95

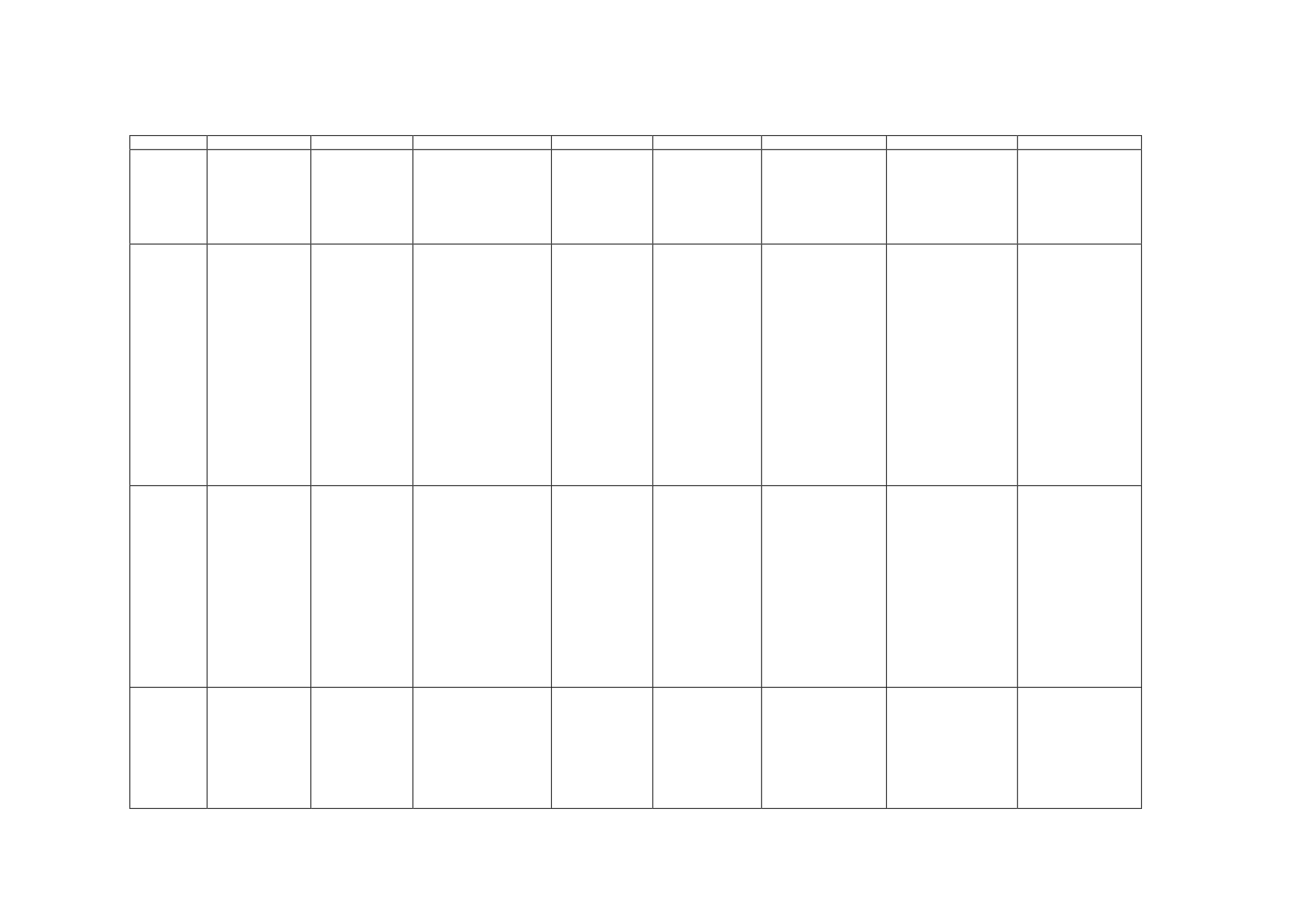

Table 9. Qualitative comparison

Egypt

Indonesia

Ivory Coast

Morocco

Nigeria

Pakistan

Turkey

UAE

Bank

supervision

The Central Bank

of Egypt (CBE)

Bank Indonesia

(BI) , now moved

to new regulator,

Otoritas Jasa

Keuangan (OJK)

The Central Bank of

West African States

(BCEAO)

The Bank Al-

Maghrib,

founded as the

successor to the

Banque d’Etat du

Maroc

The Central Bank

of Nigeria (CBN)

State Bank of

Pakistan (SBP)]

The independent

Banking Regulation

and Supervisory

Agency (BRSA) or

Bankacılık Düzenleme

ve Denetleme Kurumu

(BDDK)

Central Bank of the

UAE

Legal

Regulatory

Framework

The Law of the

Central Bank, the

Banking Sector

and Money

contains the legal

basis for the

oversight

function of the

Central Bank of

Egypt (CBE).

Central Bank Act,

the UU No.

23/1999 on

Bank Indonesia

(17 May 1999),

then amended

with UU

No.3/2004 (15

January 2004)

BCEAO Bill No.

15/2002/CM/UEMOA

related to payment

systems in the WAEMU

space issued on

September 2002.

Under the

banking law, The

Bank Al-Maghrib

and its Governor

are operationally

independent in

making

decisions on

banking and

payment

supervision.

CBN Act of 1958

(amended with

CBN Decree No.

24 of 1991), CBN

Decree

Amendments No.

3 and No. 4 of

1997, No. 37 of

1998, No. 38 of

1998, 1999 and

CBN Act of 2007.

The State Bank of

Pakistan is a central

bank established

under the State Bank

of Pakistan Act, 1956.

The other banking

companies in

Pakistan were

established under the

Banking Companies

Ordinance, 1962. The

Financial Institutions

(Recovery of

Finances) Ordinance,

2001 provides the

legal structure and

procedure for the

recovery of finances.

The Central Bank of

the Republic of Turkey

is responsible for

securing the objectives

of financial system

stability as well as the

operation, regulation

and oversight of

payment systems in

Turkey. The Banking

Regulation and

Supervision Agency

(BRSA), issues

licences, and regulates

and supervises all

major financial

institutions.

Union Law No. 10 of

1980 regulate the

central bank, the

monetary system, as

well as organisation

of banking and

payment systems.

Banking

service

provision

There are 5

public sector

banks, 27 private

and joint-venture

banks and eight

branches of

foreign banks

operating in

Egypt.

There are 120

commercial

banks in

Indonesia (four

state-owned

commercial

banks, 79 private

national banks,

26 government

regional banks

and 11 private

Islamic

commercial

banks).

There are more than 20

banks, including

international banks,

regional banks, and

private banks (2012),

In 2011, there

were 76

financial

institutions,

including 16

commercial

banks, 37

financing

companies, 6

offshore banks,

14 micro-finance

associations.

There are 24

banks operating in

Nigeria. There

also exists a

network of highly

structured

community,

development and

microfinance

banks and

financial

institutions, which

serve SMEs and

microfinance

needs.

There are 5 public

sector commercial

banks with 2,022

total branches, 22

local private banks

with 8,388 total

branches, 7 foreign

banks with 27

branches, as well as 4

specialised banks

with 547 branches.

There are 47 banks

(13 investment banks,

25 commercial banks,

4 participation

(Islamic) banks and 5

branches of foreign

banks) operating in

Turkey, in addition to

48 representative

offices of foreign

banks.

There are 23

domestic commercial

banks (three of which

are Islamic banks),

28 foreign banks

operating in the UAE,

as well as 110

representative offices

of foreign banks.

Emirates NBD is the

largest bank in terms

of total assets.

Large Value

Payment

System

The RTGS system

Automated

Clearing House

(ACH).

BI-RTGS

SKNBI

BCAO-RTGS

Système des

Règlements

Bruts du Maroc

(SRBM)

Central Bank

Interbank Funds

Transfer System

(CIFTS).

Nigerian

Automated

Clearing System

(NACS)

ACH operated by

Pakistan Real-time

Interbank Settlement

Mechanism (PRISM)

TIC-RTGS

UAE Funds Transfer

System (UAEFTS)

Image cheque

clearing system

(ICCS)