Improving Public Debt Management

In the OIC Member Countries

209

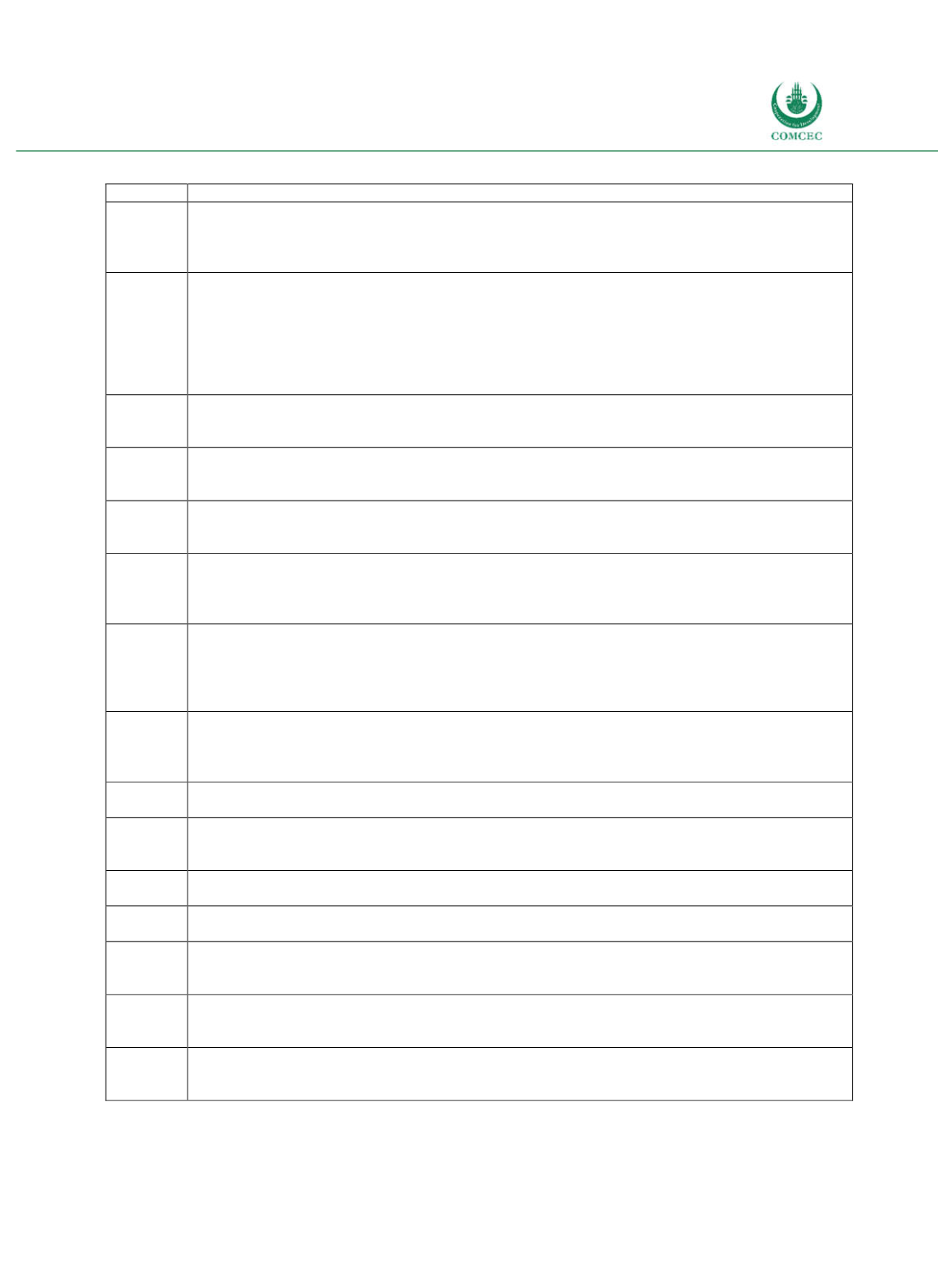

Table G-0-2: General Islamic Finance Terms

Term

Meaning

Commodity

murābaḥah

A murabaḥah transaction based on the purchase of a commodity from a seller or a broker and its resale

to the customer on the basis of deferred murabaḥah, followed by the sale of the commodity by the

customer for a spot price to a third party for the purpose of obtaining liquidity, provided that there are

no links between the two contracts.

Diminishing

musharakah

A form of partnership in which one of the partners promises to buy the equity share of the other partner

over a period of time until the title to the equity is completely transferred to the buying partner. The

transaction starts with the formation of a partnership, after which buying and selling of the other

partner’s equity takes place at market value or at the price agreed upon at the time of entering into the

contract. The “buying and selling” is independent of the partnership contract and should not be

stipulated in the partnership contract, since the buying partner is only allowed to promise to buy. It is

also not permitted that one contract be entered into as a condition for concluding the other.

Islamic window The part of a conventional financial institution (which may be a branch or a dedicated unit of that

institution) that provides both fund management (investment accounts) and financing and investment

that are shariahcompliant, with separate funds. It could also provide takaful or retakaful services.

Ijarah

A contract made to lease the usufruct of a specified asset for an agreed period against a specified rental.

It could be preceded by a unilateral binding promise from one of the contracting parties. As for the ijarah

contract, it is binding on both contracting parties.

Istisnaa

The sale of a specified asset, with an obligation on the part of the seller to manufacture/construct it using

his own materials and to deliver it on a specific date in return for a specific price to be paid in one lump

sum or instalments.

Murabahah A sale contract whereby the institution offering Islamic financial services sells to a customer a specified

kind of asset that is already in its possession, whereby the selling price is the sum of the original price

and an agreed profit margin. The murabaḥah contract can be preceded by a promise to purchase from

the customer.

Mudarabah A partnership contract (profit sharing contract) between the capital provider (rabb almal) and an

entrepreneur (muḍarib) whereby the capital provider would contribute capital to an enterprise or

activity that is to be managed by the entrepreneur. Profits generated by that enterprise or activity are

shared in accordance with the percentage specified in the contract, while losses are to be borne solely by

the capital provider unless the losses are due to misconduct, negligence or breach of contracted terms.

Musharakah

(sharikat

alaqd)

A partnership contract (profit and loss sharing contract) in which the partners agree to contribute

capital to an enterprise, whether existing or new. Profits generated by that enterprise are shared in

accordance with the percentage specified in the musharakah contract, while losses are shared in

proportion to each partner’s share of capital.

Shariah Often referred to as Islamic law, deduced from its legitimate sources: the quran, sunnah, consensus

(ijma), analogy (qiyas) and other approved sources of the shariah.

Shariah compliant

product

The term used in Islamic finance to indicate that a financial product or activity that complies with the

requirements of the shariah.

Shariah board

A committee of wellversed Islamic scholars available to an Islamic financial institution for guidance and

supervision in the development of shariah compliant products.

Salam

The sale of a specified commodity that is of a known type, quantity and attributes for a known price paid

at the time of signing the contract for its delivery in the future in one or several batches.

Sukuk

An Arabic term for financial certificate. It is defined as “Certificates of equal value representing undivided

shares in ownership of tangible assets, usufructs and services or (in the ownership of) the assets of

particular projects or special investment activity”.

Takāful

A mutual guarantee in return for the commitment to donate an amount in the form of a specified

contribution to the participants’ risk fund, whereby a group of participants agree among themselves to

support one another jointly for the losses arising from specified risks.

Zakah

An obligatory contribution or tax which is prescribed by Islam on all Muslims having wealth above an

exemption limit at a rate fixed by the shariah. The objective is to make available to the state a proportion

of the wealth of the welltodo for distribution to the poor and needy.

Sources: Islamic Financial Services Board, Islamic Financial Services Industry Stability Report 2016, p. x;

International Islamic Financial Market, Sukuk Report 2016, pp. 158-160.