Risk Management in

Islamic Financial Instruments

57

Central Shariah Board to oversee the functions of Islamic finance industry. The council of

guardians in Iran provides guidelines for Islamic finance industry. There is still an on-going

debate about what role the shariah board plan-a supervisory role or certification role of

islamicity of products.

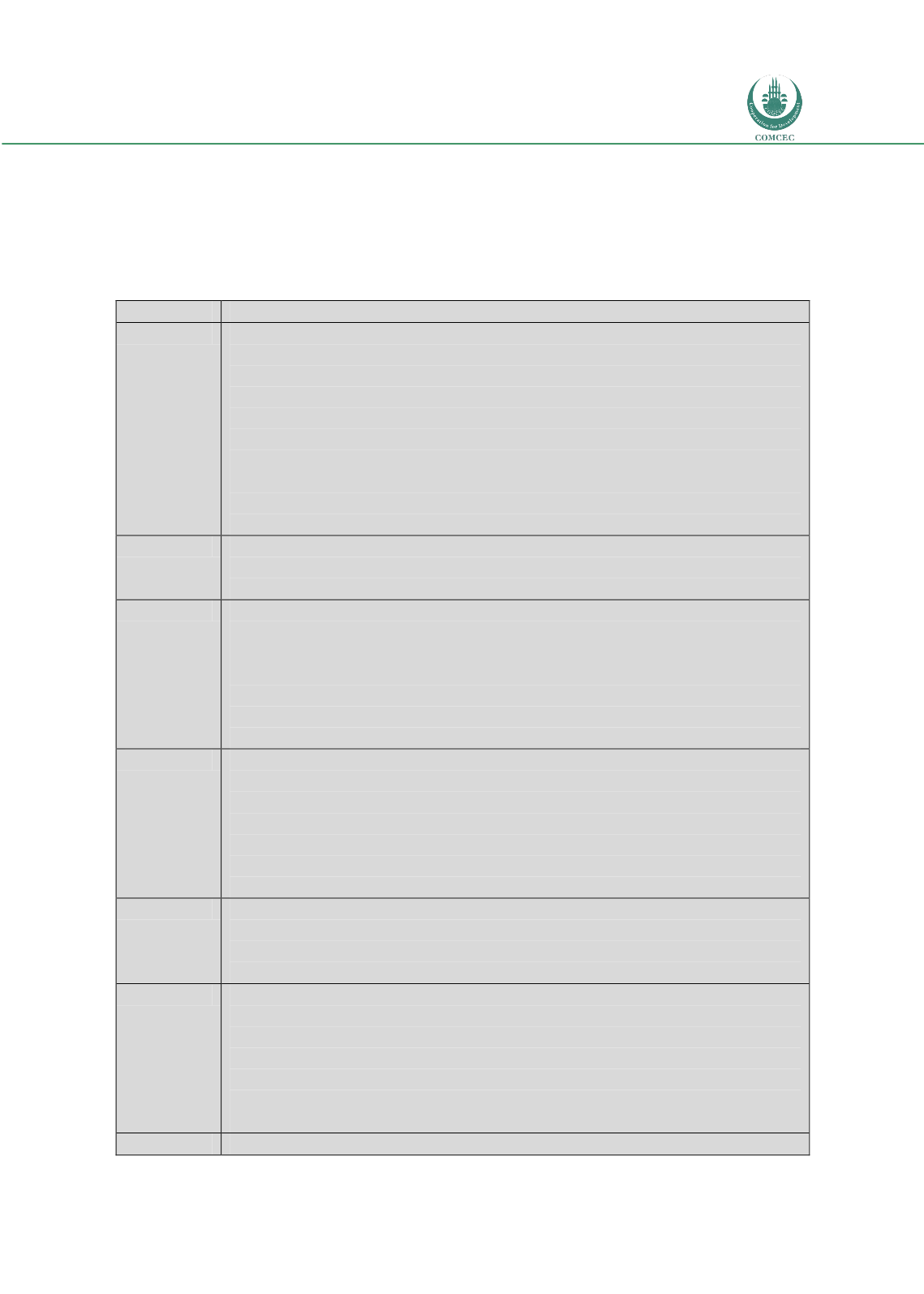

Table 3.3. Regulatory and Supervisory Structures and Laws and Regulations in OIC member countries

Country

Important Regulation, Supervisory Authorities and Risk Management Framework

Bahrain

Regulated by the Bahrain Monetary Agency (BMA)

♦

BMA regulates both commercial banks and

investment banks (securities firms); insurance companies are under separate regulatory authority

♦

Dual banking (Islamic and conventional) banking system; Basel capital requirements and core

principles adopted for both groups,

♦

Four Islamic banking groups: a) Islamic commercial banks, b)

Islamic investment banks, c)Islamic Offshore banks, and d) Islamic banking windows in conventional

banks

♦

Consolidated supervision

♦

International Accounting Standards adopted,

♦

Each Islamic bank

must have a Sharī‘ah board

♦

Compliance with AAOIFI standards under active consideration

♦

Investment deposits, current accounts and capital allocation for assets must be declared,

♦

Mandatory

liquidity management by adopting the standardized maturity buckets of assets

♦

Islamic and

conventional mixed system

The Gambia

Regulated by the Central Bank of Gambia(CBG)

♦

Islamic banking law exists

♦

Dual system

♦

Separate

Sharī‘ah board required

♦

Compliance with Basel capital requirements and core principles and

International Accounting Standards not clear

Indonesia

Regulated by the Central Bank of Indonesia (Bank Central Republic Indonesia – BSRI)

♦

Separate

regulatory bodies for banks and securities firms

♦

Separate Islamic banking law does not exist; Islamic

(Sharī‘ah) banking is covered by added section in the banking law (Act No. 10 1998 and Act No. 23

1999)

♦

Separate Sharī‘ah board required

♦

Islamic windows allowed

♦

Consolidated supervision

♦

Basel

capital requirements and core principles adopted

♦

International Accounting Standards adopted

♦

Major financial transformation in process to strengthen bank capital and solvency

♦

Active Sharī‘ah

bank development strategy in place by the government

Iran

Regulated by the Central Bank of Iran (Bank Jamhuri Islamic Iran)

♦

All banks in the public sector with

a plan for minority privatization

♦

Bank regulation and supervision is strongly affected by monetary as

well as fiscal and other government policies

♦

Single (Islamic) banking system under the 1983 Usury

Free Banking Law

♦

Modes of finance are defined by this Law

♦

Recent policy orientation towards

adopting the Basel capital and supervisory standards and International Accounting Standards

♦

No

Sharī‘ah board for individual banks

♦

Onsite and offsite supervisory methods and objectives defined

and applied

♦

Banks and insurance companies are supervised by different regulatory authorities

Jordan

Regulated by the Central Bank of Jordan (CBJ)

♦

Separate regulatory bodies for banks and securities

firms

♦

Islamic banking law exists

♦

Dual system

♦

Separate Sharī‘ah board required

♦

Consolidated

supervision

♦

Basel capital requirements and core principles adopted

♦

International Accounting

Standards adopted

Kuwait

Supervised by the Central Bank of Kuwait (CBK)

♦

CBK regulates both commercial banks and

investment banks (securities firms); insurance companies are under separate regulatory authority

♦

Dual banking system

♦

Two Islamic banking groups: a) Islamic commercial banks, and b) Islamic

investment banks. Conventional banks not allowed having Islamic banking windows.

♦

Consolidated

supervision

♦

Basel capital requirements and supervisory standards adopted

♦

International

Accounting Standards adopted

♦

Separate Islamic banking law under active consideration

♦

Separate

Sharī‘a hboard for each bank necessary

Malaysia

Regulated by the Central Bank of Malaysia (Bank Nagara Malaysia – BNM)

♦

Insurance companies and