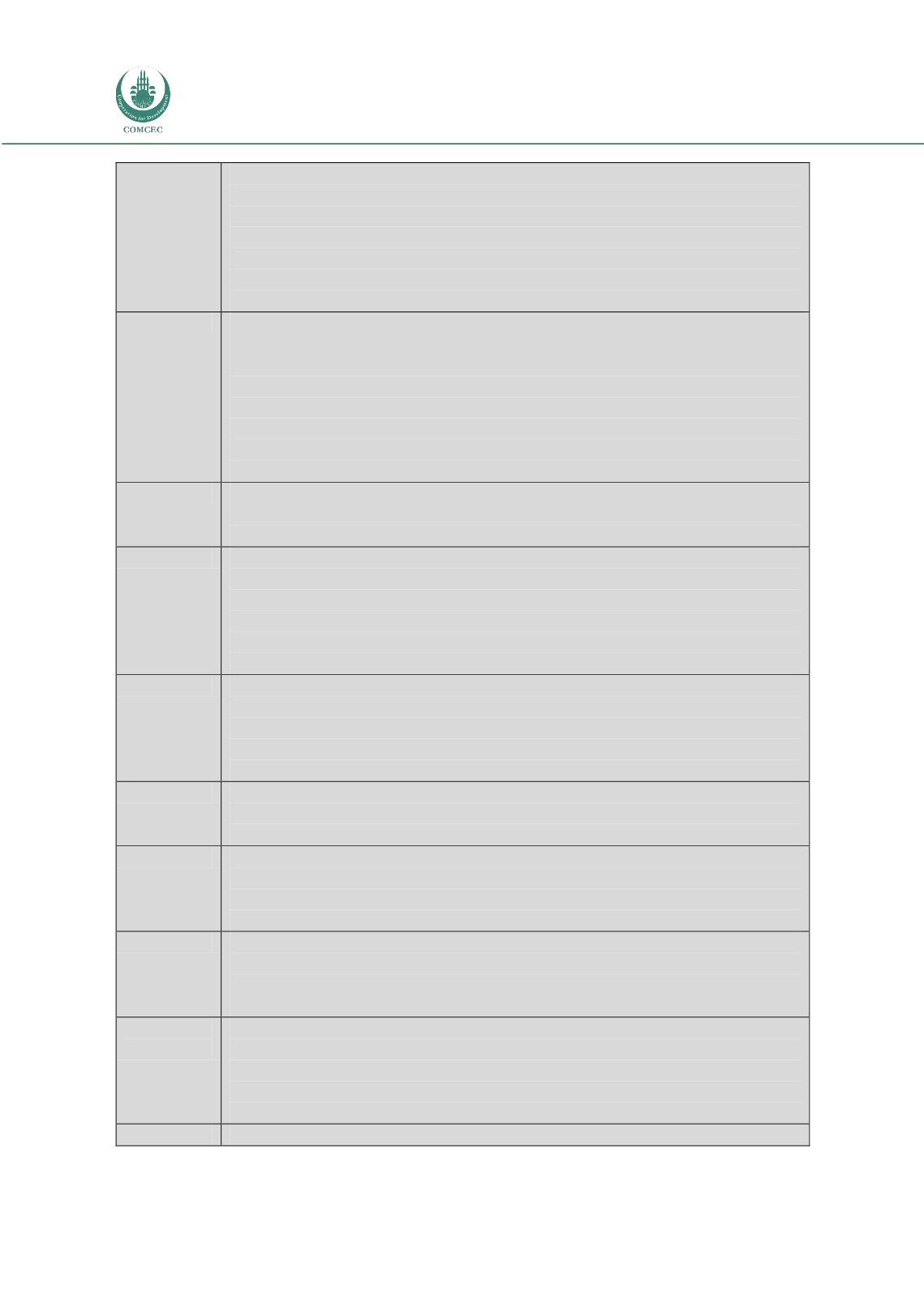

Risk Management in

Islamic Financial Instruments

58

banks under same regulatory authority; securities firms under separate authority

♦

Private banks

♦

Dual banking system

♦

Islamic windows allowed in conventional banks

♦

Consolidated supervision

♦

Basel capital requirements and core principles adopted

♦

International Accounting Standards

adopted

♦

CAMELS rating system adopted

♦

Onsite and offsite supervision well defined with clear

objectives

♦

Separate Sharī‘ah boards at institutional level in the BNM and Securities Exchange

Commission

♦

Islamic money market and liquidity arrangement exists

♦

Ministry of Finance closely

associated with the supervision of Islamic banks

Pakistan

Regulated by the Central Bank of Pakistan (State Bank of Pakistan-SBP)

♦

Securities firms, and

Insurance Companies are regulated by separate regulatory bodies

♦

Major banks in the Public Sector;

bank regulation and supervision effected by government policies

♦

Islamic banking law does not exist

♦

Mudārabah Companies Law exists

♦

Sharī‘ah board concept does not exist

♦

Islamic banks are not

identified distinctly

♦

Basel capital requirements and supervisory standards adopted

♦

Bank merger is

on cards to strengthen capital

♦

Concept of onsite and offsite supervision exists

♦

Major financial

transformation is called for by the Supreme Court of Pakistan to introduce Islamic banking and

financial system; a Financial Services Transformation Committee has been established by the SBP.

Qatar

Regulated by the Central Bank of Qatar (CBQ)

♦

Dual banking and separate regulatory system

♦

No

separate Islamic banking law exists

♦

Islamic banks supervised by special directives of CBQ

♦

Separate

Sharī’ah boards for banks required

♦

Standardized transparency requirements for Islamic banks exist

Sudan

Regulated by the Central Bank of Sudan (CBS)

♦

Single (Islamic) system

♦

Islamic banking law in place

♦

Separate Sharī’ah boards for banks required, also the Central Bank has a Sharī‘ah Supervisory Board

♦

Substantial public sector control; supervision and regulation is effected by other government policies

♦

Evolution of financial instruments underway

♦

Compliance with the capital adequacy and supervisory

oversight standards of the Basel Committee not clear

♦

Major bank merger is planned to strengthen

bank capital

Turkey

Regulated by the Banking Regulation and Supervision Agency (Bankacılık Düzenleme ve Denetleme

Kurumu – BDDK

♦

Banks and securities firms regulated by separate bodies

♦

Law about Special Finance

Houses covers Islamic banks

♦

Dual system; no Islamic windows allowed

♦

Basel Committee capital

adequacy requirements and supervisory standards recently introduced

♦

Major financial

transformation underway

♦

Onsite and offsite supervision concepts and methods exist

UAE

Regulated by the Central Bank of UAE

♦

Islamic banking law exists

♦

Dual system

♦

Islamic banking

windows allowed

♦

Separate Sharī‘ah boards required

♦

Basel Committee capital adequacy

requirements and supervisory standards in place

♦

International Accounting Standards in place

Yemen

Regulated by the Central Bank of Yemen (CBY)

♦

Islamic banking law exists

♦

Dual system

♦

Islamic

banking windows allowed

♦

Separate Sharī‘ah board required

♦

Major policies and standards set by the

CBY are equally applicable to all banks

♦

Separate supervisory office for Islamic banks inside the CBY

under active consideration

♦

Compliance with the Basel standards not clear

Bangladesh

Regulated by Bangladesh Bank, the central bank of the country

♦

Dual banking system

♦

Window

banking has recently criticized but still available

♦

moving towards Basel II full implementation, and

running Basel III quantitative impact studies

♦

separate divisions in central bank to monitor Islamic

banking activities, but now separate law for Islamic banking.

Brunei-

Darussalam

Authority Monetary Brunei Darussalam monitors the monetary issues in Brunei

♦

currency is pegged

to Singaporean Dollar

♦

separate control authority under AMBD for insurance capital market and

banks

♦

both on-site and off-site supervision available using risk-based approach

♦

will be

implementing Basel II fully shortly

♦

IOSCO standards were also followed

♦

dual banking system is

currently at operation.

Comoros

Central Bank of Comoros monitors the regulatory issues

♦

follows Basel banking supervision standards