leader with the highest

economic freedom score (74/100) in the year 2019.

Further, seven countries – Jordan, Kuwait, Oman, Pakistan, Turkey, Bahrain, and Sudan – form a

third group based on the first criterion. Jordan and Bahrain have marginally higher economic

freedom score compared to Turkey (66.5, 66.4, and 64.6, respectively). Since, according to

COMCEC’s classification of countries, Jordan, Kuwait, Oman, Bahrain, and Sudan belong to the

Arab group same as Saudi Arabia, and Pakistan belongs to Asian group as Malaysia, Turkey was

picked from the list of countries.

Meanwhile, due to the low IFDI score, the African group countries were not included in the

analysis. Finally, the UK is in the list of selected countries because this is the only country which

has the highest IFDI score among non-Muslim countries showing strong trends in the

development of the Islamic finance industry. Also, UK carries high economic freedom score

(79/100).

In summary, the sample includes three OIC countries: 1) Saudi Arabia with 100 per cent

Takaful

-based economy, 2) Malaysia with the dual banking and

Takaful

systems, and 3) Turkey with its

emerging Islamic finance industry. The study also includes the UK as a non-OIC country – an

economy with IFIs.

Table 2presents the Islamic Finance Development Indicators (IFDI) for each of the sample

countries. It shows that Malaysia leads other selected countries in terms of IFDI overall score

93

57 53

42 40

35 34 30 28 26 25 22 21 21

14

9 8 8 5 5 5 4 3 3 2 2 2 1 1 1 0

0

10

20

30

40

50

60

70

80

90

100

Saudi Arabia

Iran

Bangladesh

Malaysia

Indonesia

UAE

Qatar

Jordan

Kuwait

Oman

Pakistan

Turkey

Bahrain

Sudan

Brunei

Egypt

Syria

Tunisia

Yemen

Palestine

Mauritania

Libya

Lebanon

Nigeria

Somalia

Gambia

Senegal

Kazakhstan

Algeria

Iraq

UK

IFDI Score