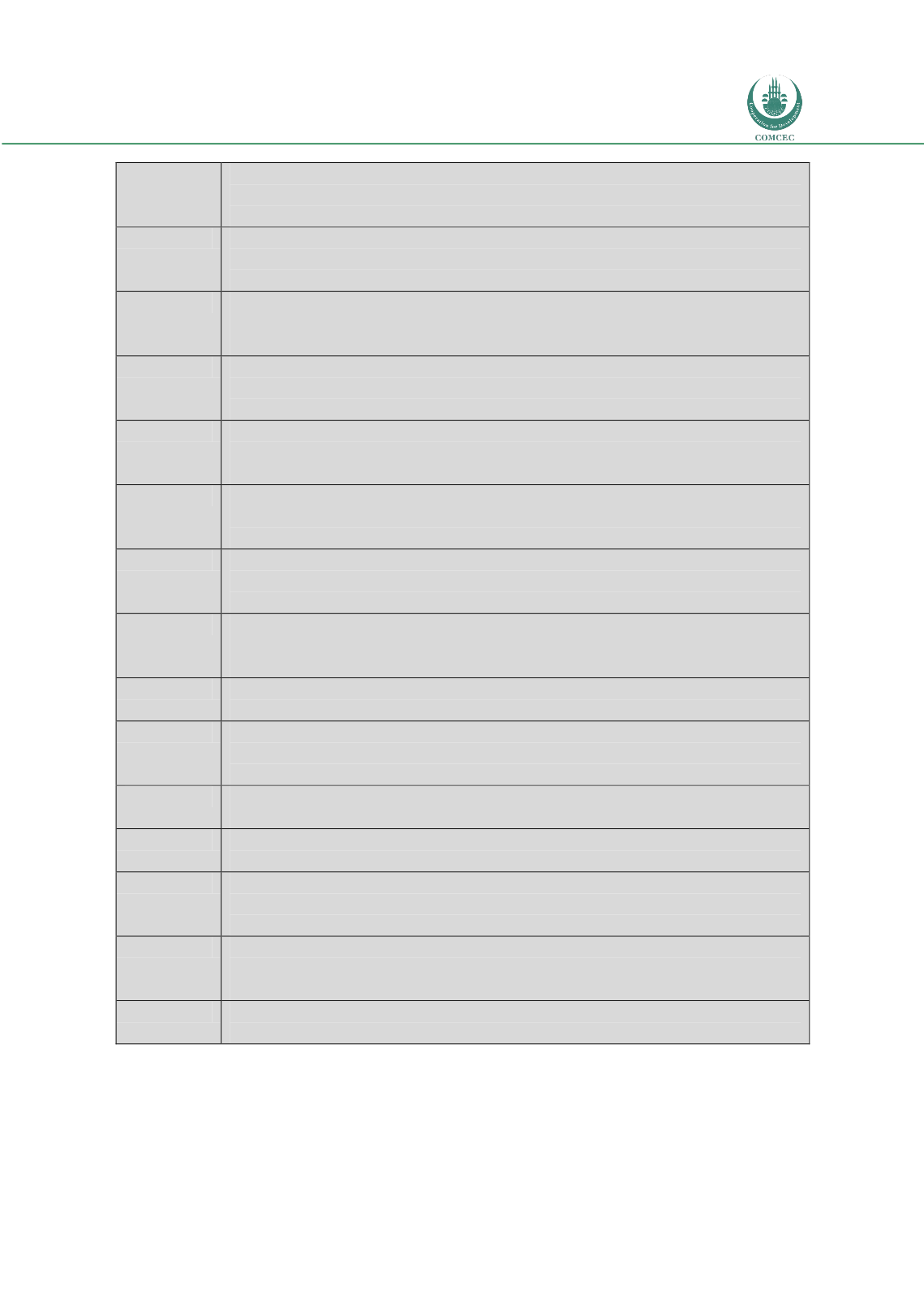

Risk Management in

Islamic Financial Instruments

59

♦

central bank is in the midst of developing a new regulatory frameworks for the financial industry

♦

has an agreement with Bank of Tanzania for supervision of banks

♦

information on Islamic banking

or banking system was not reported.

Djibouti

Central Bank of Djibouti is the primary regulator

♦

dual banking system in operation

♦

issued separate

law on the establishment of Islamic banking

♦

has separate law for monitoring various banking risks

♦

maintains the Basel standards for calculating minimum capital requirements

Egypt

The economy is monitored by the Central Bank of Egypt

♦

both on-site and off-site supervision systems

are present

♦

separate Basel II implementation unit

♦

long history of Islamic banking

♦

dual banking

system

♦

expect to see Islamic capital market activity soon.

Iraq

Central Bank of Iraq maintain the regulatory atmosphere

♦

dual banking system

♦

long history of

banking but abrupt political condition has been the major challenge

♦

from 2003-04, banks follow

international standards on minimum capital requirement.

Kazakhstan

The National Bank of Kazakhstan is the Central Bank

♦

dual banking available with only one Islamic

bank

♦

no separate Islamic banking act or law

♦

follows Basel for risk supervision and prudential

guidelines

♦

expects to see the country as the Islamic finance hub of Central Asia.

Lebanon

Banque Du Liban or Bank of Lebanon is the Central Bank of Lebanon

♦

freely floating exchange rate

♦

banking secrecy act is active

♦

established free banking zone

♦

dual banking system

♦

separate law on

Islamic banking operation (from 2004)

♦

implementing Basel II capital adequacy accord

Libya

The Central Bank of Libya is the center of financial and monetary authority

♦

dual banking is active but

expects to change it entirely to Islamic banking

♦

recognizes the importance of Basel regulation but has

not yet implemented Basel II

Maldives

Maldives Monetary Authority is the Central Bank of Maldives

♦

dominated by foreign banks

♦

dual

banking available with only one Islamic bank

♦

Sukuk market is active

♦

separate Islamic banking

regulation act of 2011

♦

implementing Basel II regulations

Morocco

Bank Al-Maghrib is the Central Bank of Morocco

♦

recognizes Basel II and currently implementing it

♦

expects to see more from Islamic banking in future

♦

presence of separate Islamic law was not found

Mozambique

Bank of Mozambique is the Central Bank

♦

July 2014 saw the introduction of a partnership between

Islamic and conventional banks

♦

policies in place for dual banking

♦

from January 2014; all banks must

implement Basel II.

Nigeria

Central Bank of Nigeria recently announced extension of duration to implement the Pillar 1 of Basel II

♦

dual banking system

♦

no separate law for Islamic banking

Oman

Central Bank of Oman established separate regulation for Islamic banking

♦

adhered to Basel III capital

adequacy norms

♦

dual banking system

♦

Islamic window banking

♦

Issuance of Sukuk in near future.

Palestine

Palestine Monetary Authority controls the financial sector

♦

dual banking

♦

no window banking

♦

no

specific Islamic banking law

♦

Basel II is at the implementation stage

♦

no Islamic capital market

activity present at this moment

Somalia

Central Bank of Somalia is the Central Bank

♦

No Islamic windows

♦

no dual banking – only Islamic

banking

♦

no separate Islamic banking law

♦

yet to formulate standards in relation to Basel standards

♦

Central Bank recently change the fee structure to a minimum that is required while chartering a bank

Saudi Arabia

Saudi Arabian Monetary Association oversees the fiscal policies and regulates the financial sectors

♦

dual banking system

♦

Islamic banking regulation

♦

Basel III implementation since 2013.

Sources: Compiled from Chapra and Khan (2000) Exhibit 1 and authors’ compilation from Central Bank websites and

National Islamic Finance Regulation.