Risk Management in

Islamic Financial Instruments

2

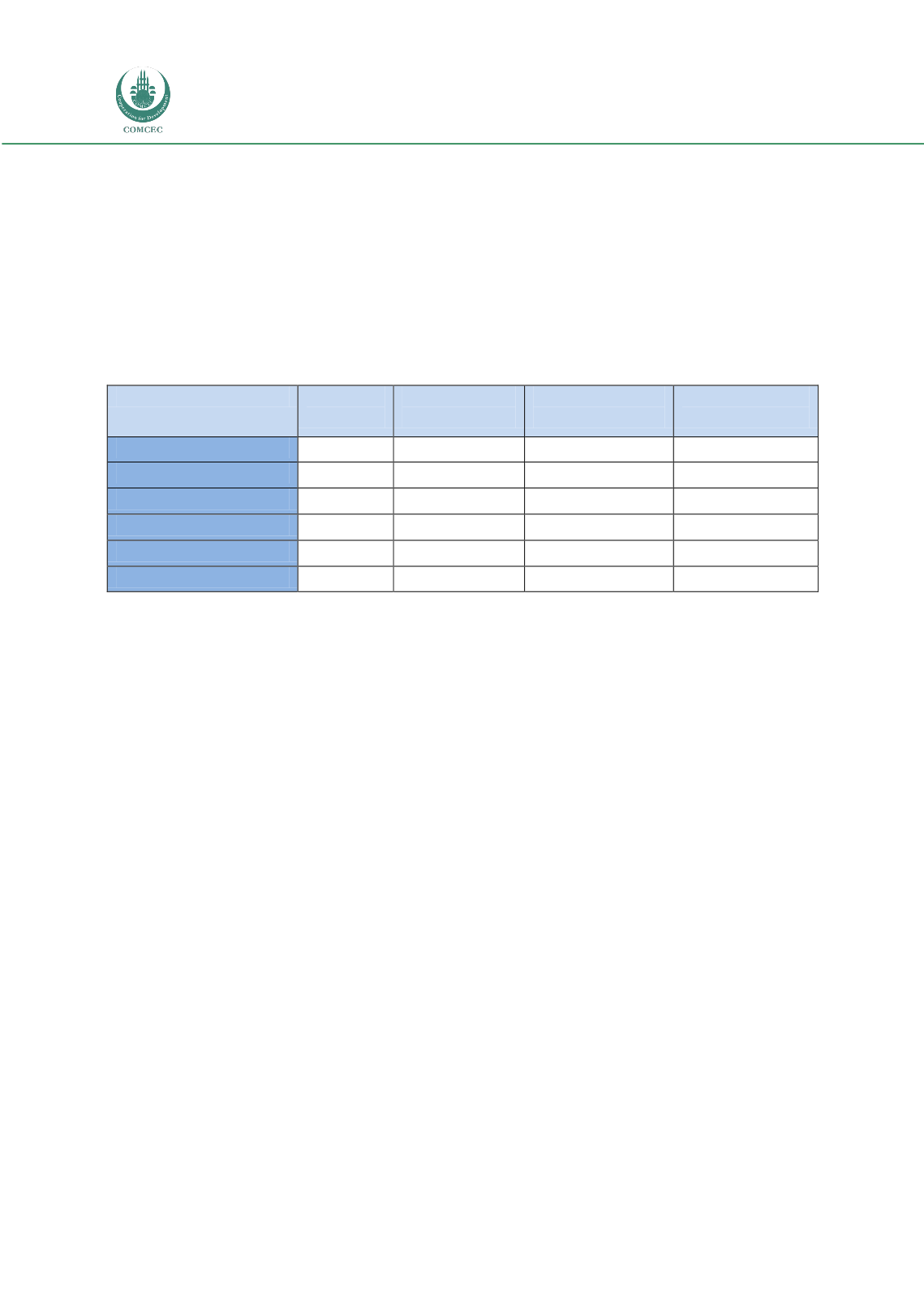

Around 50% of total Islamic financial assets are geographically concentrated in Islamic banks

in the Middle East and Asia. Although contributions the total assets invested in sukuk, Islamic

funds and takaful institutions are relatively small at present, these alternate asset classes have

enjoyed remarkable growth and have expanded the breadth and depth of the Islamic Financial

Industry in general. Table 1 presents the summary distribution of Islamic Financial Industry

Assets across major geographical regions.

Table 1.1: Breakdown of Islamic Financial Assets (in USD billion, as of 2012)

Banking

Assets

Sukūk

Outstanding

Islamic Funds’

Assets

Takāful

Contributions

Asia

171.8

160.3

22.6

2.7

GCC

434.5

66.3

28.9

7.2

MENA (exc. GCC)

590.6

1.7

0.2

6.9

Sub-Saharan Africa

16.9

0.1

1.6

0.4

Others

59.8

1.0

10.8

0.0

Total

1,273.6

229.4

64.2

17.2

Source: Regulatory authorities, Bloomberg, Zawya, IFIS, The Banker, KFHR

The Islamic finance industry is composed of four asset classes: banking, sukuk, funds, and

takaful. A brief discussion on the present status of these four asset classes is presented in the

following segments.

1.2 CURRENT STATUS OF ISLAMIC BANKS

In the early 2000s, Islamic banking was a niche market in most jurisdictions, with only a few

institutions offering basic depository and financing instruments. Additionally, there was low

awareness and demand for Islamic banking services, particularly in the Asia Pacific and

developed markets. Beginning in the mid-2000s, regulatory authorities in different

jurisdictions started introducing and amending legislation to make the legal system more

supportive of the Islamic banking industry’s growth. In addition, following the financial crisis,

increased interest about Islamic banking has increased the level of awareness among

investors, regulators and other stakeholders.

As a result, assets under management in Islamic banks and Islamic banking windows have

grown at a compound annual growth rate (hereafter CAGR) of 40.3% between 2004 and 2011

to reach USD1.1 trillion. Among financial institutions and asset classes, Islamic banks have

contributed to the overwhelming majority of the total assets managed over the last decade

(“GIFF 2012 Executive Summary” 1). In 2013, the assets of Islamic commercial banks were

expected to grow to USD $1.7 trillion. The average return on equity for the top 20 Islamic

banks was 12.6%, which is comparable to the 15% ROE of conventional banks.