Risk Management in

Islamic Financial Instruments

6

that the products they purchase are Shariah compliant and do not violate any religious edicts.

While tools to identify Shariah compliant shares are available, they are restricted in use by

only a limited number of jurisdictions. Islamic rating agencies are another underdeveloped

area in Islamic finance. To compete with conventional securities products, Islamic securities

need to be evaluated by either an Islamic rating agency or an existing conventional rating

agency that is able to perform an Islamic rating assessment (

10 Year Framework

43-44).

1.3.1 Islamic Indices

Since the launch of Islamic indices in 1999, Islamic indices have expanded across both regional

and economic geographies. Four major global Islamic indices providers are: 1) Dow Jones

Islamic Market Indices, 2) S&P

Shari’ah

Indices, 3) MSCI Global Islamic Indices, 4) FTSE Global

Islamic Indices. Following Table 1.2 summarizes the evolution of the Islamic indices and their

major focus areas.

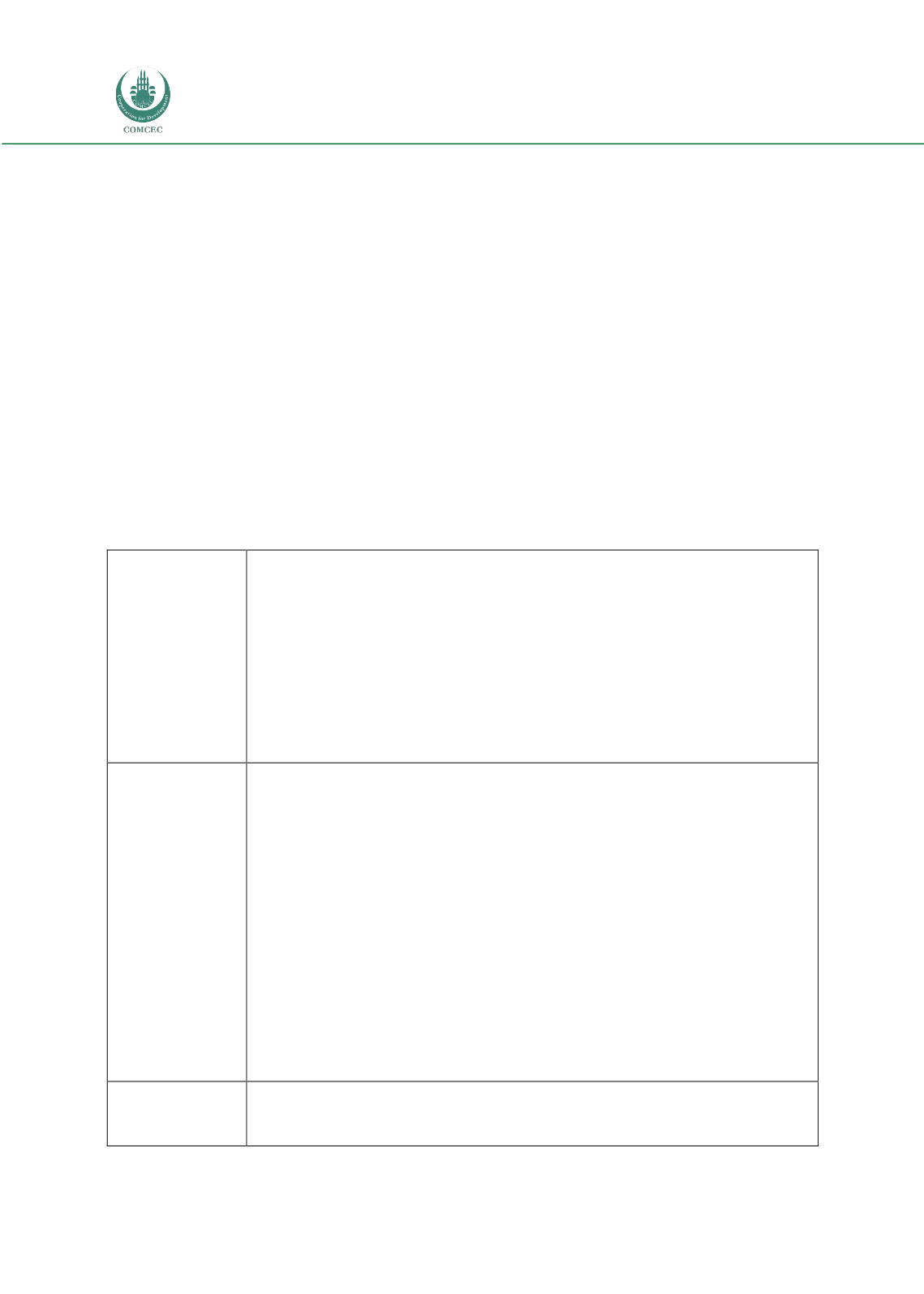

Table 1.2: Islamic Indices Providers for Equity Markets

Dow Jones Islamic

Market Indices

(a) Country Indices

- track

Sharī`ah

-compliant securities in 69 countries across both developed and

emerging markets

- Example: DJIM Canada, DJIM China, DJIM Kuwait, DJIM U.K., etc.

(b) Global/Regional Indices

- include regional, industry sector and market capitalization indices, as well as

specialized indices and custom measures

- Example: DJIM Asia Pacific, DJIM GCC, DJIM Europe, DJIM Emerging Markets

(c) Strategy/Thematic Indices

- Example: DJIM BRC, DJIM Global Finance and

Takāful

.

S&P

Sharī`ah

Indices

(a) Major Indices

- In 2006, S&P applied

Sharī`ah

screens to three major indices – the S&P 500, the S&P

Europe 350 and the S&P Japan 500

(b) Regional Indices

- In 2007, S&P followed with the S&P GCC

Sharī`ah

and the S&P Pan Asia

Sharī`ah

Indices, to cater for the demand for

Sharī`ah

product benchmarks for those regions

- Other regional indices: Europe 350

Sharī`ah

, Global BMI

Sharī`ah

, BRIC

Sharī`ah.

(c) Global Indices

- In 2008, S&P reviewed S&P Global Broad Market Index (BMI) Equity Indices for

Sharī`ah

compliance and created the S&P Global BMI

Sharī`ah

index that includes 6,000

companies in 10 sectors and 47 countries.

(d) Market Cap Indices

- Example: IFCI Large-Mid Cap

Sharī`ah

, 500

Sharī`ah

, etc.

(e) Sector Indices

- Global Healthcare

Sharī`ah

, Global Property

Sharī`ah

, etc.

MSCI Global

Islamic Indices

MSCI began its Islamic indices series in 2007. Later, the indices were developed to cover

over 50 developed and emerging countries and over 50 regions such as the GCC

countries and Arabian markets