134

new customers online. Over 90% of the respondents in Malaysia and Saudi Arabia, and almost

80% in Turkey agreed that attracting new customers via online channels can be a good

opportunity to enhance the growth of the

Takaful

industry. This is contrary to the views of 100%

of the respondents in the UK who believe new customers via online channels do not provide

opportunity for enhancing the growth of the

Takaful

industry.

Over 90% of the respondents in Malaysia, slightly 90% of respondents in Saudi Arabia, and

almost 80% in Turkey agreed that access to new insurance technology creates opportunity for

the growth of the

Takaful

industry. In contrast, 100% of the respondents in the UK are of the

view that access to new insurance technology does not create opportunity for the growth of the

Takaful

sector. Meanwhile all the respondents in the four selected countries agreed that political

and economic stability provide opportunities for the future growth of the

Takaful

industry. The

level of agreement varied: 100% of the respondents in the UK, over 90% in Malaysia, over 70%

in Saudi Arabia and slightly over 80% in Turkey. Similarly, all the respondents in the four

selected countries agreed that cross-border expansion of the

Takaful

business to other countries

create opportunities for the

Takaful

industry. The levels of agreement of the respondents are:

100% in the UK, over 70% in Malaysia and Turkey and, over 60% in Saudi Arabia.

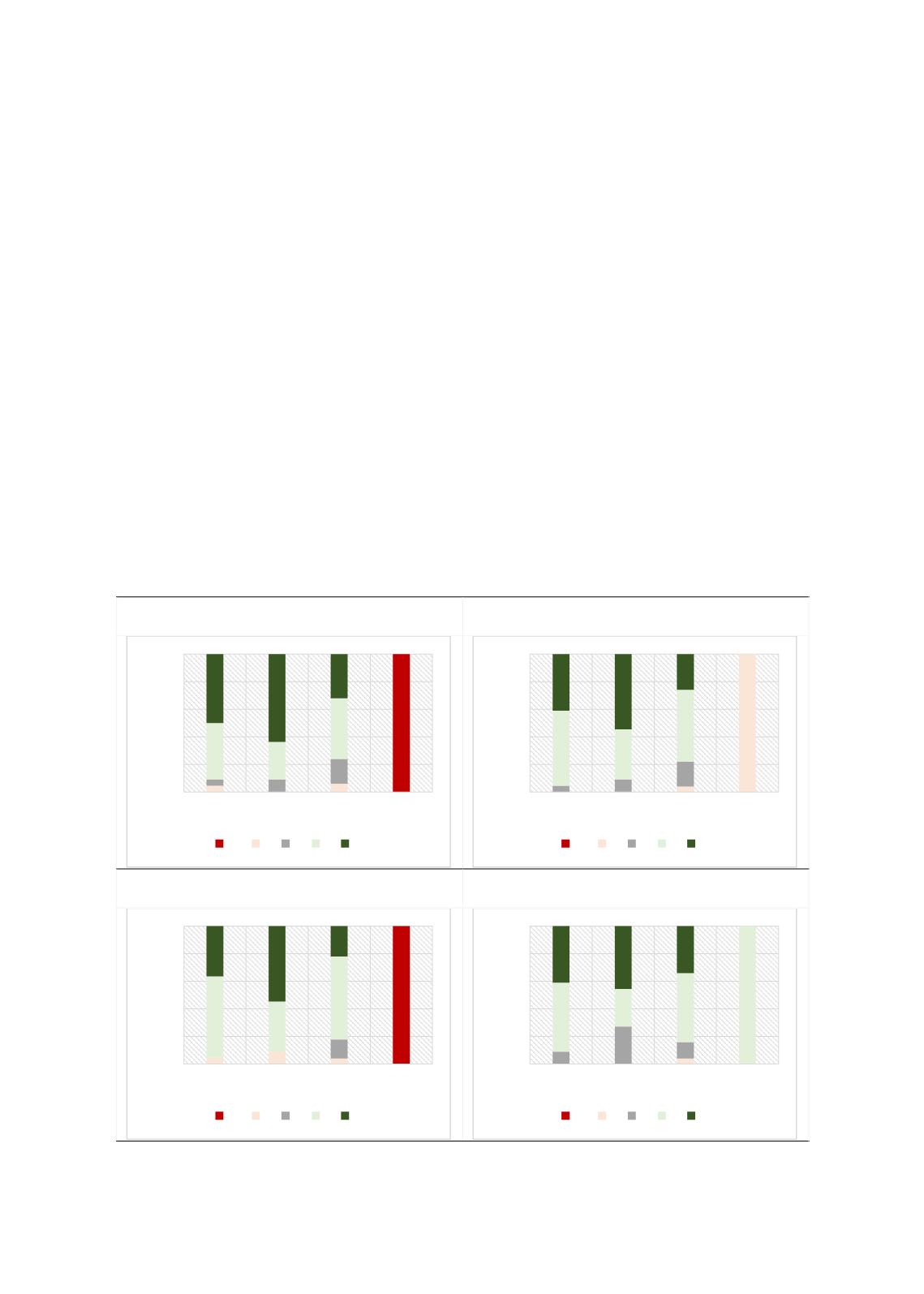

F

IGURE

41: O

PPORTUNITIES

(SWOT S

URVEY

R

ESULTS

)

(A) Strong Support from the Government for

Development of the Industry

(B) New Customers via Online Channels

(C) Access to New Insurance Technology

(D) Future Growth due to Political and

Economic Stability

0%

20%

40%

60%

80%

100%

MY

SA

TR

UK

SD D U A SA

0%

20%

40%

60%

80%

100%

MY

SA

TR

UK

SD D U A SA

0%

20%

40%

60%

80%

100%

MY

SA

TR

UK

SD D U A SA

0%

20%

40%

60%

80%

100%

MY

SA

TR

UK

SD D U A SA