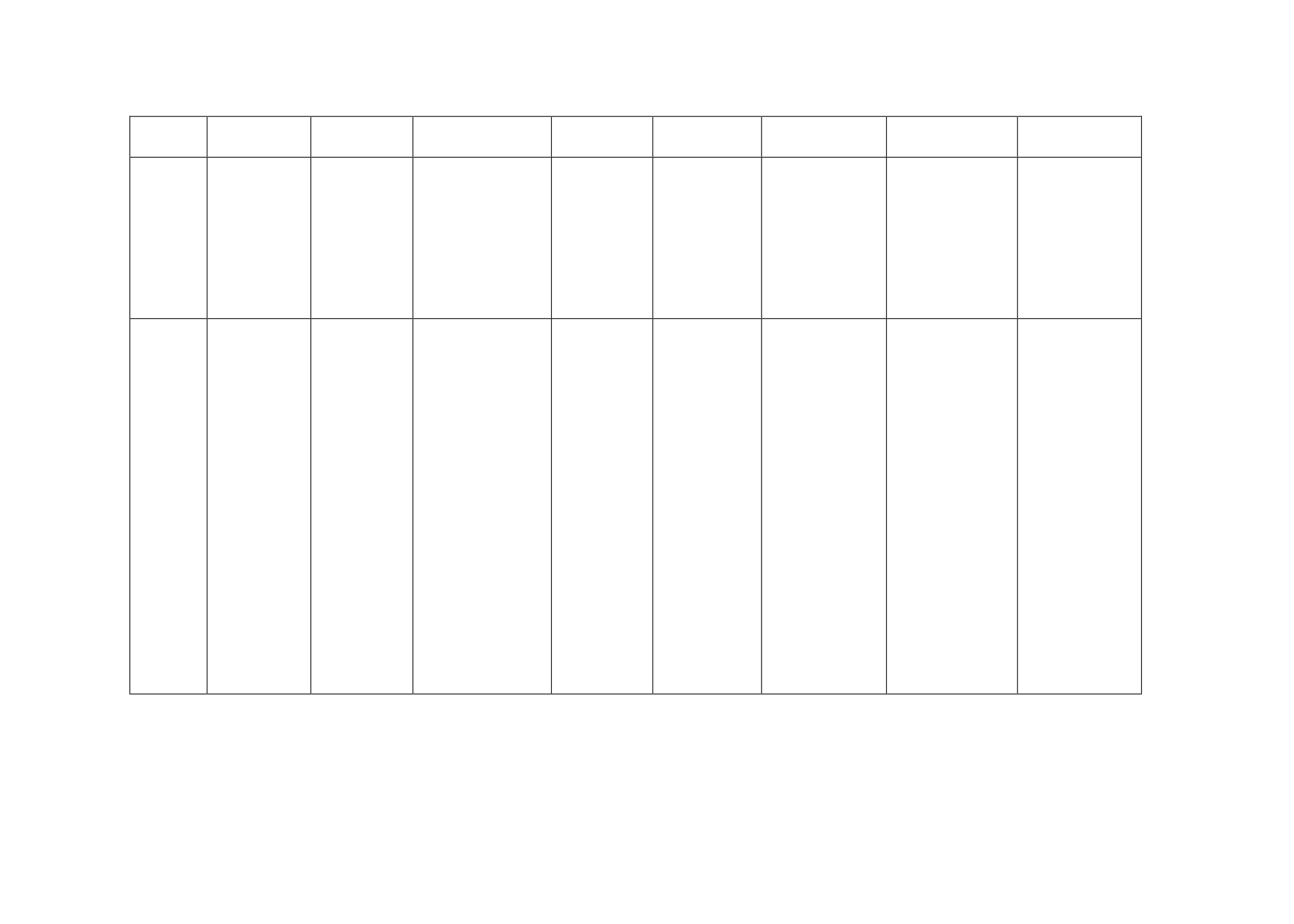

96

NIBSS which

offers credit and

debit transfers

Retail

Payment

System

Cash.

Cheques

Credit transfers

Payment cards

Direct debits

Drafts.

Giros.

Cross-border

Mobile money

Cash

Credit transfers

Direct debits

Payment cards

Cheques and

bilyet giros

Postal

instruments

Electronic

money

Cross border

Mobile money

Cash

Cheques

Credit transfers

Payments cards

ATM Transaction

Mobile

Banking/Payments

Bills of exchange

Promissory notes

Cash

Cheques

Credit transfers

Debit transfers

Payments cards

Mobile money

Cash

Cheques

Credit transfers

Debit transfers

Payment cards

Mobile payment

Internet payment

Cash

Cheques

Payment cards

Mobile money

Cash

Credit transfers

Direct debits

Cheques

Payment cards

Promissory note

Postal instruments

Cash

Cheques

Credit transfers

Direct debits

Payment cards

Electronic money

Drafts

Giros

Cross-border

General

outlook

Slower growth,

but not negative

Increasing

competition

among the

leading players

Lack of

infrastructure

make

smartphones and

tablet PCs

increasingly

become popular

The rising

ownership of

smartphones and

tablet PCs

Debit cards

dominated the

payment

circulation

Payment cards

remains

prevalent

The role of e-

money is

increasing

MNOs are

increasing their

stake in

providing e-

money

Banking and

financial services

are mainly

focused in the

more developed

cities and urban

markets

Huge gaps in

terms of access

to various

services and

technologies

Payment cards

are also used as

a status symbol

Cash remains the

popular means of

transaction

Mobile payment is a

quite recent but fast-

growing phenomenon

Mobile payment

systems have a great

potential in contributing

towards financial

inclusion

Cash payments

still dominate,

and electronic

payments have

also seen

increase usage

Most Moroccan

consumers

remain cautious

when making

purchases via

the internet

The competitive

environment did

not change

significantly in

2013

Banks also

became more

active in terms

of offering

mobile banking

solutions

Small businesses

are still reluctant

to embrace

credit card

acceptance

Cash dominated

the transactions

CBN encourage

the elimination of

the amount of

cash and coins

Risk and security

management are

the major

challenges

A series of

initiatives had

been implemented

to improve their

positioning in the

global community

Cash-dominant,

sometimes even for

large business

transactions.

Shops and

restaurants rarely

accept cards, or

charge a premium of

2.5%.

There are no 3rd

party wallets,

localised PayPal, nor

3rd party payment

service providers.

Payment cards

demonstrated volume

and current value

growth

Pre-paid cards

demonstrated the

highest growth in

terms of cards in

numbers and value

Regulation limit the

performance of

personal credit cards

Private banks led

financial cards in value

terms

Banks worked

together to raise

awareness of the

safety of using cards

at POS rather than

solely for ATM

withdrawal

A huge influx of

expatriates had a

profound positive

effect on payment

cards, with more

people using public

transport and roads

Rising number of

consumers opting to

shop online and

through their mobile

phones

Premiumisation

consumers are on the

rise

Source: Compiled from official statistics, trade associations, trade press, company research, trade interviews, trade sources, and Euromonitor International