Risk Management in

Islamic Financial Instruments

4

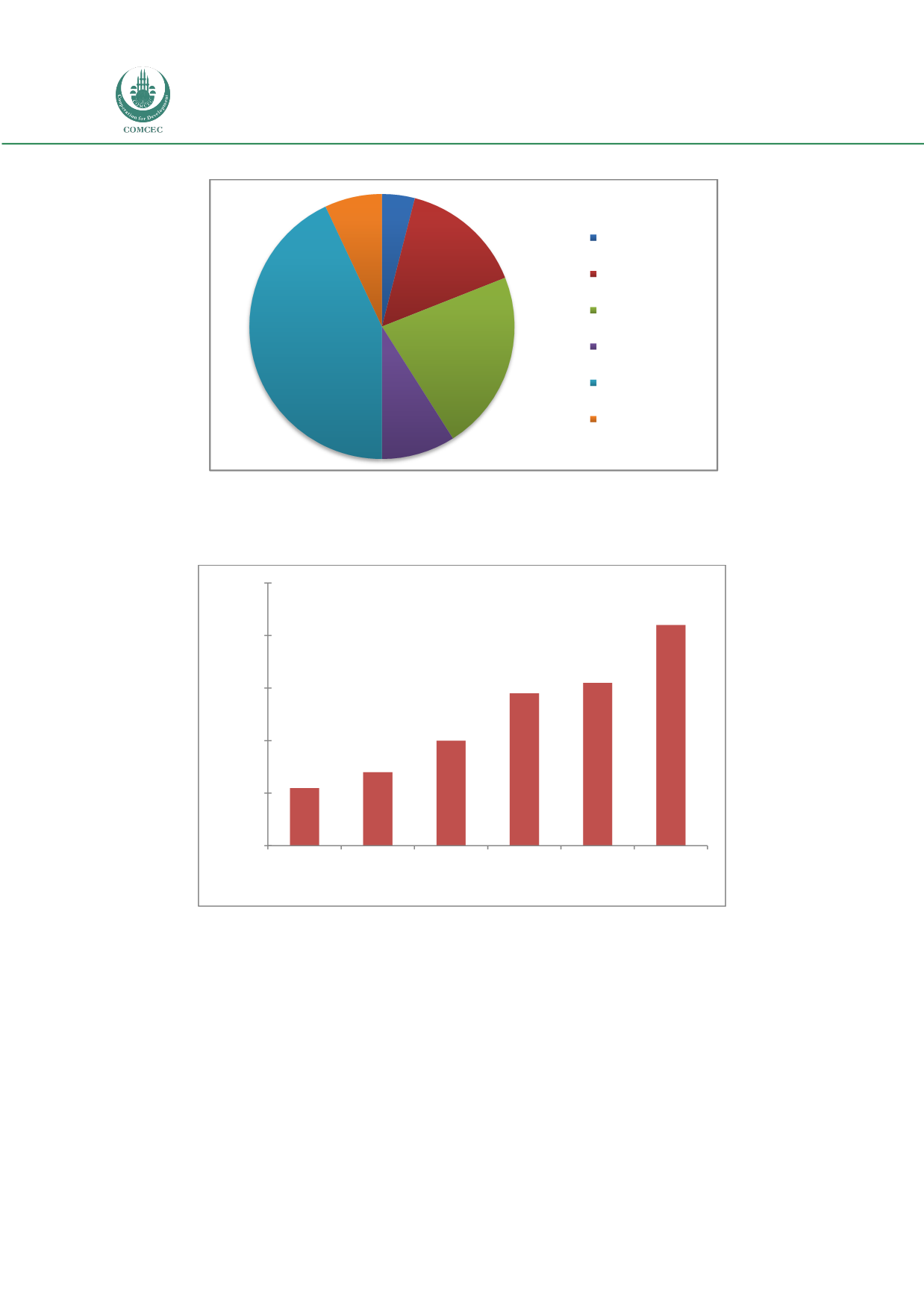

Chart 1.1: Distribution of Islamic Banking Assets of QISMUT Countries

Source: EY World Islamic Banking Competitiveness Report 2013-2014

Chart 1.2: 2008-2012 CAGR of QISMUT Countries

Source: EY World Islamic Banking Competitiveness Report 2013-2014

In addition, 17 Islamic banks currently possess USD $1 billion or more in equity and regulatory

capital. 14 of the 17 banks are headquartered in the QISMUT countries. However, economic

and political instability in highly populated Muslim countries has slowed the growth of the

financial sector. The recent large-scale operational changes that leading banks have taken on is

a second factor slowing growth (EY 4-20).

Apart from the QISMUT countries, Islamic banking has been making strides in other parts of

the world. In Africa, Nigeria, Kenya, Uganda, Tanzania, Zimbabwe, Malawi, Morocco, Algeria

and Tunisia are all beginning to introduce Islamic banking. In India, the S&P and Bombay Stock

4%

15%

22%

9%

43%

7%

Indonesia

UAE

Malaysia

Qatar

Saudi Arabia

Turkey

11%

14%

20%

29%

31%

42%

0%

10%

20%

30%

40%

50%

Saudi Arabia

UAE

Malaysia

Turkey

Qatar

Indonesia

5- Year CAGR (2008-2012)

QISMUT Countries