Improving Public Debt Management

In the OIC Member Countries

210

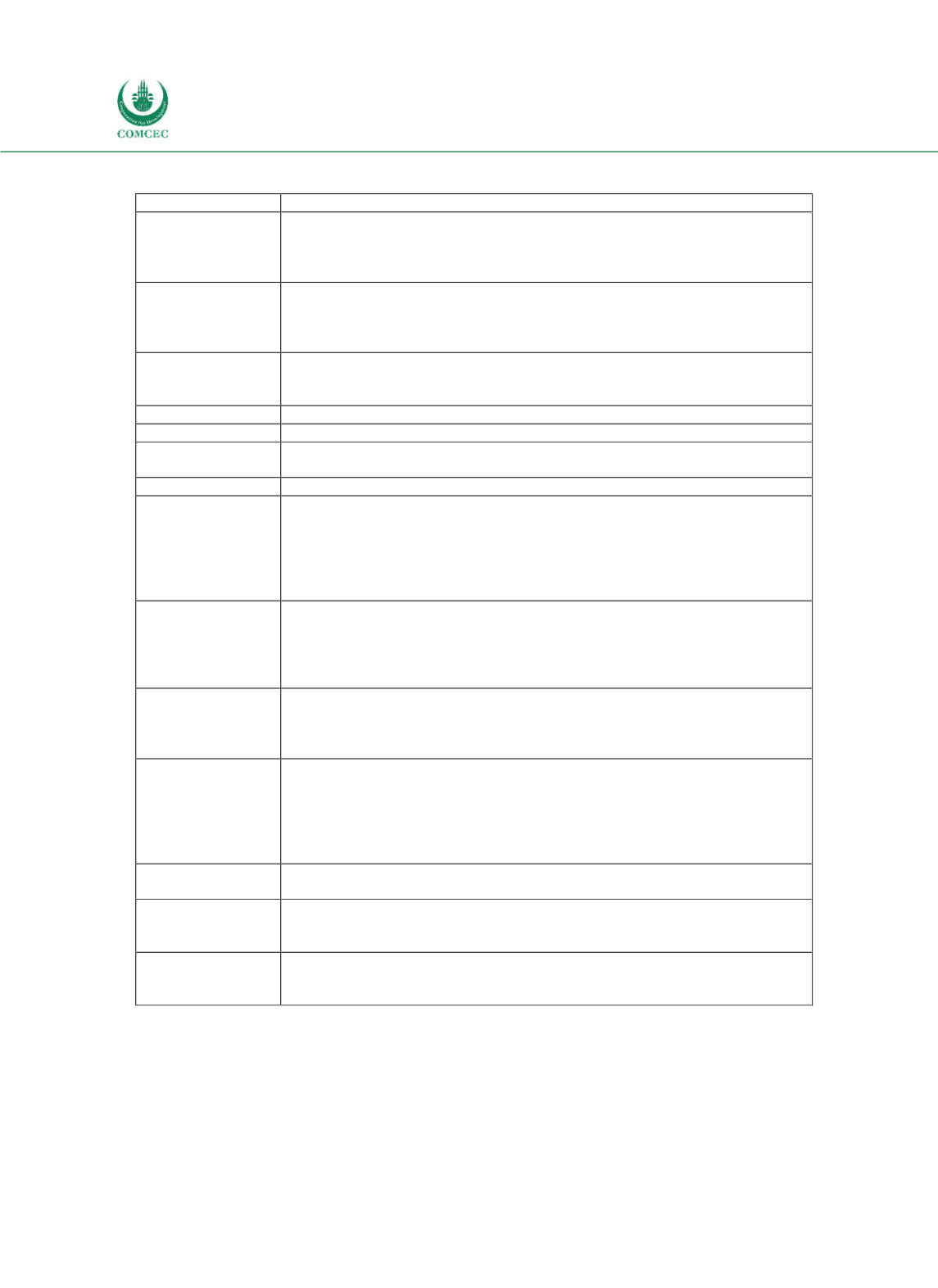

Table G-0-3: Types of Sukuk

Term

Meaning

AlIjarah Sukuk

An Islamic certificate for the buying and leasing of assets by the investors to the

issuer and such Sukuk shall represent the undivided beneficial

rights/ownership/interest in the asset held by the trustee on behalf of the

investors.

Convertible or

exchangeable Sukuk Convertible or exchangeable Sukuk certificates are convertible into the issuer’s

shares or exchangeable into a third party’s shares at an exchange ratio, which is

determinable at the time of exercise with respect to the going market price and a

prespecified formula.

Corporate Sukuk Is a Sukuk issued by a corporation as opposed to those issued by the government. It

is a major way for companies to raise funds in order to expand its business or for a

specific project.

Domestic Sukuk

A Sukuk issued in local currency.

Global Sukuk

Both international and domestic Sukuk

Hybrid Sukuk

Hybrid sukuk combine two or more forms of Islamic financing in their structure

such as istisnaa and ijarah, murabahah and ijarah etc.

International Sukuk A sukuk issued in hard currency such as USD.

Istisnaa Sukuk

Are certificates of equal value issued with the aim of mobilizing funds to be

employed for the production of goods so that the goods produced come to be

owned by the certificate holders. (This type of sukuk has been used for the advance

funding of real estate development, major industrial projects or large items of

equipment such as:

turbines,

power plants,

ships or aircraft

(construction/manufacturing financing).

Mudarabah Sukuk Are certificates that represent project or activities managed on the basis of

Mudarabah by appointing one of the partners or another person as the Mudarib for

the management of the operation. (It is an investment partnership between two

entities whereby one entity is mainly a provider of capital and the other is mainly

the manager)

Murabahah Sukuk Are certificates of equal value issued for the purpose of financing the purchase of

goods through Murabahah so that the certificate holders become the owners of the

Murabahah commodity. (This is a pure sale contract based Sukuk, which based on

the cost plus profit mechanism).

Musharakah Sukuk

Are certificates of equal value issued with the aim of using the mobilized funds for

establishing a new project, financing a business activity etc., on the basis of any of

partnership contract so that the certificate holders become the owners of the

project. (Musharakah Sukuk is an investment partnership between two or more

entities which together provide the capital of the Musharakah and share in its

profits and losses in preagreed ratios)

Quasisovereign

Sukuk

Are sukuk issued by a public sector entity that is like sovereign sukuk. It may carry

explicit or implicit government guarantee.

Salam Sukuk

Are certificates of equal value issued with the aim of mobilizing Salam

capital/mobilizing funds so that the goods to be delivered on the basis of Salam

come to be owned by the certificate holders.

Sovereign Sukuk

Are sukuk issued by a national government. The term usually refers to sukuk

issued in foreign currencies, while sukuk issued by national governments in the

country’s own currency are referred to as government sukuk.

Source: International Islamic Financial Market, Sukuk Report 2016, p. 160.