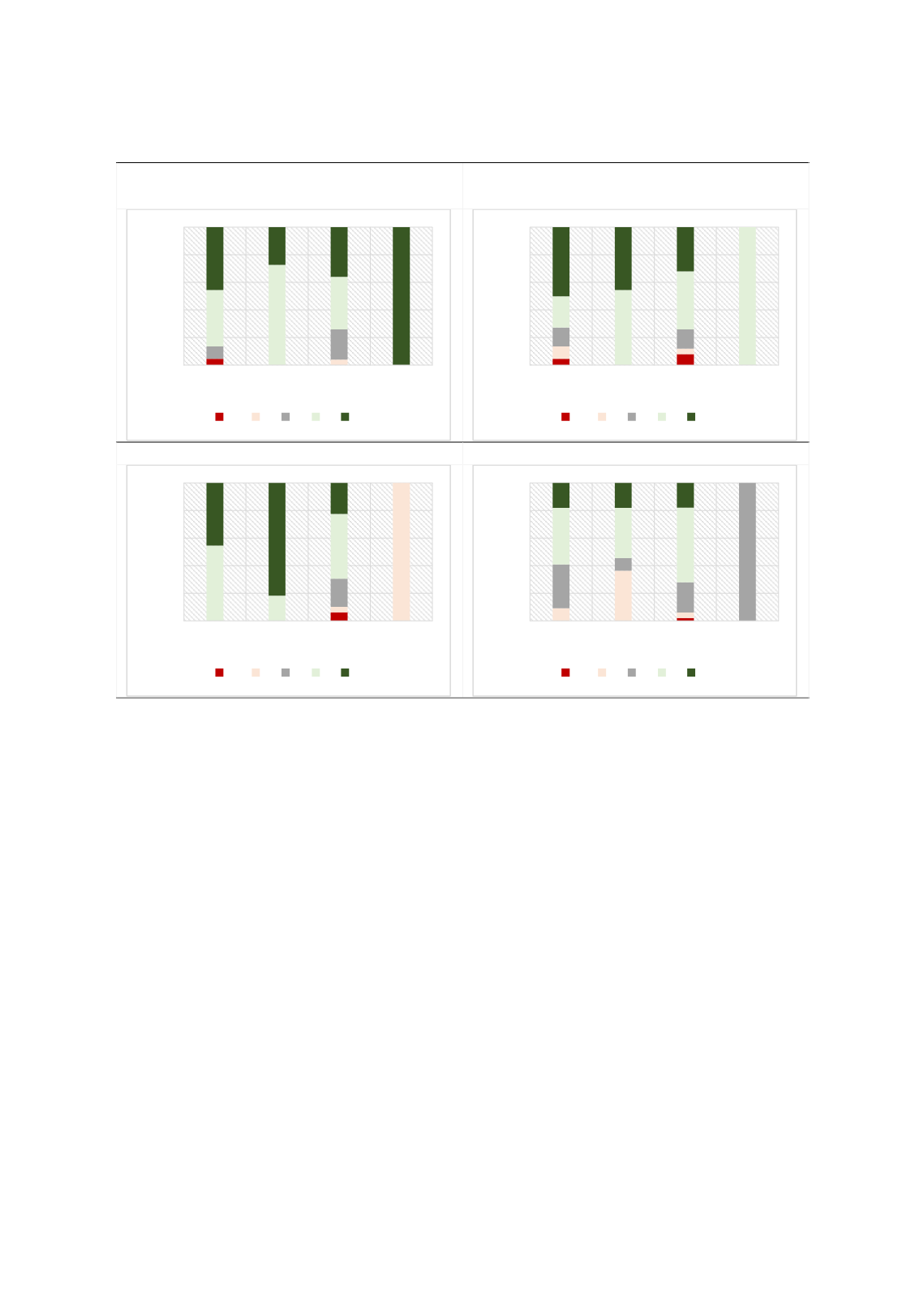

132

(E) Strong Free Cash Flow for Further

Expansion of Projects

(F) High Rate of Return on

Shari'ah

-compliant

Investments

(G) Having High-Skilled Workforce

(H) Diversification Across Countries

NOTES:

[

MY

: Malaysia,

SA

: Saudi Arabia,

TR

: Turkey,

UK

: United Kingdom]. [

SD

: Strongly disagree,

D

:

Disagree,

U

: Undecided,

A

: Agree,

SA

: Strongly agree].

Source: Authors

2) Weaknesses.

The second question of the survey questionnaire is concerned about soliciting

the opinions of the respondents in the four countries on five options and the extent to which

they contribute to the weaknesses of the

Takaful

/

Re-Takaful

companies. These five options are

attrition rate in workforce, financial planning, organisation structure, marketing strategies and

investment into Research and Development (se

e Figure 40 ).

Figure 40shows that over 75% of the respondents in Saudi Arabia and Malaysia and over 50%

in Turkey agreed that a high attrition rate in the workforce contributes to the weakness of

Takaful

and

Re-Takaful

companies. Meanwhile, over 60% of the respondents in both Malaysia

and Turkey agreed that lack of efficient financial planning contributes to the weakness of

Takaful

and

Re-Takaful

companies.

100% of the respondents in Saudi Arabia, over 90% in Malaysia and over 60% in Turkey agreed

that Poor marketing strategies contribute to the weakness of

Takaful

and

Re-Takaful

companies.

Similarly, 100% of the respondents in Saudi Arabia, over 70% in Malaysia and nearly 60% in

Turkey agreed that Lack of investment into Research and Development (R&D) - below industry

average contributes to the weaknesses of both companies.

0%

20%

40%

60%

80%

100%

MY

SA

TR

UK

SD D U A SA

0%

20%

40%

60%

80%

100%

MY

SA

TR

UK

SD D U A SA

0%

20%

40%

60%

80%

100%

MY

SA

TR

UK

SD D U A SA

0%

20%

40%

60%

80%

100%

MY

SA

TR

UK

SD D U A SA