28

F

IGURE

2:

R

E

-T

AKAFUL

C

ONCEPT

Source: Authors

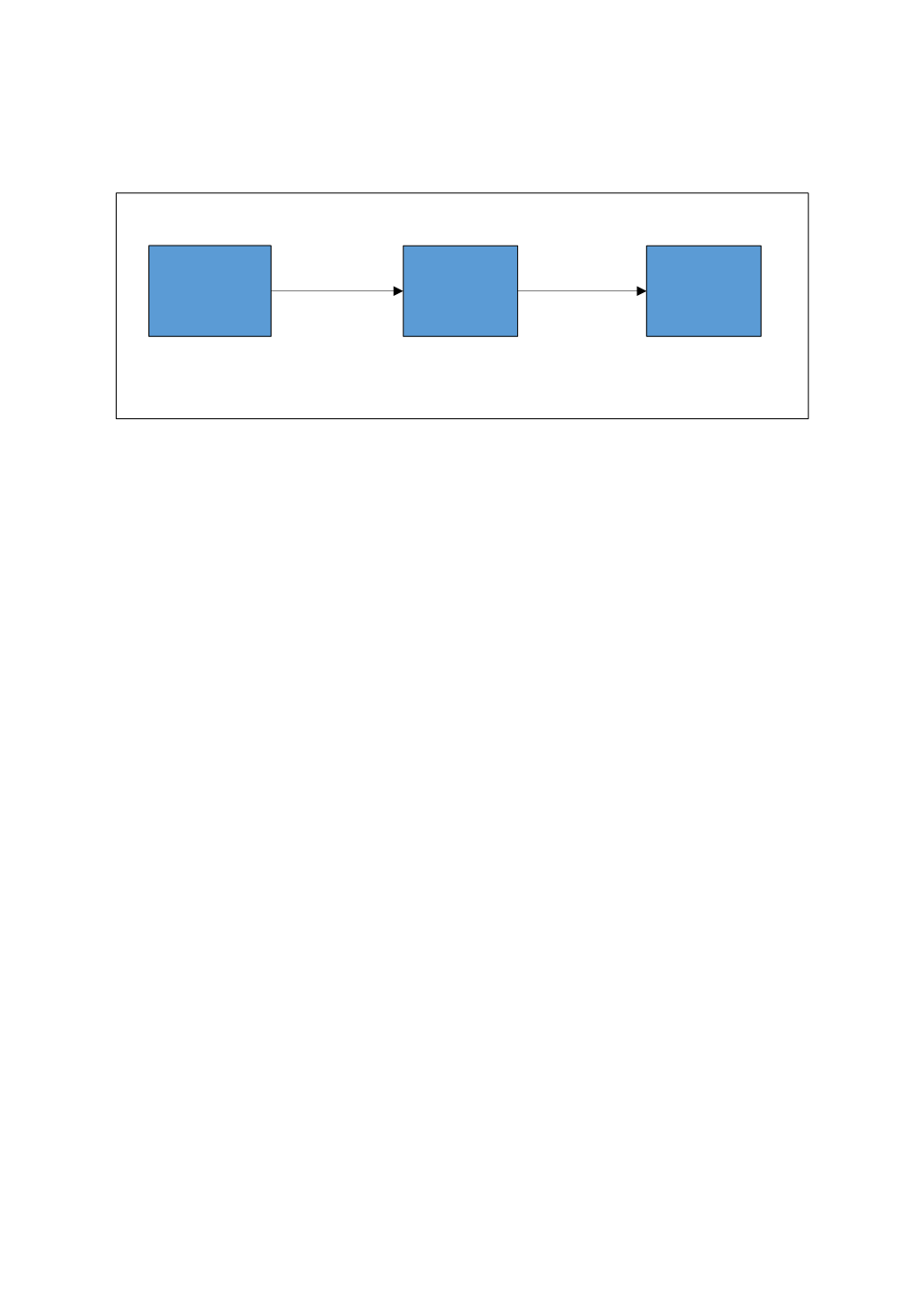

While the TO is the primary

Takaful

provider for the people and corporations, the RTO exists in

the secondary

Takaful

market with a direct function to accept cessations of risks based on its

contractual obligations. As illustrated i

n Figure 2above, the participants of

Re-Takaful

are the

TO instead of individual or group participants. This arrangement is required because the TO

needs to share the risks (undertaken from individuals and group participant) with the

Re-

Takaful

operator. Just as the TO does to the

Takaful

participants, the RTO also assumes the

responsibility of managing and investing the premiums of the TO.

Types of Re-Takaful

In the

Takaful

industry, a TO reduces its risk of paying a large number of claims by sharing its

risk with another company. This other company is RTO. This arrangement supports the TO in

situations of high claims, such as in the case of natural calamities, fires, riots, and other major

disasters that significantly affect many policyholders at once. In such unforeseen situations, a

TO may not be able to cover the entire risk of covering the claims of its participants.

Consequently, the

Takaful

fund may be depleted, in which case the participants, the

shareholders, and the TO will suffer significant losses. Splitting and sharing the risk with an RTO

through a

Re-Takaful

arrangement enables the TO to manage the company better through such

difficult periods. Therefore,

Re-Takaful

is a practical arrangement to ensure the stability of not

only the TOs but also the entire Islamic finance industry.

Re-Takaful

operates a similar way that

Takaful

does. The only difference is that while the

participants or policyholders of regular

Takaful

products are individuals, businesses, and other

commercial organisations; the

Re-Takaful’s

participants or policyholders are the TOs. The fund

operator is the RTO that operate its business and activities according to the principles as

required by

Shari'ah

and the domestic laws or regulations.

The contracting parties who sign the

Re-Takaful

contract are the TO and the RTOs. The original

policyholders of the

Takaful

products are not directly involved in the

Re-Takaful

contract, and

Takaful

Participants

Takaful

Operator

Re-Takaful

Operator

Pays

premium

from

Takaful

fund

Family and

General

Takaful

Individuals

and

Companies

Re-Takaful