Improving Public Debt Management

In the OIC Member Countries

208

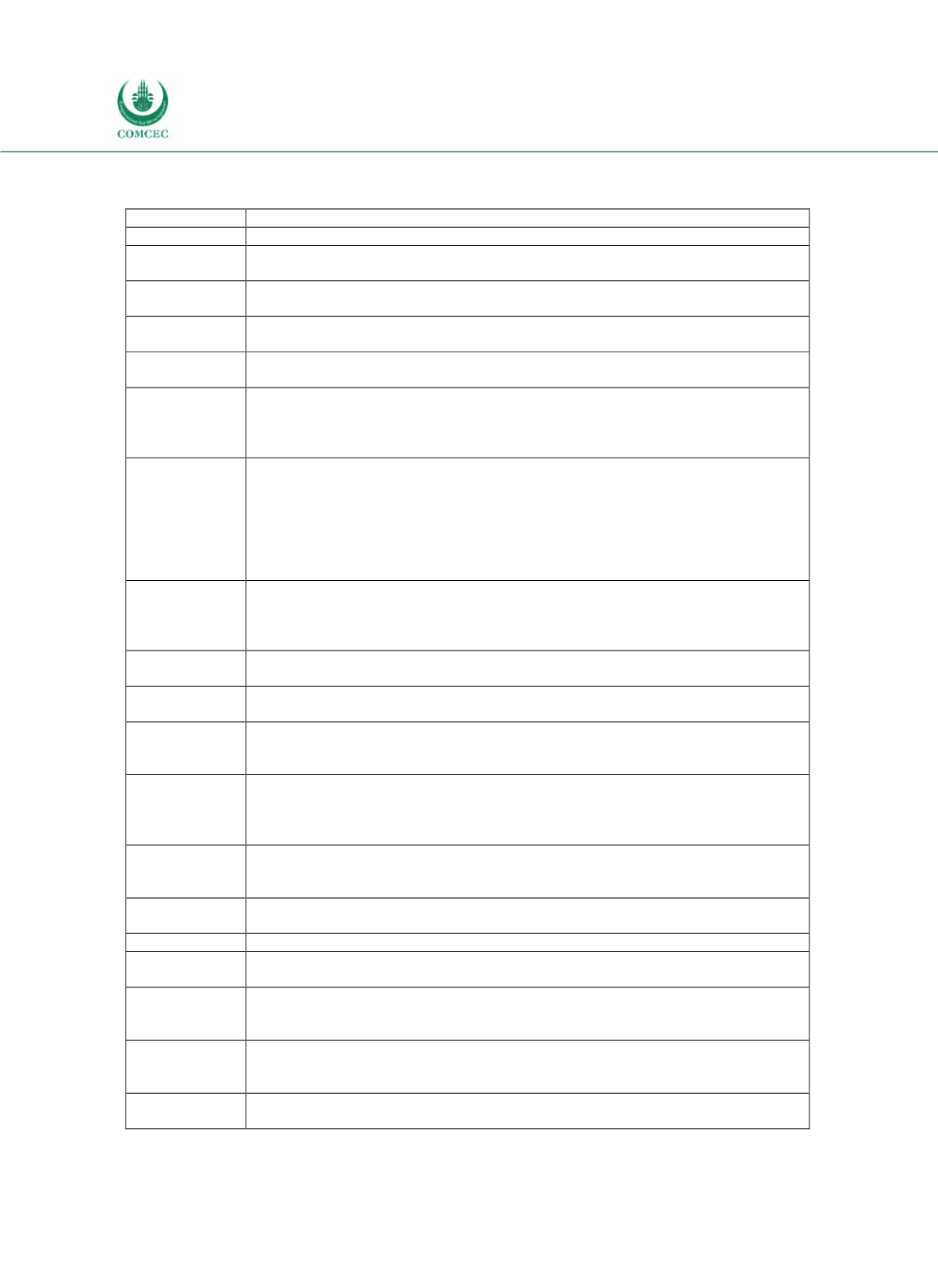

Glossary

Table G-0-1: General Public Debt Terms

Term

Meaning

Arrears

The part of a debt that is both unpaid and past the due date for payment.

Average interest

rate

The weighted average level of interest rates on the outstanding gross public sector debt

or any specific debt instrument, at nominal and market value, as at the reference date.

Average time to

maturity

The weighted average time to maturity of all the principal payments in the debt portfolio.

Average time to

refixing

The weighted average time until all the principal payments in the debt portfolio become

subject to a new interest rate.

Coupon

The yield paid by a fixedincome security on its issue date (relative to the bond's face or

par value). This yield changes as the value of the bond changes.

Domestic public

debt

All debt liabilities of a national (federal) government that are issued under and subject

to national jurisdiction, regardless of the nationality of the creditor or the currency

denomination of the debt. Terms of the debt contracts can be marketdetermined or set

unilaterally by the government.

Eurobond

A bond denominated in a currency other than the home currency of the country or

market in which it is issued. These bonds are frequently grouped together by the

currency in which they are denominated, such as eurodollar or euroyen bonds. Issuance

is usually handled by an international syndicate of financial institutions on behalf of the

borrower. The term Eurobond refers only to the fact the bond is issued outside of the

borders of the currency's home country; it does not mean the bond was issued in Europe

or denominated in Euro.

External public

debt

All debt liabilities of a national (federal) government with foreign creditors, both official

(public) and private. Creditors often determine all the terms of the debt contracts, which

are normally subject to the jurisdiction of the foreign creditors or to international law

(for multilateral credits).

Foreign currency

public debt

All debt liabilities of a national (federal) government that are expressed in (or linked to)

a currency different from the national currency of the country.

Government Bond A debt security issued by a national (federal) government to support government

spending.

Government

Development

Bond (GDB)

A bond issued by a national (federal) government to raise financing for funding one or

more specific projects or development work in geographic area.

Maturity

The time until the debt is extinguished according to the contract between the debtor and

the creditor. In the statistical guidelines this time period is either from the date of

incurrence or reference (original/remaining maturity, respectively) of the debt liability

to the date at which the liability will be extinguished.

Publicly guaranteed debt

Debt liabilities of public and private sector units, the servicing of which is contractually

guaranteed by public sector units. These guarantees consist of loan and other payment

guarantees, which are a specific type of oneoff guarantees.

Special Drawing

Rights (SDR)

International reserve assets created by the International Monetary Fund (IMF) and

allocated to its members to supplement reserve assets.

Total public debt Total debt liabilities of a government with both domestic and foreign creditors.

Traded/tradable

debt

Debt securities traded (or tradable) in organized and other financial markets such as

bills, bonds, negotiable certificates of deposits, assetbacked securities, etc.

Treasury Bill

(TBill)

A (usually) shortterm (less than one year) marketable fixed interest rate debt security

issued by a national (federal) government. Bills give holders the unconditional rights to

receive stated fixed sums on a specified date.

Treasury Bond

(TBond)

A longterm marketable fixed interest rate debt security issued by a national (federal)

government. Bonds give the holders the unconditional right to fixed payments or

contractually determined variable payments on a specified date or dates.

Zerocoupon bond A longterm security that does not involve periodic payments during the life of the bond.

A single payment, that includes accrued interest, is made at maturity.

Sources: Reinhard, C., and Rogoff, R. (2011). From Financial Crash to Debt Crisis, American Economic Review 101,

p. 1702; Investopedia; Task Force on Finance Statistics (TFFS).